America’s Best Tax and Accounting Firms 2020

Use the Forbes Logo…*

- On your company website

- In advertising materials

- In presentations

- On official documents

- E-mail signatures

- Business papers

- In social media

- Magazine print advertising

- Sales and marketing brochures

Methodology

For the first time, Forbes and Statista, are awarding America’s Best Tax Firms and Best Accounting Firms.

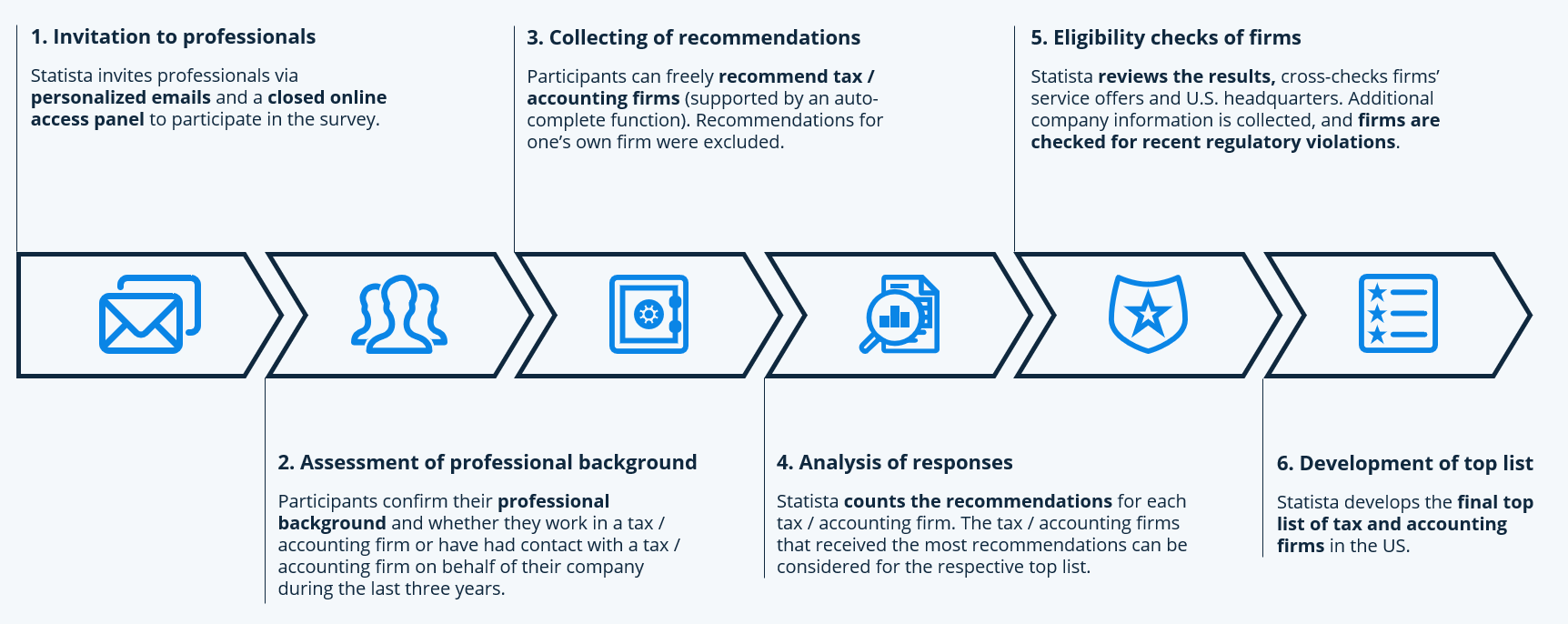

Between 12th August 2019 and 13th September 2019, Statista, the independent market research institute and statistics platform, conducted broad surveys among tax and accounting professionals (e.g. Chartered Public Accountants (CPAs), Enrolled Agents, Tax Attorneys, Accountants, CFOs) in the United States, working in:

- tax / accounting firms (“peers”)

- companies (other than a tax / accounting firm, “clients”)1

The participants had to specify their professional activity first and choose whether they work in a tax / accounting firm or in a company on the clients’ side. In a second step participants were able to select the area of expertise for which they can share their experiences (tax, accounting or both).

Peers were asked to indicate up to 10 tax / accounting firms they would recommend, if their company were not able to take on a client for a certain assignment or question (regardless of the reason). Clients were asked to name up to 10 tax / accounting firms they would recommend based on their professional experience during the last three years.

The list of awarded companies is based on a survey with 1,800 tax and accounting professionals. Participants’ responses as well as the final selection of firms in each list were carefully reviewed. Recommendations of peers for their own firm were excluded. In addition, Statista carried out additional checks on recent regulatory violations.

In total, 202 companies were awarded as “America’s Best Tax Firms” and 115 companies were awarded as “America’s Best Accounting Firms”. The quality of tax firms or accounting firms that are not included in the lists is not disputed.

1 This group included professionals, who have had professional contact with a tax / accounting firm on behalf of their company during the last three years.

* Please note the following conditions

Use of the label in your promotional materials is only permitted unmodified and only for a period of one year. You may not attribute any statement of fact to Forbes other than your placement on the list in your respective industry. You alone are responsible for the admissibility of the commercial use of the logo under competition law; in this respect, Forbes Media (FM) and Statista give no guarantee and assume no liability.

In consideration for payment, you (The Licensee) are hereby granted a nonexclusive, worldwide, non-transferable, non-sub-licensable license during the term of this Agreement for digital use rights (web posting, email, digital presentations, branded social media and similar) and print reproduction use rights (letterhead, sales materials, reports, white papers, brochures, posters and signage and similar) of the Forbes Logo (The Logo) pictured in this agreement. Licensee acknowledges and agrees that The Logo and all right, title and interest therein, is and shall remain the exclusive property of FM. Licensee shall not distort, misrepresent, alter the meaning of or otherwise edit The Logo. FM may terminate this Agreement upon 30 days’ written notice if Licensee materially breaches any of the terms of this Agreement; provided, however, that this Agreement will not terminate if the breaching party has substantially cured the breach to the reasonable satisfaction of FM within 30 days of a notice pursuant to this section. Upon termination or expiration of this Agreement, Licensee’s right to use The Logo shall immediately terminate and all rights granted to Licensee hereunder with respect to The Logo shall automatically revert to FM without further notice. This Agreement contains the full and complete understanding of the parties with respect to the subject matter hereof and supersedes all prior representations and understanding, whether oral or written. This Agreement shall be construed and the rights and obligations of the parties shall be governed by the laws of the State of New York.