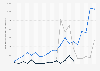

Tax-exempt employer firm expenses in the social assistance sector

This statistic shows the estimated total expenses for tax-exempt employer firms in the social assistance sector, presented annually from 2001 to 2009. In 2009, tax-exempt employer firm expenses in this sector were estimated at about 99 billion U.S. dollars.