Automotive industry in Russia - statistics & facts

Key insights

- Most sold car model

- Lada Granta

Detailed statistics

Most sold passenger car models in Russia in 2022

- Largest car market segment in Russia

- SUV

Detailed statistics

Car market sales share in Russia 2022, by segment

- Estimated electric car sales

- 8.5k units

Detailed statistics

Forecasted sales of electric vehicles in Russia 2017-2025, by scenario

Editor’s Picks Current statistics on this topic

Current statistics on this topic

Related topics

Recommended statistics

Market overview

6

- Basic Statistic Major passenger car producing countries 2023

- Premium Statistic Number of cars in operation per 1,000 people in Russia 2013-2028

- Premium Statistic Vehicle sales volume in Russia 2005-2022

- Premium Statistic Sales share of new passenger cars and LCVs in Russia 2023, by manufacturer

- Basic Statistic Used PC registrations in Russia 2023, by region

- Basic Statistic New PC registrations in Russia 2022, by region

Market overview

-

Basic Statistic

Major passenger car producing countries 2023

Major passenger car producing countries 2023

Estimated passenger car production in selected countries in 2023 (in million units)

-

Premium Statistic

Number of cars in operation per 1,000 people in Russia 2013-2028

Number of cars in operation per 1,000 people in Russia 2013-2028

Number of cars in operation per 1,000 people in Russia from 2013 to 2028

-

Premium Statistic

Vehicle sales volume in Russia 2005-2022

Vehicle sales volume in Russia 2005-2022

Annual vehicle sales volume in Russia from 2005 to 2022 (in 1,000s)

-

Premium Statistic

Sales share of new passenger cars and LCVs in Russia 2023, by manufacturer

Sales share of new passenger cars and LCVs in Russia 2023, by manufacturer

Retail sales share of new passenger cars and light commercial vehicles (LCVs) in Russia from January to September 2023, by group of manufacturer

-

Basic Statistic

Used PC registrations in Russia 2023, by region

Used PC registrations in Russia 2023, by region

Number of used passenger cars (PCs) registered n Russia in October 2023, by region

-

Basic Statistic

New PC registrations in Russia 2022, by region

New PC registrations in Russia 2022, by region

Number of new passenger cars (PCs) registered in Russia in June 2022, by region

Production

5

- Premium Statistic Car production in Russia monthly 2024

- Premium Statistic Foreign passenger car production volume in Russia 2014-2026

- Premium Statistic Light commercial vehicles production volume in Russia 2018-2022, by scenario

- Premium Statistic Car production volume in Russia 2022-2023, by type

- Premium Statistic Forecast trucks production volume in Russia 2018-2022, by scenario

Production

-

Premium Statistic

Car production in Russia monthly 2024

Car production in Russia monthly 2024

Production of passenger cars in Russia from January 2022 to February 2024 (in 1,000s)

-

Premium Statistic

Foreign passenger car production volume in Russia 2014-2026

Foreign passenger car production volume in Russia 2014-2026

Annual production volume of foreign passenger cars in Russia from 2014 to 2026 (in 1,000s)

-

Premium Statistic

Light commercial vehicles production volume in Russia 2018-2022, by scenario

Light commercial vehicles production volume in Russia 2018-2022, by scenario

Projected production volume of light commercial vehicles (LCV) in Russia from 2018 to 2022, by scenario (in 1,000s)

-

Premium Statistic

Car production volume in Russia 2022-2023, by type

Car production volume in Russia 2022-2023, by type

Number of motor vehicles produced in Russia from 1st quarter 2022 to 1st quarter 2023, by type (in 1,000s)

-

Premium Statistic

Forecast trucks production volume in Russia 2018-2022, by scenario

Forecast trucks production volume in Russia 2018-2022, by scenario

Estimated production volume of trucks in Russia from 2018 to 2022, by scenario (in 1,000s)

Retail

6

- Premium Statistic Number of new passenger cars sold in Russia 2012-2027

- Premium Statistic Car market sales share in Russia 2022, by segment

- Premium Statistic Most sold passenger car models in Russia in 2022

- Premium Statistic Annual new commercial vehicle sales in Russia 2005-2022

- Premium Statistic Sales volume of truck cars in Russia 2012-2022

- Premium Statistic Sales volume of new buses in Russia 2022-2023, by manufacturer

Retail

-

Premium Statistic

Number of new passenger cars sold in Russia 2012-2027

Number of new passenger cars sold in Russia 2012-2027

Sales volume of new passenger cars in Russia from 2012 to 2027 (in millions)

-

Premium Statistic

Car market sales share in Russia 2022, by segment

Car market sales share in Russia 2022, by segment

Distribution of the automotive sales revenue in Russia in 2022, by segment

-

Premium Statistic

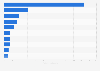

Most sold passenger car models in Russia in 2022

Most sold passenger car models in Russia in 2022

Best sold passenger cars in Russia from January to September 2022, by model and manufacturer

-

Premium Statistic

Annual new commercial vehicle sales in Russia 2005-2022

Annual new commercial vehicle sales in Russia 2005-2022

Annual sales volume of new commercial vehicles in Russia from 2005 to 2022 (in 1,000s)

-

Premium Statistic

Sales volume of truck cars in Russia 2012-2022

Sales volume of truck cars in Russia 2012-2022

Sales volume of truck cars in Russia from 2012 to 2022* (in 1,000s)

-

Premium Statistic

Sales volume of new buses in Russia 2022-2023, by manufacturer

Sales volume of new buses in Russia 2022-2023, by manufacturer

Monthly sales volume of new buses in Russia from 1st half of 2022 to 1st half 2023

Passenger car manufacturers

6

- Premium Statistic New PC registrations in Russia 2022, by manufacturer

- Premium Statistic Used PC registrations in Russia 2023, by manufacturer

- Premium Statistic Russian car sales volume by leading foreign brand 2021

- Premium Statistic Volume of new F+S class cars in Russia 2021, by manufacturer

- Premium Statistic Number of new SUV registrations in Russia 2021, by brand

- Premium Statistic Market share of Renault Group 2023, by country

Passenger car manufacturers

-

Premium Statistic

New PC registrations in Russia 2022, by manufacturer

New PC registrations in Russia 2022, by manufacturer

Number of new passenger cars (PCs) registered in Russia in June 2022, by manufacturer

-

Premium Statistic

Used PC registrations in Russia 2023, by manufacturer

Used PC registrations in Russia 2023, by manufacturer

Number of used passenger cars (PCs) registered in Russia in October 2023, by manufacturer

-

Premium Statistic

Russian car sales volume by leading foreign brand 2021

Russian car sales volume by leading foreign brand 2021

Automobile sales volume in Russia in 2021, by leading foreign brand

-

Premium Statistic

Volume of new F+S class cars in Russia 2021, by manufacturer

Volume of new F+S class cars in Russia 2021, by manufacturer

Number of new luxury and sports (F+S) cars registered in Russia from January to November 2021, by manufacturer

-

Premium Statistic

Number of new SUV registrations in Russia 2021, by brand

Number of new SUV registrations in Russia 2021, by brand

Number of new SUV segment cars registered in Russia from January to November 2021, by manufacturer

-

Premium Statistic

Market share of Renault Group 2023, by country

Market share of Renault Group 2023, by country

Market share of Renault Group in 2023, by country

Commercial vehicle manufacturers

4

Commercial vehicle manufacturers

-

Basic Statistic

New LCV car registrations in Russia 2023, by manufacturer

New LCV car registrations in Russia 2023, by manufacturer

Number of new light commercial vehicles (LCVs) registered in Russia in August 2023, by manufacturer

-

Basic Statistic

Number of pickups with mileage in Russia 2023, by brand

Number of pickups with mileage in Russia 2023, by brand

Number of re-registered pickup cars with mileage in Russia in January 2023, by manufacturer*

-

Basic Statistic

Number of HCV cars with mileage in Russia in 2022, by brand

Number of HCV cars with mileage in Russia in 2022, by brand

Number of heavy commercial vehicles (HCV) with mileage registered in Russia in December 2022, by manufacturer

-

Basic Statistic

Leading truck car brands in Russia 2022-2023, by sales volume

Leading truck car brands in Russia 2022-2023, by sales volume

Number of new trucks sold in Russia from 1st half 2022 to 1st half 2023, by manufacturer

Electric cars

-

Premium Statistic

Number of new electric cars sold in Russia 2015-2023

Number of new electric cars sold in Russia 2015-2023

Annual sales volume of new electric vehicles (EV) in Russia from 2015 to 2023 (in units)

-

Premium Statistic

Number of new and used EVs in Russia 2013-2023

Number of new and used EVs in Russia 2013-2023

Electric vehicles (EV) car parc in Russia from 2013 to January 2023, by mileage (in units)

-

Premium Statistic

Number of EVs in the Russian car market 2022, by model

Number of EVs in the Russian car market 2022, by model

Electric car fleet in Russia in 2022, by car model (in units)

Trade

8

- Premium Statistic Cars export value in the CEE region 2022

- Premium Statistic Trucks export value in the CEE region 2022

- Premium Statistic Cars import value in the CEE region 2022

- Premium Statistic Electric cars import value in the CEE region 2022

- Premium Statistic Export value of cars from Russia 2018-2021, by vehicle type

- Basic Statistic Car import value in Russia 2020-2021, by vehicle type

- Premium Statistic New car import share in Russia 2023, by country

- Premium Statistic Import share of cars with mileage in Russia 2023, by country

Trade

-

Premium Statistic

Cars export value in the CEE region 2022

Cars export value in the CEE region 2022

Export value of cars in Central and Eastern European countries in 2022 (in million U.S. dollars)

-

Premium Statistic

Trucks export value in the CEE region 2022

Trucks export value in the CEE region 2022

Export value of trucks in Central and Eastern European countries in 2022 (in million U.S. dollars)

-

Premium Statistic

Cars import value in the CEE region 2022

Cars import value in the CEE region 2022

Import value of cars in Central and Eastern European countries in 2022 (in million U.S. dollars)

-

Premium Statistic

Electric cars import value in the CEE region 2022

Electric cars import value in the CEE region 2022

Import value of electric cars in Central and Eastern European countries in 2022 (in million U.S. dollars)

-

Premium Statistic

Export value of cars from Russia 2018-2021, by vehicle type

Export value of cars from Russia 2018-2021, by vehicle type

Value of car exports from Russia from 2018 to 2021, by vehicle type (in million U.S. dollars)

-

Basic Statistic

Car import value in Russia 2020-2021, by vehicle type

Car import value in Russia 2020-2021, by vehicle type

Import value of cars in Russia from 2020 to 2021, by vehicle type (in million U.S. dollars)

-

Premium Statistic

New car import share in Russia 2023, by country

New car import share in Russia 2023, by country

Share of new car imports in Russia in June 2023, by country

-

Premium Statistic

Import share of cars with mileage in Russia 2023, by country

Import share of cars with mileage in Russia 2023, by country

Share of imports of cars with mileage in Russia in June 2023, by country

Consumer behavior

-

Premium Statistic

Car ownership in Russia 2023

Car ownership in Russia 2023

Car ownership in Russia as of March 2023

-

Premium Statistic

Satisfaction with car make in Russia 2022

Satisfaction with car make in Russia 2022

Satisfaction with car make in Russia in 2022

-

Basic Statistic

Public survey on willingness to buy an electric car in Russia in 2022

Public survey on willingness to buy an electric car in Russia in 2022

Would you like to purchase an electric car?

-

Basic Statistic

Public survey on disadvantages of electric cars in Russia in 2022

Public survey on disadvantages of electric cars in Russia in 2022

What are the main disadvantages of electric vehicles over conventional cars with a fuel engine?

Further reportsGet the best reports to understand your industry

Get the best reports to understand your industry

Contact

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)