Coffee production and exports in Indonesia

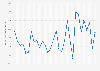

Around the world, the word java is synonymous with coffee. However, in Indonesia, the island of Sumatra is where the coffee is mostly to be found, making up more than 60 percent of the coffee crop growing areas in the country. Almost all of the coffee grown in Indonesia come from smallholder estates scattered around the main coffee-growing islands of Sumatra, Java, Flores, and the Bali islands. More than 70 percent of the coffee grown in Indonesia were of the Robusta variety, which has a lower market value than Arabica beans. Robusta beans, known for their strong and bitter aftertaste, are mainly used in instant coffee production, as well as in espresso and coffee blends.Historically, Indonesia had exported a majority of the coffee that it produced, with its biggest markets being the United States, Italy and Malaysia. However, a change in domestic consumption patterns has started to affect its coffee exports. Indonesian coffee production had seen yearly increases in the last few years. However, so too has its domestic coffee consumption. Recently, rising demand is expected to outstrip its coffee supply starting in 2021/2022 mostly due to unfavorable weather conditions, raising fears of a shortage in global coffee availability.