Three pillars of the Chinese telecommunications services

As a result of the reconstruction and acquisitions in 2008, the Chinese telecommunications market was dominated by three state-controlled telecommunications service operators: China Mobile, China Telecom, and China Unicom. While China Mobile focused on providing mobile services, China Telecom and China Unicom were also issued with nationwide fixed-line licenses. In 2021, China Mobile generated revenue of more than 848 billion yuan and ranked in third place among all telecommunications operators worldwide.In the same year, its competitor China Telecom generated a revenue of nearly 400 billion yuan from its voice, internet, and other services. While the number of mobile subscribers of China Telecom increased, its fixed-lines users shrank to almost half compared to 2008. To stay competitive in the coming digital era, the major telecommunications providers in China also expanded to innovative business segments, such as IoT devices, e-payment, and cloud services.

The age of 5G

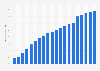

With almost 1.7 billion mobile subscriptions, China has become the country with the largest mobile-cellular user base worldwide. When 5G (fifth generation) technology started to hit the market in 2019, China became one of the frontrunners in the global 5G deployment and 5G devices production race.By 2025, China was forecasted to host the most 5G connections in the world, approximately equaling to the sum of North America, Asia-Pacific developed countries, and western Europe. By the end of 2020, China was planning to activate more than 130,000 5G base stations. In the meantime, Chinese smartphone companies Vivo, Xiaomi, and OPPO shipped about 58 million units of 5G smartphones in the first quarter of 2021. A year later Xiaomi alone accounted for almost 16 percent of the global 5G smartphone shipments.

The vast majority of Chinese believed that the implementation of 5G technology would have a significant impact on their daily lives. Fast internet speeds and stable internet signals were the leading features that Chinese consumers expected from 5G technology.