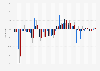

Despite this positive trade performance, the European automotive sector has faced various hurdles since the coronavirus outbreak in 2020. An August 2023 forecast projected that passenger car revenue in Europe would dip in 2023 and would not fully surpass its pre-pandemic levels until 2027. On the heels of the global automotive semiconductor shortage, which led to supply issues in 2021 and 2022, rising raw material costs, consumer price inflation, new technologies, and automotive layoffs are putting pressure on the industry to adapt to a shifting market.

Challenges from multiple directions

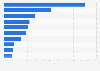

The coronavirus outbreak led to a dramatic decline in new vehicle sales across the continent in 2020. Decreasing affordability and an economic downturn added to the lack of demand in European markets. The most noticeable drop in demand occurred in the United Kingdom, where passenger car sales peaked in 2016 and fell consistently until 2021. A weakening currency in the wake of the 2016 Brexit referendum made new vehicles more difficult. The UK’s trade relationship with the EU has also been declining in the past years: The UK was the leading importer of EU cars in 2020 but was second importer in 2022, behind the United States.This slump in the sector in the UK was also observable across the region, with many countries reporting a drop in automobile sales between 2021 and 2022. The industry was deeply impacted by production halts and lay-offs throughout the pandemic and chip shortage. 2022 brought another challenge for the European automotive industry. Volkswagen, Porsche, and BMW had to temporarily halt production in March 2022 due to supply chain disruptions resulting from the Russian invasion of Ukraine, and many manufacturers such as the Renault Group discontinued their operations in Russia as a result of the war.

Despite these challenges, the industry recorded a good financial performance, with most European manufacturers reporting a revenue increase in 2022—Volkwagen AG’s sales revenue exceeded its pre-pandemic levels, similar to BMW. Headquarter to renowned brands such as Volkswagen, BMW, and Mercedes-Benz, Germany was one of the European countries where automobile demand boosted sales in 2022. However, while the German demand for passenger cars grew, the country has been contending with production hurdles. German automotive industry produced nearly 3.5 million passenger cars in 2022—the largest automobile production in Europe—which represented a small increase after its production volume had been in free fall since 2016 and was at its record low since 1990 in 2021.

The road to sustainability

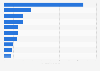

In June 2022, the European Union parliament approved a ban on new fossil-fuel cars from 2035, but the road to zero-emission still had miles to go. An amendment put forward by Germany will allow the sale of internal combustion engine (ICE) vehicles after that deadline, provided they run on e-fuels or carbon neutral fuels. Plug-in electric vehicles (PEVs) made up 21.5 percent of new automobile sales in 2022, outweighed by ICE car sales, representing over half of the market. A year earlier, fossil-fuel cars made up over 60 percent of the market, but non-rechargeable hybrid cars have slowly edged out diesel vehicles as the second best-selling propulsion type in the EU. Part of the reasons for this popularity relate to consumer perception of the market. For example, range anxiety and inaccessible charging infrastructure were the leading German consumer concerns hampering PEV sales.While EV adoption has been slow in Europe, some countries have stood out for their drive towards battery electric power, namely Norway, following decisive policy making from the government. Battery-electric vehicles (BEVs) have a larger market share in Norway than anywhere else, at 79.3 percent of 2022 sales. Sweden and the Netherlands were second and third in the region for their battery electric market share. In contrast, BEVs represented 17.8 percent of the German market. Despite this, Germany was still at the forefront of the new energy vehicle market, with Volkswagen recording a strong worldwide performance. The ID.4 ranked among the best-selling PEV models worldwide in 2022, and was the only European model to reach the top ten.