Groupon - statistics & facts

Key insights

- Global revenue

- 599m USD

Detailed statistics

Groupon: global revenue 2008-2022

- Revenue in North America

- 436m USD

Detailed statistics

Groupon: annual revenue in North America 2009-2022

- Monthly website visits in the U.S.

- 40m

Detailed statistics

Most visited coupon websites in the U.S. 2021-2022

Editor’s Picks Current statistics on this topic

Current statistics on this topic

Related topics

Recommended statistics

Overview

6

- Basic Statistic Groupon: global revenue 2008-2022

- Premium Statistic Groupon: quarterly revenue 2009-2023

- Premium Statistic Groupon: annual revenue in North America 2009-2022

- Premium Statistic Leading coupons and rebates websites worldwide 2023, based on visit share

- Premium Statistic Leading coupons and rebates websites in the U.S. 2023, based on visit share

- Premium Statistic Most visited coupon websites in the U.S. 2021-2022

Overview

-

Basic Statistic

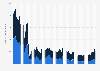

Groupon: global revenue 2008-2022

Groupon: global revenue 2008-2022

Global revenue of Groupon from 2008 to 2022 (in million U.S. dollars)

-

Premium Statistic

Groupon: quarterly revenue 2009-2023

Groupon: quarterly revenue 2009-2023

Revenue of Groupon from 1st quarter 2009 to 2nd quarter 2023 (in million U.S. dollars)

-

Premium Statistic

Groupon: annual revenue in North America 2009-2022

Groupon: annual revenue in North America 2009-2022

Groupon's revenue in North America from 2009 to 2022 (in million U.S. dollars)

-

Premium Statistic

Leading coupons and rebates websites worldwide 2023, based on visit share

Leading coupons and rebates websites worldwide 2023, based on visit share

Most popular coupons and rebates websites worldwide in December 2023, based on share of visits

-

Premium Statistic

Leading coupons and rebates websites in the U.S. 2023, based on visit share

Leading coupons and rebates websites in the U.S. 2023, based on visit share

Most popular coupons and rebates websites in the United States in December 2023, based on share of visits

-

Premium Statistic

Most visited coupon websites in the U.S. 2021-2022

Most visited coupon websites in the U.S. 2021-2022

Most popular coupon websites in the United States from May 2021 to April 2022, based on average monthly visits (in millions)

Financials

7

- Premium Statistic Groupon market cap development 2011-2023

- Basic Statistic Groupon: annual net income/loss 2009-2022

- Basic Statistic Groupon: quarterly net income/loss 2015-2023

- Premium Statistic Groupon: quarterly gross billings 2014-2023, by category

- Premium Statistic Groupon: marketing expense 2013-2022

- Premium Statistic Groupon: operating expenses 2008-2022

- Basic Statistic Groupon: global sales force 2009-2023

Financials

-

Premium Statistic

Groupon market cap development 2011-2023

Groupon market cap development 2011-2023

Market capitalization of Groupon from 2011 to 2023 (in billion U.S. dollars)

-

Basic Statistic

Groupon: annual net income/loss 2009-2022

Groupon: annual net income/loss 2009-2022

Annual net income/loss of Groupon from 2009 to 2022 (in million U.S. dollars)

-

Basic Statistic

Groupon: quarterly net income/loss 2015-2023

Groupon: quarterly net income/loss 2015-2023

Groupon's net income/loss from 1st quarter 2015 to 2nd quarter 2023 (in million U.S. dollars)

-

Premium Statistic

Groupon: quarterly gross billings 2014-2023, by category

Groupon: quarterly gross billings 2014-2023, by category

Groupon's consolidated gross billings from 1st quarter 2014 to 1st quarter 2023, by category (in million U.S. dollars)

-

Premium Statistic

Groupon: marketing expense 2013-2022

Groupon: marketing expense 2013-2022

Marketing expense of Groupon from 2013 to 2022 (in million U.S. dollars)

-

Premium Statistic

Groupon: operating expenses 2008-2022

Groupon: operating expenses 2008-2022

Operating expenses of Groupon from 2008 to 2022 (in million U.S. dollars)

-

Basic Statistic

Groupon: global sales force 2009-2023

Groupon: global sales force 2009-2023

Number of Groupon's merchant sales representatives and sales support staff from 1st quarter 2009 to 1st quarter 2023

Consumption

5

- Premium Statistic Number of Groupon active customers 2009-2023

- Premium Statistic Groupon mobile shoppers share in the U.S. 2023, by income

- Premium Statistic Sources of inspiration for new products in the U.S. 2023

- Premium Statistic Sources of information about products in the U.S. 2023

- Premium Statistic Shoppers who have used digital and paper coupons in the U.S. 2022, by generation

Consumption

-

Premium Statistic

Number of Groupon active customers 2009-2023

Number of Groupon active customers 2009-2023

Number of Groupon's active customers from 2nd quarter 2009 to 2nd quarter 2023 (in millions)

-

Premium Statistic

Groupon mobile shoppers share in the U.S. 2023, by income

Groupon mobile shoppers share in the U.S. 2023, by income

Distribution of Groupon mobile shoppers in the United States as of March 2023, by income (in U.S. dollars)

-

Premium Statistic

Sources of inspiration for new products in the U.S. 2023

Sources of inspiration for new products in the U.S. 2023

Sources of inspiration for new products in the U.S. as of December 2023

-

Premium Statistic

Sources of information about products in the U.S. 2023

Sources of information about products in the U.S. 2023

Sources of information about products in the U.S. as of December 2023

-

Premium Statistic

Shoppers who have used digital and paper coupons in the U.S. 2022, by generation

Shoppers who have used digital and paper coupons in the U.S. 2022, by generation

Share of shoppers who have used digital and paper coupons in the United States in 2022, by generational cohort

Online traffic

7

- Premium Statistic Groupon.com: key figures 2023

- Premium Statistic Total global visitor traffic to Groupon.com 2023

- Premium Statistic Groupon.com: website traffic share in the U.S. 2023, by device

- Premium Statistic Groupon app monthly downloads worldwide 2019-2023, by operating system

- Premium Statistic Countries with most Groupon app downloads 2022

- Premium Statistic Leading discount and offer apps worldwide 2022, by downloads

- Premium Statistic Leading discount and offer apps in the U.S. 2023, by downloads

Online traffic

-

Premium Statistic

Groupon.com: key figures 2023

Groupon.com: key figures 2023

Key figures on Groupon.com as of May 2023

-

Premium Statistic

Total global visitor traffic to Groupon.com 2023

Total global visitor traffic to Groupon.com 2023

Worldwide visits to Groupon.com from July 2023 to December 2023 (in millions)

-

Premium Statistic

Groupon.com: website traffic share in the U.S. 2023, by device

Groupon.com: website traffic share in the U.S. 2023, by device

Distribution of Groupon.com visits in the United States in May 2023, by device

-

Premium Statistic

Groupon app monthly downloads worldwide 2019-2023, by operating system

Groupon app monthly downloads worldwide 2019-2023, by operating system

Number of monthly downloads of the Groupon app worldwide from January 2019 to May 2023, by operating system (in 1,000s)

-

Premium Statistic

Countries with most Groupon app downloads 2022

Countries with most Groupon app downloads 2022

Countries with the highest number of Groupon app downloads in 2022 (in 1,000s)

-

Premium Statistic

Leading discount and offer apps worldwide 2022, by downloads

Leading discount and offer apps worldwide 2022, by downloads

Most popular free discount and offer apps worldwide in 2022, by number of downloads (in millions)

-

Premium Statistic

Leading discount and offer apps in the U.S. 2023, by downloads

Leading discount and offer apps in the U.S. 2023, by downloads

Most popular free discount and offer apps in the United States in 2023, by number of downloads (in millions)

Further reportsGet the best reports to understand your industry

Get the best reports to understand your industry

Contact

Get in touch with us. We are happy to help.

Meredith Alda

Sales Manager– Contact (United States)

Mon - Fri, 9am - 6pm (EST)

Yolanda Mega

Operations Manager– Contact (Asia)

Mon - Fri, 9am - 5pm (SGT)

Kisara Mizuno

Senior Business Development Manager– Contact (Asia)

Mon - Fri, 10:00am - 6:00pm (JST)

Lodovica Biagi

Director of Operations– Contact (Europe)

Mon - Fri, 9:30am - 5pm (GMT)

Carolina Dulin

Group Director - LATAM– Contact (Latin America)

Mon - Fri, 9am - 6pm (EST)