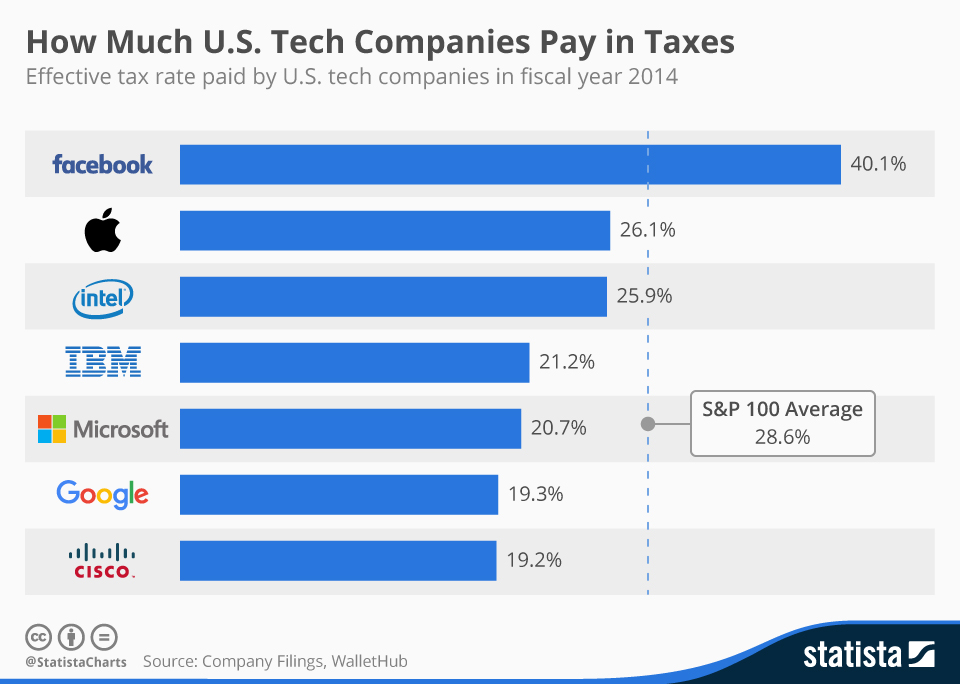

How Much U.S. Tech Companies Pay in Taxes

Large tech companies such as Apple and Google are often accused of avoiding U.S. taxes by stashing foreign earnings in countries with lower corporate tax rates. When asked about his company’s tax avoidance practices in an interview with “60 Minutes”, Apple’s CEO Tim Cook rebutted the allegations saying that Apple pays “every tax dollar it owes”. He also criticized the U.S. tax code for being outdated in the digital age and claimed that Apple pays more taxes than any other company.

While that may be true in total terms, it definitely isn't in relation to the company's outlandish profits. In 2014, Apple paid $13.97 billion in income taxes, which is more than what IBM, Microsoft and Google paid combined. More importantly though, Apple’s effective tax rate (the average rate at which pre-tax profits are taxed) in 2014 was 26.1%. While that is actually higher than it is for many of its fellow tech companies, it is 2.5 percentage points below the average tax rate paid by S&P 100 companies in 2014, not to mention the statutory federal income tax rate of 35%.

As our chart illustrates, Apple is far from alone in trying to pay as little taxes as possible. As a matter of fact, it is paying higher taxes than many of its peers.

While that may be true in total terms, it definitely isn't in relation to the company's outlandish profits. In 2014, Apple paid $13.97 billion in income taxes, which is more than what IBM, Microsoft and Google paid combined. More importantly though, Apple’s effective tax rate (the average rate at which pre-tax profits are taxed) in 2014 was 26.1%. While that is actually higher than it is for many of its fellow tech companies, it is 2.5 percentage points below the average tax rate paid by S&P 100 companies in 2014, not to mention the statutory federal income tax rate of 35%.

As our chart illustrates, Apple is far from alone in trying to pay as little taxes as possible. As a matter of fact, it is paying higher taxes than many of its peers.