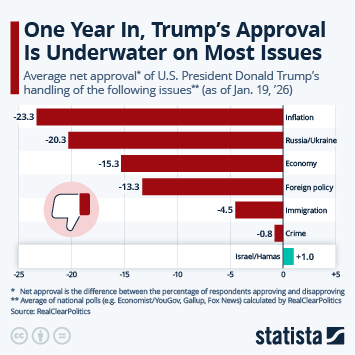

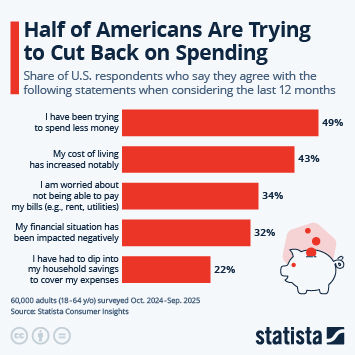

While the U.S. economy has come through the inflation crisis relatively unscathed, with robust if unspectacular growth, relatively low unemployment and high stock prices, many American families have not. Confidence is down as millions of Americans feel worse off than they did a couple of years ago - and many actually are. The main problem with inflation is the fact that it hits consumers right where it hurts: the wallet. In times of high inflation, when prices increase faster than nominal wages, real wages go down, meaning that workers feel the purchasing power of their income decline.

During the inflation crisis of the past few years, this was the case from April 2021 to April 2023, when average real hourly earnings declined for 25 consecutive months on a year-over-year basis. In May 2023, real wages began to rise again as nominal wage growth outpaced inflation once again as it normally should. That doesn't mean that the effects of the inflation spike in 2021 and 2022 can no longer be felt, though. Looking at cumulative wage growth since January 2021 and comparing it to the cumulative increase of consumer prices shows that wages have barely caught up with price increases, even two and half years after nominal wage growth began outpacing inflation. As our chart shows, real wages are still down 0.1 percent compared to January 2021, meaning that, adjusted for price increases, Americans, on average, haven't gotten a raise in the past five years.

The good news is that wages are consistently growing faster than prices again, meaning that real wages are rising and will soon exceed pre-crisis levels. In his press conference following the December FOMC meeting, Fed chairman Jerome Powell acknowledged those lasting effects of the inflation crisis. "We’re going to need to have some years where real compensation is higher, significantly positive ... for people to start feeling good about affordability,” Powell said.