U.S. self-storage - statistics & facts

Key insights

- New self-storage space completed in the U.S.

- 43.5m sq ft

Detailed statistics

Size of self-storage space completed in the U.S. 2016-2022, with a forecast for 2023

- Vacancy rate of self-storage space in the U.S.

- 8%

Detailed statistics

Vacancy rate of self-storage space in the U.S. 2015-2022 with a forecast for 2023

- Revenue of Public Storage

- 2.51bn USD

Detailed statistics

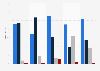

Leading self-storage companies in the U.S. 2017, by revenue

Editor’s Picks Current statistics on this topic

Current statistics on this topic

Related topics

Recommended statistics

Overview

9

- Premium Statistic Fastest growing self-storage markets in the U.S. 2020, by inventory change

- Premium Statistic Number of self-storage facilities, by state U.S. 2020

- Premium Statistic Size of self-storage space, by state U.S. 2020

- Premium Statistic Size of self-storage space completed in the U.S. 2016-2022, with a forecast for 2023

- Premium Statistic Size of self-storage space completed in the U.S. 2022-2023, by market

- Premium Statistic Share of self-storage acquisitions in the U.S. 2015-2019, by buyer type

- Premium Statistic Vacancy rate of self-storage space in the U.S. 2015-2022 with a forecast for 2023

- Premium Statistic Asking rent per sf of self-storage space in the U.S. 2016-2022 with forecast for 2023

- Premium Statistic Asking rent per sf of self-storage space in the U.S. 2022-2023, by market

Overview

-

Premium Statistic

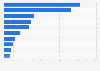

Fastest growing self-storage markets in the U.S. 2020, by inventory change

Fastest growing self-storage markets in the U.S. 2020, by inventory change

Fastest growing self-storage markets in the United States in 2020, by expected inventory change

-

Premium Statistic

Number of self-storage facilities, by state U.S. 2020

Number of self-storage facilities, by state U.S. 2020

Number of self-storage facilities in the United States in 2020, by state

-

Premium Statistic

Size of self-storage space, by state U.S. 2020

Size of self-storage space, by state U.S. 2020

Size of rentable self-storage space in the United States in 2020, by state (in million square feet)

-

Premium Statistic

Size of self-storage space completed in the U.S. 2016-2022, with a forecast for 2023

Size of self-storage space completed in the U.S. 2016-2022, with a forecast for 2023

Size of self-storage space completed in the United States from 2016 to 2022, with a forecast until 2023 (in million square feet)

-

Premium Statistic

Size of self-storage space completed in the U.S. 2022-2023, by market

Size of self-storage space completed in the U.S. 2022-2023, by market

Size of self-storage space completed in the United States in 2022 with a forecast until 2023, by market (in 1,000 square feet)

-

Premium Statistic

Share of self-storage acquisitions in the U.S. 2015-2019, by buyer type

Share of self-storage acquisitions in the U.S. 2015-2019, by buyer type

Distribution of self-storage acquisitions in the United States from 2015 to August 2019, by buyer type

-

Premium Statistic

Vacancy rate of self-storage space in the U.S. 2015-2022 with a forecast for 2023

Vacancy rate of self-storage space in the U.S. 2015-2022 with a forecast for 2023

Vacancy rate of self-storage space in the United States from 2015 to 2022 with a forecast for 2023

-

Premium Statistic

Asking rent per sf of self-storage space in the U.S. 2016-2022 with forecast for 2023

Asking rent per sf of self-storage space in the U.S. 2016-2022 with forecast for 2023

Asking rent per square foot of self-storage space in the United States from 2016 to 2022 with a forecast until 2023 (in U.S. dollars)

-

Premium Statistic

Asking rent per sf of self-storage space in the U.S. 2022-2023, by market

Asking rent per sf of self-storage space in the U.S. 2022-2023, by market

Asking rent per square foot of self-storage space in the United States in 2022 with a forecast for 2023, by market (in U.S. dollars)

Market overview

6

- Premium Statistic Volume of self-storage investment in the U.S. 2012-2020

- Premium Statistic Leading self-storage operators in the U.S. 2020, by rentable space

- Premium Statistic Leading self-storage companies in the U.S. 2020, by number of facilities

- Premium Statistic Cap rate of self-storage properties in the U.S. Q2 2010-Q4 2021

- Premium Statistic Leading self-storage acquisition markets in the U.S. 2019

- Premium Statistic Leading self-storage REITs in the U.S. 2019-2020, by rental income

Market overview

-

Premium Statistic

Volume of self-storage investment in the U.S. 2012-2020

Volume of self-storage investment in the U.S. 2012-2020

Volume of self-storage investment in the United States from 2012 to 2020 (in billion U.S. dollars)

-

Premium Statistic

Leading self-storage operators in the U.S. 2020, by rentable space

Leading self-storage operators in the U.S. 2020, by rentable space

Leading self-storage operators in the United States in 2020, by net rentable space (in million square feet)

-

Premium Statistic

Leading self-storage companies in the U.S. 2020, by number of facilities

Leading self-storage companies in the U.S. 2020, by number of facilities

Leading self-storage companies in the United States in 2020, by number of facilities owned

-

Premium Statistic

Cap rate of self-storage properties in the U.S. Q2 2010-Q4 2021

Cap rate of self-storage properties in the U.S. Q2 2010-Q4 2021

Capitalization rate of self-storage investment properties in the United States from 2nd quarter 2010 to 4th quarter 2021

-

Premium Statistic

Leading self-storage acquisition markets in the U.S. 2019

Leading self-storage acquisition markets in the U.S. 2019

Value of self-storage property acquisitions in selected markets in the United States from Q3 2018 to Q2 2019 (in million U.S. dollars)

-

Premium Statistic

Leading self-storage REITs in the U.S. 2019-2020, by rental income

Leading self-storage REITs in the U.S. 2019-2020, by rental income

Leading self-storage REITs in the United States in 2nd quarter 2019 and 2nd quarter 2020, by rental income (in million U.S. dollars)

Public Storage

5

- Premium Statistic Market capitalization of Public Storage in the U.S. 2015-2022

- Premium Statistic Revenue of Public Storage in the U.S. 2013-2022

- Premium Statistic Debt of Public Storage in the U.S. 2013-2021

- Premium Statistic Debt to assets ratio of Public Storage in the U.S. 2015-2021

- Premium Statistic Net income of Public Storage in the U.S. 2013-2022

Public Storage

-

Premium Statistic

Market capitalization of Public Storage in the U.S. 2015-2022

Market capitalization of Public Storage in the U.S. 2015-2022

Market capitalization of Public Storage in the United States from 2015 to 2022 (in billion U.S. dollars)

-

Premium Statistic

Revenue of Public Storage in the U.S. 2013-2022

Revenue of Public Storage in the U.S. 2013-2022

Revenue of Public Storage in the United States from 2013 to 2022 (in billion U.S. dollars)

-

Premium Statistic

Debt of Public Storage in the U.S. 2013-2021

Debt of Public Storage in the U.S. 2013-2021

Total debt of Public Storage in the United States from 2013 to 2021 (in million U.S. dollars)

-

Premium Statistic

Debt to assets ratio of Public Storage in the U.S. 2015-2021

Debt to assets ratio of Public Storage in the U.S. 2015-2021

Debt to total assets ratio of Public Storage in the United States from 2015 to 2021

-

Premium Statistic

Net income of Public Storage in the U.S. 2013-2022

Net income of Public Storage in the U.S. 2013-2022

Net income of Public Storage in the United States from 2013 to 2022 (in billion U.S. dollars)

Extra Space Storage

4

Extra Space Storage

-

Basic Statistic

Market capitalization of Extra Space Storage in the U.S. 2015-2022

Market capitalization of Extra Space Storage in the U.S. 2015-2022

Market capitalization of Extra Space Storage in the United States from 2015 to 2022 (in billion U.S. dollars)

-

Premium Statistic

Revenue of Extra Space Storage in the U.S. 2015-2022

Revenue of Extra Space Storage in the U.S. 2015-2022

Revenue of Extra Space Storage in the United States from 2015 to 2022 (in million U.S. dollars)

-

Premium Statistic

Debt of Extra Space Storage in the U.S. 2015-2021

Debt of Extra Space Storage in the U.S. 2015-2021

Total debt of Extra Space Storage in the United States from 2015 to 2021 (in billion U.S. dollars)

-

Premium Statistic

Net income of Extra Space Storage in the U.S. 2015-2022

Net income of Extra Space Storage in the U.S. 2015-2022

Net income of Extra Space Storage in the United States from 2015 to 2022 (in million U.S. dollars)

Other competitors

4

- Premium Statistic Market capitalization of Amerco Inc in the U.S. 2015-2021

- Premium Statistic Market capitalization of CubeSmart in the U.S. 2015-2022

- Premium Statistic Market capitalization of Prologis in the U.S. 2015-2023

- Premium Statistic Market capitalization of Life Storage in the U.S. 2015-2022

Other competitors

-

Premium Statistic

Market capitalization of Amerco Inc in the U.S. 2015-2021

Market capitalization of Amerco Inc in the U.S. 2015-2021

Market capitalization of Amerco Inc in the United States from 2015 to 2021 (in billion U.S. dollars)

-

Premium Statistic

Market capitalization of CubeSmart in the U.S. 2015-2022

Market capitalization of CubeSmart in the U.S. 2015-2022

Market capitalization of CubeSmart in the United States from 2015 to 2022 (in billion U.S. dollars)

-

Premium Statistic

Market capitalization of Prologis in the U.S. 2015-2023

Market capitalization of Prologis in the U.S. 2015-2023

Market capitalization of Prologis Inc in the United States from 2015 to 2023 (in billion U.S. dollars)

-

Premium Statistic

Market capitalization of Life Storage in the U.S. 2015-2022

Market capitalization of Life Storage in the U.S. 2015-2022

Market capitalization of Life Storage in the United States from 2015 to 2022 (in billion U.S. dollars)

Further reportsGet the best reports to understand your industry

Get the best reports to understand your industry

Contact

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)