Amna Puri-Mirza

Research Expert covering the Middle East

Detailed statistics

Total assets of commercial banks in the GCC 2021, by country

Detailed statistics

Net profit of commercial banks in the GCC 2021, by country

Detailed statistics

ROE of commercial banks in the GCC 2021, by country

Total assets of banking sector in select countries worldwide 2022

Total assets of the banking sector in select countries worldwide 2022, by country (in trillion U.S. dollars)

Assets of all central banks globally 2002-2022

Total assets of central banks worldwide from 2002 to 2022 (in trillion U.S. dollars)

Assets of banks worldwide 2002-2022

Total assets of banks worldwide from 2002 to 2022 (in trillion U.S. dollars)

Market share of revenue of leading global investment banks 2024

Global market share of revenue of leading investment banks as of June 2024

Cost-income ratio in Saudi Arabia 2021, by key commercial bank

Cost-to-income ratio in Saudi Arabia in 2021, by leading commercial bank

Return on equity in Saudi Arabia 2021, by key commercial bank

Return on equity in Saudi Arabia in 2021, by leading commercial bank

Net profit in Saudi Arabia 2021, by key commercial bank

Net profit in Saudi Arabia in 2021, by leading commercial bank (in million U.S. dollars)

Total assets in Saudi Arabia 2021, by key commercial bank

Total assets in Saudi Arabia in 2021, by leading commercial bank (in billion U.S. dollars)

Loan-deposit ratio in Saudi Arabia 2020, by key commercial bank

Loan-to-deposit ratio in Saudi Arabia in 2020, by leading commercial bank

Capital adequacy ratio in Saudi Arabia 2021, by key commercial bank

Capital adequacy ratio in Saudi Arabia in 2021, by leading commercial bank

Return on assets in Saudi Arabia 2021, by leading commercial bank

Return on assets in Saudi Arabia in 2021, by leading commercial bank

Distribution of banking sector assets in Saudi Arabia by key commercial bank Q3 2022

Breakdown of total banking sector assets in Saudi Arabia in third quarter of 2022, by leading commercial bank

Distribution of lending rate in Saudi Arabia by key commercial bank 2021

Distribution of lending rates of the banking sector in Saudi Arabia in Q4 2021, by leading commercial bank

Distribution of global Islamic banking assets 2022, by country

Distribution of global Islamic banking assets in of 2022, by country

Leading countries in Islamic banking assets worldwide 2022, by value

Leading countries in Islamic banking assets worldwide in 2022, by value (in billion U.S. dollars)

Distribution of global Islamic fund assets 2022, by domicile

Distribution of global Islamic fund assets in 2022, by domicile

Value of sukuk assets outstanding 2022, by region

Value of Islamic bond (sukuk) assets outstanding worldwide in 2022, by region (in billion U.S. dollars)

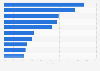

Online banking penetration worldwide 2023, by country

Penetration rate of online banking worldwide in 2023, by country

Online banking penetration in MENA 2020, by country

Ranking of the online banking penetration in MENA by country 2020

Penetration rate of online banking in Saudi Arabia 2014-2029

Penetration rate of online banking in Saudi Arabia from 2014 to 2029

Share of online financial services usage Saudi Arabia 2022

Share of online financial services usage in Saudi Arabia in 2022

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)