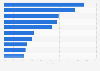

Distribution of global Islamic banking assets 2022, by country

In 2021, the largest share of about 32.9 percent of the Islamic banking assets worldwide were in Saudi Arabia. It was followed by Iran which held about 16.2 percent of the total Islamic banking assets.

Islamic financial services

The Islamic banking sector is an alternative to conventional banking to operate in accordance with Islamic shariah law. The main Islamic principle of Islamic banks is to have a business model which avoids taking riba, that is to profit from interest or usury. Islamic banking includes the sharing of profit and loss, and the prohibition of interest payments between borrowers and lenders. The banks profit through equity participation with the borrower rather than receiving interest payments. The largest Sharia’ah compliant bank was Ayandeh Bank of Iran with assets exceeding 26 billion U.S. dollars in 2019. Further growth of the current Islamic services requires the simultaneous development of other segments of the Islamic capital market to offer a wider range of Islamic financial instruments for assets managers.

Islamic banking assets

Islamic financial institutions offer a variety of Islamic financial services such as Islamic banking, sukuk, Islamic funds, and takaful. Islamic banking was the most popular service with a share exceeding 70 percent of the global Islamic banking services worldwide. The number of jurisdictions with a systemically important Islamic banking sector increased marginally from 2018 to 2019. The Gulf Cooperation Council (GCC) region still accounts for the largest share of the global Islamic banking assets, followed by the Middle East and South Asia region and the South-East Asian region. The growth of the Islamic banking sector continued in 2019, driven by the increase in oil prices and improved credit growth. Its stability indicators were satisfactory in accordance with international regulatory requirements.

Islamic financial services

The Islamic banking sector is an alternative to conventional banking to operate in accordance with Islamic shariah law. The main Islamic principle of Islamic banks is to have a business model which avoids taking riba, that is to profit from interest or usury. Islamic banking includes the sharing of profit and loss, and the prohibition of interest payments between borrowers and lenders. The banks profit through equity participation with the borrower rather than receiving interest payments. The largest Sharia’ah compliant bank was Ayandeh Bank of Iran with assets exceeding 26 billion U.S. dollars in 2019. Further growth of the current Islamic services requires the simultaneous development of other segments of the Islamic capital market to offer a wider range of Islamic financial instruments for assets managers.

Islamic banking assets

Islamic financial institutions offer a variety of Islamic financial services such as Islamic banking, sukuk, Islamic funds, and takaful. Islamic banking was the most popular service with a share exceeding 70 percent of the global Islamic banking services worldwide. The number of jurisdictions with a systemically important Islamic banking sector increased marginally from 2018 to 2019. The Gulf Cooperation Council (GCC) region still accounts for the largest share of the global Islamic banking assets, followed by the Middle East and South Asia region and the South-East Asian region. The growth of the Islamic banking sector continued in 2019, driven by the increase in oil prices and improved credit growth. Its stability indicators were satisfactory in accordance with international regulatory requirements.