Lai Lin Thomala

Research expert covering Greater China

Detailed statistics

Crude steel production in China 2012-2022

Detailed statistics

China's share in worldwide crude steel production 2013-2022

Detailed statistics

Production of hot rolled steel products in China 2008-2020

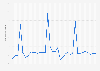

Crude steel production by month in China 2022-2024

Monthly crude steel production in China from June 2022 to June 2024 (in million metric tons)

Crude steel production in China 2012-2022

Crude steel production in China from 2012 to 2022 (in million metric tons)

China's share in worldwide crude steel production 2013-2022

China's share in worldwide crude steel production from 2013 to 2022

China's production of crude steel by category 2012-2020

Production of crude steel in China from 2012 to 2020, by category (in million metric tons)

Production of crude steel in China 2012-2019, by process

Production of crude steel in China from 2012 to 2019, by process* (in million metric tons)

Production of hot rolled steel products in China 2008-2020

Production of hot rolled steel products in China from 2008 to 2020 (in million metric tons)

Apparent steel use (ASU) in China 2008-2022

Apparent steel use (ASU) in China from 2008 to 2022 (in million metric tons)

True steel use (TSU) in China 2007-2019

True steel use (TSU)* in China from 2007 to 2019 (in million metric tons)

China's exports of semi-finished and finished steel products 2008-2020

Export volume of semi-finished and finished steel products in China from 2008 to 2020 (in million metric tons)

China's indirect exports of steel 2007-2019

Indirect export volume of steel from China from 2007 to 2019 (in million metric tons)

Forecasted world HRC benchmark steel price for 2023

Forecasted hot-rolled coil (HRC) steel benchmark price worldwide for 2023 (in U.S. dollars per metric ton)

Iron ore mining per month in China 2021-2024

Monthly iron ore mining in China from June 2021 to June 2024 (in million metric tons)

Production volume of iron ore in China 2015-2023

Production of iron ore in China from 2015 to 2023 (in million metric tons)

Iron ore import volume in China 2012-2022

Import volume of iron ore in China between 2012 and 2022 (in million tons)

Value of iron ore imports to China by major country of origin 2023

Import value of iron ore to China in 2023, by country of origin (in million U.S. dollars)

Global iron ore reserves 2023, by top country

Reserves of iron ore worldwide in 2023, by country (in million metric tons)

Steel scrap recycling in steel production in China 2014-2021

Volume of steel scrap metal used for steelmaking in China from 2014 to 2021 (in million metric tons)

Steel scrap usage rate in steel production in China 2014-2021

Steel scrap to crude steel ratio in steel production in China from 2014 to 2021

Steel scrap imports to China 2008-2020

Import volume of steel scrap to China from 2008 to 2020 (in 1,000 metric tons)

Steel scrap exports from China 2008-2020

Export volume of steel scrap from China from 2008 to 2020 (in 1,000 metric tons)

Largest steel producers worldwide based on production volume 2022

The world's largest 15 crude steel producers in 2022, by production volume (in million metric tons)

Largest steel producers in mainland China 2022, based on production volume

Leading steel manufacturers in mainland China in 2022, based on crude steel production volume (in million metric tons)

Revenue of Baowu Steel Group in China 2014-2022

Revenue of China Baowu Steel Group Co., Ltd. from 2014 to 2022 (in billion yuan)

Revenue of China's HBIS Group 2014-2021

Revenue of China's HBIS Group from 2014 to 2021 (in billion yuan)

Total operating revenue of steelmaker Shagang Group in China 2016-2021

Total operating revenue of the steel company Shagang Group Co., Ltd. in China from 2016 to 2021 (in billion yuan)

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)