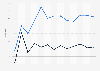

Thanks to robust consumer spending and better-than-expected private investment, the U.S. economy grew even faster than previously estimated in the third quarter of 2023. Real GDP increased at an annual rate of 5.2 percent between July and September, seemingly defying the Fed's efforts to slow the economy in order to bring down inflation. According to the second estimate released by the U.S. Bureau of Economic Analysis (BEA) on Wednesday, the annualized current dollar GDP climbed to $27.6 trillion in the third quarter, up from $27.1 trillion in the previous quarter.

Personal consumption expenditure, by far the largest component of the GDP, increased at an annual rate of 3.6 percent compared to the preceding quarter, as inflation-adjusted spending on goods and services increased by 4.7 and 3.0 percent, respectively. Gross private domestic investment grew stronger than previously expected, as private inventory investment and residential fixed investment picked up pace compared to the previous quarter, partially offset by a deceleration in nonresidential fixed investment. The following chart breaks down Q3 2023 GDP into its four components and shows how much each component contributed to the total growth of 5.2 percent.