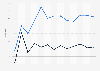

The growth of most highly developed economies has tapered off since the turn of the century due to an already high level of economic performance. Yet, two countries that are now among the nations with the highest gross domestic product worldwide have continued their ascendancy through the ranks: India and China. While the former is still projected to show significant real GDP growth over the next few years, the latter's economic upturn is estimated to slow considerably, according to the most recent IMF World Economic Outlook from October 2023.

The People's Republic reportedly showed real GDP growth of 5.2 percent in 2023, 0.2 percent above target. A recent Reuters report still proposed a grim outlook with a "deepening property crisis, mounting deflationary risks and tepid demand casting a pall over the outlook for this year". With the country's population declining again this past year after 2022 saw the first net decrease in six decades and interest rates not likely to be cut soon, experts are united in suggesting only a broad range of stimuli could help the country's economy out of its ongoing slump. The lack of said stimuli led the IMF to project China's real GDP growth to dip below four percent from 2027 onwards.

On the other hand, India is projected to see constant growth of about 6.3 percent over the next five years. The country's central bank recently revised its growth forecast for its fiscal year of 2023/2024, which ends on March 31, to 7.3 percent. If this trend continues, S&P Global estimates that the country is set to become the world's third largest economy by 2030.

This new-found economic success is not shared equally among Indians, however. In an opinion piece for Nikkei Asia published in December 2023, corporate economist and head of Indonomics Consulting Ritesh Kumar Singh illustrated how large companies prosper due to benefits, tax cuts and lackluster competition control. Meanwhile, smaller corporations are increasingly entangled in a tightening bureaucratic net and households are subjected to ever-increasing economic pressure connected to rising taxes financing said benefits.