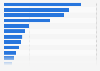

This statistic illustrates a ranking of the leading banks by cost to income ratio in Italy as of 2016. Cost to income ratio is a key financial measure used to aid in the valuation of a bank. It is calculated by dividing operating costs by operating income, and as such a lower ratio indicates a more profitable bank. It can be seen that Banca Populare di Vicenca had the largest cost to income ratio at that time, with a value of 121.5 percent. Banca Carige ranked second for the same period, with a cost to income ratio of 90.1 percent. The bank with the smallest cost to income ratio at that time was Banca IMI SpA, with a calculated ratio of 42.3 percent as of 2016.

Leading banks by cost to income ratio in Italy as of 2016

Loading statistic...

Basic Account

Get to know the platform

You only have access to basic statistics.

Starter Account

The ideal entry-level account for individual users

- Instant access to 1m statistics

- Download in XLS, PDF & PNG format

- Detailed references

$199 USD / Month *

Professional Account

Full access

Business Solutions including all features.

* Prices do not include sales tax.

Other statistics that may interest you Statistics on

About the industry

10

- Premium Statistic Largest banks in Italy 2022, by ROE

- Premium Statistic Net interest income of FDIC-insured commercial banks in the U.S 2000-2023

- Premium Statistic Non-interest income of FDIC-insured commercial banks in the U.S. 2000-2023

- Basic Statistic Net income of FDIC-insured commercial banks in the U.S. 2000-2023

- Basic Statistic Client assets at JPMorgan Chase 2013-2022, by client segment

- Basic Statistic Total assets of JPMorgan Chase 2006-2022

- Basic Statistic Retail client assets at JPMorgan Chase 2014-2022

- Premium Statistic Client assets at JPMorgan Chase 2013-2022, by region

- Premium Statistic Non-interest expense of FDIC-insured commercial banks in the U.S. 2000-2023

- Basic Statistic Return on average common shareholder equity at Goldman Sachs 2009-2023

About the region

10

- Premium Statistic Leading banks by non performing loans in Italy 2016

- Premium Statistic Cassa Depositi e Prestiti: net interest income 2012-2019

- Basic Statistic Return on equity (ROE) of the banking system in Italy 2007-2022

- Premium Statistic Leading banking groups 2019, by tangible assets

- Premium Statistic Leading banking groups 2019, by number of employees

- Premium Statistic Leading banking groups in Italy 2019, by revenue

- Premium Statistic Cassa Depositi e Prestiti: shareholders’ equity 2012-2019

- Premium Statistic Cassa Depositi e Prestiti: subsidiaries owned shares 2019

- Premium Statistic Leading banking groups 2018, by interest margin

- Premium Statistic Leading banking groups in Italy in 2018, by number of branches

Selected statistics

10

- Basic Statistic Net revenue from investment banking at Goldman Sachs 2009-2023

- Basic Statistic Net revenue from investing and lending at Goldman Sachs 2009-2021

- Premium Statistic Employee compensation and benefits at Deutsche Bank 2006-2022

- Basic Statistic Total assets of Banco Santander 2001-2023

- Basic Statistic Assets of all central banks globally 2002-2022

- Premium Statistic Number of Deutsche Bank customers 2012-2014, by segment

- Premium Statistic Operating income of the Industrial and Commercial Bank of China 2012-2022

- Basic Statistic Total assets of the Industrial and Commercial Bank of China 2012-2022

- Basic Statistic Total assets of the Bank of Communications 2012-2022

- Premium Statistic Revenue of the Bank of Communications 2022

Other regions

10

- Basic Statistic Total assets of Goldman Sachs 2009-2023

- Basic Statistic Net income of Royal Bank of Canada 2014-2023

- Basic Statistic Quarterly net income of Bank of America 2007-2023

- Premium Statistic Bolivia: deposits per capita 2016-2019

- Premium Statistic Number of employees per bank branch in Turkey 2014-2018

- Premium Statistic Bank deposits per capita in Colombia 2016-2019

- Premium Statistic Costa Rica: bank deposits per capita 2016-2019

- Premium Statistic Nicaragua: deposits per capita 2016-2019

- Premium Statistic Panama: bank deposits per capita 2016-2019

- Premium Statistic Honduras: deposits per capita 2016-2019

Related statistics

10

- Basic Statistic Stock price of Goldman Sachs 2004-2022

- Premium Statistic London Stock Exchange (UK): financial services companies 2018-2023

- Premium Statistic London Stock Exchange (UK): Financial services companies 2018-2021

- Premium Statistic London Stock Exchange (UK): insurance companies 2021

- Premium Statistic London Stock Exchange (UK): largest financial companies by market cap 2023

- Premium Statistic London Stock Exchange (UK): market capitalization of financial companies 2018-2023

- Premium Statistic Countries with the highest deposit interest rates worldwide 2023

- Premium Statistic London Stock Exchange (UK) trading: market value of insurance companies 2018-2021

- Premium Statistic London Stock Exchange (UK) trading: largest financial services companies 2021

- Premium Statistic London Stock Exchange (UK): market value financial service companies 2018-2021

Further related statistics

10

- Prepaid debit card use in U.S. households 2013-2019, by tenure

- Senior chief financial officer salary per annum in Switzerland 2023

- Total assets of the China Construction Bank 2012-2022

- Net interest income of Deutsche Bank 2006-2023

- Leading banks in the Middle East in 2023, by brand value

- Employees of Banco Santander 2013-2023, by gender

- Banco Santander global operations: geographic diversification of profit 2023

- Profit development of Santander group 2001-2023

- Number of employees at HSBC 2010-2023

- Main employment centers of HSBC in 2023, by number of employees

Further Content: You might find this interesting as well

Statistics

- Prepaid debit card use in U.S. households 2013-2019, by tenure

- Senior chief financial officer salary per annum in Switzerland 2023

- Total assets of the China Construction Bank 2012-2022

- Net interest income of Deutsche Bank 2006-2023

- Leading banks in the Middle East in 2023, by brand value

- Employees of Banco Santander 2013-2023, by gender

- Banco Santander global operations: geographic diversification of profit 2023

- Profit development of Santander group 2001-2023

- Number of employees at HSBC 2010-2023

- Main employment centers of HSBC in 2023, by number of employees

Savills. (January 16, 2017). Leading banks by cost to income ratio in Italy as of 2016 [Graph]. In Statista. Retrieved April 26, 2024, from https://www.statista.com/statistics/709597/leading-banks-by-cost-income-ratio-italy-europe/

Savills. "Leading banks by cost to income ratio in Italy as of 2016 ." Chart. January 16, 2017. Statista. Accessed April 26, 2024. https://www.statista.com/statistics/709597/leading-banks-by-cost-income-ratio-italy-europe/

Savills. (2017). Leading banks by cost to income ratio in Italy as of 2016 . Statista. Statista Inc.. Accessed: April 26, 2024. https://www.statista.com/statistics/709597/leading-banks-by-cost-income-ratio-italy-europe/

Savills. "Leading Banks by Cost to Income Ratio in Italy as of 2016 ." Statista, Statista Inc., 16 Jan 2017, https://www.statista.com/statistics/709597/leading-banks-by-cost-income-ratio-italy-europe/

Savills, Leading banks by cost to income ratio in Italy as of 2016 Statista, https://www.statista.com/statistics/709597/leading-banks-by-cost-income-ratio-italy-europe/ (last visited April 26, 2024)

Leading banks by cost to income ratio in Italy as of 2016 [Graph], Savills, January 16, 2017. [Online]. Available: https://www.statista.com/statistics/709597/leading-banks-by-cost-income-ratio-italy-europe/