Key insights

- Average price of gold per troy ounce in July 2023

- 2,325.34 USD

Detailed statistics

Monthly prices for gold worldwide 2011-2024

- Annual gold demand worldwide

- 4,740.8 metric tons

Detailed statistics

Gold demand globally 2010-2023

- Share of central banks worldwide who invest in physical gold abroad

- 73%

Detailed statistics

Portion of gold AUM by central banks worldwide in 2023, by investment type

Editor’s Picks Current statistics on this topic

Further recommended statistics

Overview

5

- Premium Statistic Leading major financial assets worldwide 2023, by average daily trading volume

- Premium Statistic Global production of gold mines 2010-2023

- Premium Statistic Gold production ranked by major countries 2023

- Premium Statistic Volume of gold reserves by country 2023

- Premium Statistic Global largest gold mines 2023, by production volume

Overview

-

Premium Statistic

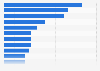

Leading major financial assets worldwide 2023, by average daily trading volume

Leading major financial assets worldwide 2023, by average daily trading volume

Leading major financial assets worldwide from Januray to December 2023, by average daily trading volume (in billion U.S. dollars)

-

Premium Statistic

Global production of gold mines 2010-2023

Global production of gold mines 2010-2023

Mine production of gold worldwide from 2010 to 2023 (in metric tons)

-

Premium Statistic

Gold production ranked by major countries 2023

Gold production ranked by major countries 2023

Leading gold mining countries worldwide in 2023 (in metric tons)

-

Premium Statistic

Volume of gold reserves by country 2023

Volume of gold reserves by country 2023

Gold reserves of largest gold holding countries worldwide as of 2023 (in metric tons)

-

Premium Statistic

Global largest gold mines 2023, by production volume

Global largest gold mines 2023, by production volume

Largest gold mines worldwide as of 2023, by production volume (in million ounces)

Demand

6

- Premium Statistic Gold demand globally 2010-2023

- Premium Statistic Gold demand volume worldwide 2023, by sector

- Basic Statistic Global gold demand share 2023, by sector

- Basic Statistic Global demand for gold by purpose quarterly 2016-2023

- Premium Statistic Global gold import value 2022, by leading country

- Premium Statistic Retail investment demand for physical gold Europe Q1 2016-Q4 2023

Demand

-

Premium Statistic

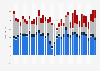

Gold demand globally 2010-2023

Gold demand globally 2010-2023

Gold demand worldwide from 2010 to 2023 (in metric tons)

-

Premium Statistic

Gold demand volume worldwide 2023, by sector

Gold demand volume worldwide 2023, by sector

Demand for gold worldwide in 2023, by sector (in metric tons)

-

Basic Statistic

Global gold demand share 2023, by sector

Global gold demand share 2023, by sector

Distribution of gold demand worldwide in 2023, by sector

-

Basic Statistic

Global demand for gold by purpose quarterly 2016-2023

Global demand for gold by purpose quarterly 2016-2023

Demand for gold worldwide from 1st quarter 2016 to 4th quarter 2023, by purpose (in metric tons)

-

Premium Statistic

Global gold import value 2022, by leading country

Global gold import value 2022, by leading country

Leading gold importing countries worldwide in 2022, based on value (in billion U.S. dollars)

-

Premium Statistic

Retail investment demand for physical gold Europe Q1 2016-Q4 2023

Retail investment demand for physical gold Europe Q1 2016-Q4 2023

Retail investment demand for physical gold in Europe from 1st quarter of 2016 to 4th quarter of 2023 (in tons)

Price

6

- Premium Statistic Price of gold per troy ounce 1990-2023

- Premium Statistic Monthly prices for gold worldwide from January 2014 to June 2024

- Basic Statistic Average prices for gold worldwide 2014-2025

- Premium Statistic Monthly prices for gold worldwide 2011-2024

- Premium Statistic Gold futures contracts price in the U.S. by month 2019-2024, with forecasts to 2029

- Premium Statistic Monthly close price of gold in London 2018-2024

Price

-

Premium Statistic

Price of gold per troy ounce 1990-2023

Price of gold per troy ounce 1990-2023

Price of gold per troy ounce from 1990 to 2023 (in U.S. dollars)

-

Premium Statistic

Monthly prices for gold worldwide from January 2014 to June 2024

Monthly prices for gold worldwide from January 2014 to June 2024

Monthly prices for gold worldwide from January 2014 to June 2024 (in nominal U.S. dollars per troy ounce)

-

Basic Statistic

Average prices for gold worldwide 2014-2025

Average prices for gold worldwide 2014-2025

Average prices for gold worldwide from 2014 to 2022 with a forecast to 2025 (in nominal U.S. dollars per troy ounce)

-

Premium Statistic

Monthly prices for gold worldwide 2011-2024

Monthly prices for gold worldwide 2011-2024

Price for an ounce of fine gold (average price) in London (morning fixing) from January 2011 to June 2024 (in U.S. dollars)

-

Premium Statistic

Gold futures contracts price in the U.S. by month 2019-2024, with forecasts to 2029

Gold futures contracts price in the U.S. by month 2019-2024, with forecasts to 2029

Monthly price of gold futures contracts in the United States from January 2019 to June 2024, with forecasts from April 2024 to December 2029 (in U.S. dollars per troy ounce)

-

Premium Statistic

Monthly close price of gold in London 2018-2024

Monthly close price of gold in London 2018-2024

Monthly close price of one kilogram of gold in London (UK) from January 2018 to March 2024 (in GBP)

Return

5

- Premium Statistic Annual return of gold and other assets worldwide 2023

- Premium Statistic Average annual return of gold and other assets worldwide 1971-2024

- Premium Statistic 10-year average return of gold and other assets worldwide 2023

- Premium Statistic 20-year average return of gold and other assets worldwide 2023

- Premium Statistic Rate of return of gold as an investment 2002-2023

Return

-

Premium Statistic

Annual return of gold and other assets worldwide 2023

Annual return of gold and other assets worldwide 2023

Annual return of gold and other assets worldwide in 2023

-

Premium Statistic

Average annual return of gold and other assets worldwide 1971-2024

Average annual return of gold and other assets worldwide 1971-2024

Average annual return of gold and other assets worldwide from 1971 to 2024

-

Premium Statistic

10-year average return of gold and other assets worldwide 2023

10-year average return of gold and other assets worldwide 2023

10-year average return of gold and other assets worldwide as of 2023

-

Premium Statistic

20-year average return of gold and other assets worldwide 2023

20-year average return of gold and other assets worldwide 2023

20-year average return of gold and other assets worldwide as of 2023

-

Premium Statistic

Rate of return of gold as an investment 2002-2023

Rate of return of gold as an investment 2002-2023

Rate of return of gold as an investment from 2002 to 2023 (based on the last London Gold Fixing of the year in U.S. dollars)

Holdings by country

5

- Premium Statistic Total weight of gold holdings by United States 2000-2023

- Premium Statistic Total weight of gold holdings Germany 2000-2023

- Premium Statistic Total weight of gold holdings in Italy 2014-2023

- Premium Statistic Total weight of gold holdings by France 2014-20223

- Premium Statistic Total weight of gold holdings by Russia 2014-2023

Holdings by country

-

Premium Statistic

Total weight of gold holdings by United States 2000-2023

Total weight of gold holdings by United States 2000-2023

Total weight of gold holdings by United States from 2000 to 2023 (in metric tons)

-

Premium Statistic

Total weight of gold holdings Germany 2000-2023

Total weight of gold holdings Germany 2000-2023

Total weight of gold holdings in Germany from 2000 to 2023 (in metric tons)

-

Premium Statistic

Total weight of gold holdings in Italy 2014-2023

Total weight of gold holdings in Italy 2014-2023

Total weight of gold holdings in Italy from 2014 to 2023 (in metric tons)

-

Premium Statistic

Total weight of gold holdings by France 2014-20223

Total weight of gold holdings by France 2014-20223

Total weight of gold holdings by France from 2014 to 2023 (in metric tons)

-

Premium Statistic

Total weight of gold holdings by Russia 2014-2023

Total weight of gold holdings by Russia 2014-2023

Total weight of gold holdings by Russia from October 2014 to July 2023 (in metric tons)

Further reports

Get the best reports to understand your industry

Contact

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)