Martin Placek

Research expert covering transportation and electronics

Detailed statistics

Limits on fuel sulfur content for the shipping industry by area 2020

Detailed statistics

Global energy consumption by shipping 2019-2070, by fuel type

Detailed statistics

Vessels fitted with scrubbing systems worldwide by type 2020

Transport volume of worldwide maritime trade 1990-2021

Transport volume of seaborne trade from 1990 to 2021 (in billion tons loaded)

Main countries based on dwt of their merchant fleet 2022

Deadweight tonnage of world merchant fleet by country of beneficial ownership as of January 1, 2022 (in million dwt)

Number of merchant ships by type 2022

Number of ships in the world merchant fleet as of January 1, 2022, by type

Global energy consumption by shipping 2019-2070, by fuel type

Consumption of energy by the shipping industry worldwide in 2019 and 2020, with a forecast through 2070, by fuel type (in million metric tons of oil equivalent)

Global fuel consumption by ships by fuel type 2019-2020

Annual fuel consumption by ships worldwide from 2019 to 2020, by fuel type (in million metric tons)

Limits on fuel sulfur content for the shipping industry by area 2020

Limits on fuel sulfur content imposed by the International Maritime Organization (IMO) as of January 1, 2020, by area (in mass percentage)

Areas in the maritime industry that will become more important 2021-2023

Topics in the maritime industry that will gain prominence between 2021 and 2023

Breakdown of CO₂ emissions in the transportation sector worldwide 2022, by sub sector

Distribution of carbon dioxide emissions produced by the transportation sector worldwide in 2022, by sub sector

Breakdown of GHG emissions in the shipping sector worldwide 2018, by emission type

Distribution of greenhouse gas (GHG) emissions produced by the global shipping industry in 2018, by emission type

International shipping CO2 emissions outlook worldwide 2019-2070

Global international shipping CO2 emissions outlook from 2019 to 2070 in the Sustainable Development Scenario* (in million metric tons of CO2)

Estimated share of maritime CO₂ emissions 2021, by flag country

Estimated share of global maritime carbon dioxide (CO₂) emissions in 2021, by flag country

CO₂ emissions in international shipping 2020, by ship type

Carbon dioxide emissions in worldwide shipping in 2020, by ship type (in million metric tons CO₂)

Ranking of ports by scrubber washwater discharged by ships 2020

Leading ports by discharged scrubber washwater masses in 2020 (in million metric tons)

Location of global scrubber washwater discharges by distance from the shore 2020

Distribution of scrubber washwater discharged by ships worldwide in 2020, by maritime zone

Global scrubber washwater discharges by ship type 2020

Distribution of scrubber washwater discharged by ships worldwide in 2020, by ship type

Expected investments in ship upgrades due to emission regulations 2021

Anticipated investments in ship upgrades to comply with emission regulations in 2021

Fuel demand expectations in the shipping industry 2022, by fuel type

In your opinion, which fuels will be in greatest demand in future in the shipping industry?

Annual costs of using different types of alternative fuels in container shipping 2030

Annual price for operating a container ship and a bunkering location in the Middle East in 2030, by fuel type (in million U.S. dollars per year)

Number of vessels fitted with scrubbing systems worldwide 2007-2020

Number of vessels fitted with exhaust gas cleaning systems (EGCS) worldwide from 2007 to 2020, with a forecast through 2023

Vessels fitted with scrubbing systems globally 2019-2021

Monthly capacity of ships fitted with scrubbing systems worldwide from January 2019 to March 2021 (in million dead-weight tons)

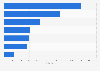

Vessels fitted with scrubbing systems worldwide by type 2020

Share of vessels fitted with scrubbing systems worldwide in 2020, by type

Monthly penetration rate of scrubbers in the global fleet by vessel type 2019-2020

Monthly penetration rate of scrubbers in the global shipping fleet from January 2019 to July 2020, by vessel type

Vessels fitted with ballast water treatment systems worldwide by type 2019

Share of vessels fitted with ballast water treatment systems worldwide in 2019, by type

Size of the global LNG fleet by status 2010-2027

Number of liquified natural gas-propelled (LNG) vessels worldwide from 2010 to 2020 with a forecast through 2027, by status

LNG bunkering availability in ports worldwide by region 2022

Number of ports with LNG bunkering facilities worldwide in 2022, by status and region

Projected size of the global electric ship market 2020-2026

Projected size of the global electric ship market between 2020 and 2026 (in million U.S. dollars)

Moeller-Maersk's energy consumption by source 2017-2022

Moeller-Maersk's energy consumption from 2017 to 2022, by source

Moeller-Maersk's GHG emissions 2017-2022, by scope

Moeller-Maersk's greenhouse gas (GHG) emissions from 2017 to 2022, by scope (in 1,000 metric tons of CO₂ equivalent)

COSCO SHIPPING Lines' fuel oil consumption 2017-2021

COSCO SHIPPING Lines' fuel oil consumption from 2017 to 2021, by type (in metric tons)

COSCO Shipping Ports Group's GHG emissions by scope 2017-2020

COSCO Shipping Ports Group's greenhouse gas (GHG) emissions from 2017 to 2020, by scope (in metric tons of CO2 equivalent)

COSCO SHIPPING Lines GHG emissions 2018-2022

Annual greenhouse gas emissions of COSCO SHIPPING Lines from 2018 to 2022 (in million metric tons carbon dioxide equivalent)

CMA CGM Group's fuel consumption 2017-2021

CMA CGM Group's fuel consumption from 2017 to 2021 (in 1,000 metric tons)

CMA CGM Group's maritime GHG emissions 2017-2022

Direct maritime greenhouse gas (GHG) emissions of CMA CGM Group from 2017 to 2022 (in million metric tons of carbon dioxide equivalent)

Hapag-Lloyd's GHG emissions 2017-2023

Hapag-Lloyd's greenhouse gas (GHG) emissions from 2017 to 2023 (in million metric tons of CO₂ equivalent)

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)