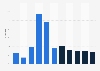

Inflation rate in the UK 1989-2024

The UK inflation rate was 3.2 percent in March 2024, compared with 3.4 percent in the previous month. Between September 2022 and March 2023, the UK experienced seven months of double-digit inflation, which peaked at 11.1 percent in October 2022. As of the most recent month, alcohol and tobacco was the sector with the highest inflation rate. In general, the last time overall inflation was rising at comparable levels was in 1992, when inflation peaked at 8.4 percent. Between 1993 and 2021, the UK inflation rate never exceeded 5.4 percent and was usually at much lower levels.

What is causing high inflation?

There are various reasons for the elevated levels of inflation seen since 2021. After the COVID-19 pandemic, global supply chains struggled to meet the renewed demand for goods and services. Food and energy prices, which were already high, increased further in 2022. Russia's invasion of Ukraine in February 2022 brought an end to the era of cheap gas flowing to European markets from Russia. The war has also disrupted global food markets, with both Russia and Ukraine being major exporters of cereal crops. As a result of these factors, inflation is high across Europe and the rest of the world.

The Cost of Living Crisis

High inflation is one of the main factors behind the ongoing Cost of Living Crisis in the UK. With global energy prices spiraling, the UK's energy price cap has increased substantially. The cap, which limits what suppliers can charge consumers, reached 3,549 British pounds per year in October 2022, compared with 1,277 pounds a year earlier. Along with soaring food costs, high-energy bills have hit UK households hard, especially lower income ones that spend more of their earnings on housing costs. As a result of these factors, UK households experienced their biggest fall in living standards in decades in 2022/23, with household disposable income also expected to fall in 2023/24, and 2024/25.