Key insights

- CPI inflation rate

- 1.7%

Detailed statistics

Inflation rate in the UK 1989-2024

- CPI inflation rate forecast for 2024

- 2.2%

Detailed statistics

CPI annual inflation rate UK 2000-2028

- Value of one 1960 British pound in 2019

- 23.2 GBP

Detailed statistics

Value of one British pound sterling in the United Kingdom 1209-2019

Editor’s Picks

Editor’s Picks

Current statistics on this topic

Recommended statistics

Inflation rates

11

- Basic Statistic Inflation rate in the UK 1989-2024

- Basic Statistic CPI inflation rate in the UK 2024, by sector

- Basic Statistic RPI inflation rate in the UK 2000-2024

- Premium Statistic CPIH inflation rate in the UK 2000-2024

- Premium Statistic PPI inflation rate in the UK 2000-2024

- Basic Statistic Core inflation rate of the UK 2000-2024

- Basic Statistic CPI inflation rate for goods and services in the UK 2000-2024

- Basic Statistic RPI annual inflation rate UK 2000-2028

- Basic Statistic CPI annual inflation rate UK 2000-2028

- Premium Statistic Sector contribution to inflation in the UK 2022-2024

- Basic Statistic Value of one British pound sterling in the United Kingdom 1209-2019

Inflation rates

-

Basic Statistic

Inflation rate in the UK 1989-2024

Inflation rate in the UK 1989-2024

Inflation rate for the Consumer Price Index (CPI) in the United Kingdom from January 1989 to September 2024

-

Basic Statistic

CPI inflation rate in the UK 2024, by sector

CPI inflation rate in the UK 2024, by sector

Inflation rate for the Consumer Price Index (CPI) in the United Kingdom in September 2024, by sector

-

Basic Statistic

RPI inflation rate in the UK 2000-2024

RPI inflation rate in the UK 2000-2024

Inflation rate for the Retail Price Index (RPI) in the United Kingdom from January 2000 to September 2024

-

Premium Statistic

CPIH inflation rate in the UK 2000-2024

CPIH inflation rate in the UK 2000-2024

Inflation rate for the Consumer Price Index including owner occupiers' housing costs (CPIH) in the United Kingdom from January 2000 to September 2024

-

Premium Statistic

PPI inflation rate in the UK 2000-2024

PPI inflation rate in the UK 2000-2024

Producer Price Index inflation rate in the United Kingdom from January 2000 to September 2024

-

Basic Statistic

Core inflation rate of the UK 2000-2024

Core inflation rate of the UK 2000-2024

Consumer price index (CPI) inflation rate excluding food and energy in the United Kingdom from January 2000 to September 2024

-

Basic Statistic

CPI inflation rate for goods and services in the UK 2000-2024

CPI inflation rate for goods and services in the UK 2000-2024

CPI inflation rate for goods and services in the United Kingdom from January 2000 to September 2024

-

Basic Statistic

RPI annual inflation rate UK 2000-2028

RPI annual inflation rate UK 2000-2028

Annual inflation rate of the Retail Price Index in the United Kingdom from 2000 to 2028

-

Basic Statistic

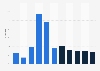

CPI annual inflation rate UK 2000-2028

CPI annual inflation rate UK 2000-2028

Annual inflation rate of the Consumer Price Index in the United Kingdom from 2000 to 2028

-

Premium Statistic

Sector contribution to inflation in the UK 2022-2024

Sector contribution to inflation in the UK 2022-2024

Sector contribution to the CPIH inflation rate in the United Kingdom from September 2022 to September 2024

-

Basic Statistic

Value of one British pound sterling in the United Kingdom 1209-2019

Value of one British pound sterling in the United Kingdom 1209-2019

Purchasing power of one British pound sterling (GBP) from 1209 to 2019

Price indices

-

Basic Statistic

CPI in the UK 2000-2024

CPI in the UK 2000-2024

Consumer Price Index (CPI) in the United Kingdom from 1st quarter 2000 to 3rd quarter 2024

-

Basic Statistic

RPI in the UK 2000-2024

RPI in the UK 2000-2024

Retail Price Index (RPI) in the United Kingdom from 1st quarter 2000 to 3rd quarter 2024

-

Premium Statistic

CPIH in the UK 2000-2024

CPIH in the UK 2000-2024

Consumer Price Index including owner occupiers' housing costs (CPIH) in the United Kingdom from 1st quarter 2000 to 3rd quarter 2024

-

Premium Statistic

PPI in the UK 2000-2024

PPI in the UK 2000-2024

Producer Price Index (PPI) in the United Kingdom from 1st quarter 2000 to 3rd quarter 2024

-

Basic Statistic

CPI index in the UK 2024, by sector

CPI index in the UK 2024, by sector

Consumer Price Index (CPI) in the United Kingdom in 3rd quarter 2024, by sector

-

Basic Statistic

Composite PMI in the UK 2019-2024

Composite PMI in the UK 2019-2024

Composite Purchasing Managers Index (PMI) in the United Kingdom from July 2019 to September 2024

Inflation by sector

12

- Premium Statistic CPI inflation rate for food and non-alcoholic beverages in the UK 2000-2024

- Premium Statistic CPI inflation rate for alcohol, tobacco and narcotics in the UK 1989-2024

- Premium Statistic CPI inflation rate for clothing and footwear in the UK 2000-2024

- Premium Statistic CPI inflation rate for housing, water, electricity, and gas in the UK 2000-2024

- Premium Statistic CPI inflation rate for furniture and furnishings in the UK 2000-2024

- Premium Statistic CPI inflation rate for health in the UK 2000-2024

- Premium Statistic CPI inflation rate for transport services in the UK 2000-2024

- Premium Statistic CPI inflation rate for communication in the UK 2000-2024

- Premium Statistic CPI inflation rate for recreation and culture in the UK 2000-2024

- Premium Statistic CPI inflation rate for education in the UK 2000-2024

- Premium Statistic CPI inflation rate for restaurants and hotels in the UK 2000-2024

- Premium Statistic CPI inflation rate for miscellaneous goods and services in the UK 2000-2024

Inflation by sector

-

Premium Statistic

CPI inflation rate for food and non-alcoholic beverages in the UK 2000-2024

CPI inflation rate for food and non-alcoholic beverages in the UK 2000-2024

CPI inflation rate for food and non-alcoholic beverages in the United Kingdom from 1st quarter 2000 to 3rd quarter 2024

-

Premium Statistic

CPI inflation rate for alcohol, tobacco and narcotics in the UK 1989-2024

CPI inflation rate for alcohol, tobacco and narcotics in the UK 1989-2024

CPI inflation rate for alcoholic beverages, tobacco and narcotics in the United Kingdom from 1st quarter 1989 to 2nd quarter 2024

-

Premium Statistic

CPI inflation rate for clothing and footwear in the UK 2000-2024

CPI inflation rate for clothing and footwear in the UK 2000-2024

CPI inflation rate for clothing and footwear in the United Kingdom from 1st quarter 2000 to 3rd quarter 2024

-

Premium Statistic

CPI inflation rate for housing, water, electricity, and gas in the UK 2000-2024

CPI inflation rate for housing, water, electricity, and gas in the UK 2000-2024

CPI inflation rate for housing, water, electricity, gas and other fuels in the United Kingdom from 1st quarter 2000 to 3rd quarter 2024

-

Premium Statistic

CPI inflation rate for furniture and furnishings in the UK 2000-2024

CPI inflation rate for furniture and furnishings in the UK 2000-2024

CPI inflation rate for furniture, household equipment and maintenance in the United Kingdom from 1st quarter 2000 to 3rd quarter 2024

-

Premium Statistic

CPI inflation rate for health in the UK 2000-2024

CPI inflation rate for health in the UK 2000-2024

CPI inflation rate for health in the United Kingdom from 1st quarter 2000 to 3rd quarter 2024

-

Premium Statistic

CPI inflation rate for transport services in the UK 2000-2024

CPI inflation rate for transport services in the UK 2000-2024

CPI inflation rate for transport services in the United Kingdom from 1st quarter 2000 to 3rd quarter 2024

-

Premium Statistic

CPI inflation rate for communication in the UK 2000-2024

CPI inflation rate for communication in the UK 2000-2024

CPI inflation rate for communication in the United Kingdom from 1st quarter 2000 to 3rd quarter 2024

-

Premium Statistic

CPI inflation rate for recreation and culture in the UK 2000-2024

CPI inflation rate for recreation and culture in the UK 2000-2024

CPI inflation rate for recreation and culture in the United Kingdom from 1st quarter 2000 to 3rd quarter 2024

-

Premium Statistic

CPI inflation rate for education in the UK 2000-2024

CPI inflation rate for education in the UK 2000-2024

CPI inflation rate for education in the United Kingdom from 1st quarter 2000 to 3rd quarter 2024

-

Premium Statistic

CPI inflation rate for restaurants and hotels in the UK 2000-2024

CPI inflation rate for restaurants and hotels in the UK 2000-2024

CPI inflation rate for restaurants and hotels in the United Kingdom from 1st quarter 2000 to 3rd quarter 2024

-

Premium Statistic

CPI inflation rate for miscellaneous goods and services in the UK 2000-2024

CPI inflation rate for miscellaneous goods and services in the UK 2000-2024

CPI inflation rate for miscellaneous goods and services in the United Kingdom from 1st quarter 2000 to 3rd quarter 2024

Cost of living

6

- Basic Statistic Average weekly earning growth in the UK compared with inflation 2001-2024

- Basic Statistic British adults reporting a cost of living increase 2021-2024

- Basic Statistic Inability to pay an unexpected expense of 850 GBP in Great Britain 2021-2024

- Basic Statistic Main reasons that people have seen their cost of living increase Great Britain 2024

- Basic Statistic Main measures taken due to the cost of living increase in Great Britain 2024

- Premium Statistic Percentage of people who see inflation an important issues in Britain 1974-2024

Cost of living

-

Basic Statistic

Average weekly earning growth in the UK compared with inflation 2001-2024

Average weekly earning growth in the UK compared with inflation 2001-2024

Average growth of weekly earnings in the United Kingdom compared with the CPI inflation rate from March 2001 to August 2024

-

Basic Statistic

British adults reporting a cost of living increase 2021-2024

British adults reporting a cost of living increase 2021-2024

Percentage of adults reporting their cost of living has increased in the previous month in Great Britain from November 2021 to September 2024

-

Basic Statistic

Inability to pay an unexpected expense of 850 GBP in Great Britain 2021-2024

Inability to pay an unexpected expense of 850 GBP in Great Britain 2021-2024

Percentage of adults reporting their household could not afford to pay an unexpected, but necessary, expense of 850 GBP in Great Britain from November 2021 to September 2024

-

Basic Statistic

Main reasons that people have seen their cost of living increase Great Britain 2024

Main reasons that people have seen their cost of living increase Great Britain 2024

Main reasons that people have seen their cost of living increase over the previous month in Great Britain in September 2024

-

Basic Statistic

Main measures taken due to the cost of living increase in Great Britain 2024

Main measures taken due to the cost of living increase in Great Britain 2024

Main measures that people have taken due to the cost of living increase over the previous month in Great Britain in September 2024

-

Premium Statistic

Percentage of people who see inflation an important issues in Britain 1974-2024

Percentage of people who see inflation an important issues in Britain 1974-2024

Percentage of people who think that inflation is one of the most important issues facing Great Britain from 1974 to 2024

International comparison

6

- Basic Statistic Inflation rate of the European Union 1997-2024

- Basic Statistic Inflation rate in Europe in March 2024, by country

- Basic Statistic CPI inflation rate among large economies in Western Europe 2010-2023

- Basic Statistic U.S. monthly inflation rate 2024

- Basic Statistic Countries with the highest inflation rate 2023

- Basic Statistic Countries with the lowest inflation rate 2023

International comparison

-

Basic Statistic

Inflation rate of the European Union 1997-2024

Inflation rate of the European Union 1997-2024

Harmonized index of consumer prices (HICP) inflation rate of the European Union from January 1997 to July 2024

-

Basic Statistic

Inflation rate in Europe in March 2024, by country

Inflation rate in Europe in March 2024, by country

Harmonized index of consumer prices (HICP) inflation rate in Europe in March 2024, by country

-

Basic Statistic

CPI inflation rate among large economies in Western Europe 2010-2023

CPI inflation rate among large economies in Western Europe 2010-2023

Annual inflation rate of the consumer price index (CPI) among large economies in Western Europe from January 2010 to November 2023

-

Basic Statistic

U.S. monthly inflation rate 2024

U.S. monthly inflation rate 2024

Monthly 12-month inflation rate in the United States from September 2020 to September 2024

-

Basic Statistic

Countries with the highest inflation rate 2023

Countries with the highest inflation rate 2023

The 20 countries with the highest inflation rate in 2023 (compared to the previous year)

-

Basic Statistic

Countries with the lowest inflation rate 2023

Countries with the lowest inflation rate 2023

The 20 countries with the lowest inflation rate in 2023 (compared to the previous year)

Further reports

Get the best reports to understand your industry

Contact

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)