Mathilde Carlier

Research Expert covering transportation and logistics

Detailed statistics

Brazil: automotive industry net revenue 2000-2022

Detailed statistics

Brazil: automotive industry workforce 2005-2021

Detailed statistics

Brazil: number of automotive companies 2022, by segment

Worldwide motor vehicle production 2000-2023

Estimated worldwide motor vehicle production from 2000 to 2023 (in million vehicles)

Leading passenger vehicle producers worldwide 2023

Global passenger vehicle production in 2023, by country

Largest automobile markets based on new car registrations 2023

Largest automobile markets worldwide in 2023, based on new car registrations (in million units)

Latin America: leading motor vehicle producers 2023, by type

Number of motor vehicles produced in selected countries in Latin America in 2023, by type of vehicle (in 1,000s)

Interannual variation on motor vehicle sales in Latin America 2021-2023, by country

Year-over-Year (YoY) change in motor vehicle sales in selected countries in Latin America in 2023

Latin America: passenger car sales by selected countries 2023

Number of passenger cars sold in selected countries in Latin America in 2023 (in 1,000s)

Brazil: motor vehicle fleet size 2009-2023

Number of motor vehicles in circulation in Brazil from 2009 to 2023 (in million units)

Brazil: automotive industry net revenue 2000-2022

Net revenue of the automotive industry in Brazil from 2000 to 2022 (in billion U.S. dollars)

Brazil: motor vehicle production 2010-2023

Production of motor vehicles in Brazil from 2010 to 2023 (in 1,000 units)

Brazil: motor vehicle production share 2023, by type

Distribution of motor vehicle production in Brazil in 2023, by type

Brazil: passenger car production 2010-2023

Passenger car production in Brazil from 2010 to 2023 (in 1,000 units)

Brazil: light commercial vehicle production 2010-2023

Production of light commercial vehicles in Brazil from 2010 to 2023 (in 1,000 units)

Brazil: truck production 2010-2023

Production of trucks in Brazil from 2010 to 2023 (in 1,000 units)

Brazil: buses production 2010-2023

Production of buses in Brazil from 2010 to 2023 (in 1,000 units)

Brazil: light vehicle production value 2008-2022

Production of the light vehicle manufacturing industry in Brazil from 2008 to 2022 (in billion Brazilian reals)

Brazil: number of motor vehicle registrations 2010-2023

Number of new motor vehicles registered in Brazil from 2010 to 2023 (in 1,000 units)

Brazil: new passenger car registrations 2010-2023

Passenger cars registrations in Brazil from 2010 to 2023 (in 1,000 units)

Brazil: light commercial vehicle registrations 2010-2023

Light commercial vehicle registrations in Brazil from 2010 to 2023 (in 1,000 units)

Brazil: light vehicles registrations 2014-2023, by fuel type

Number of registered new light vehicles in Brazil from 2014 to 2023, by fuel type

Brazil: electric motor vehicle registrations 2006-2023

Electric and hybrid motor vehicle registrations in Brazil from 2006 to 2023

Brazil: vehicle manufacturing sales 2008-2022

Sales of the motor vehicle manufacturing industry in Brazil from 2008 to 2022 (in billion Brazilian reals)

Brazil: automotive industry export value 2010-2023

Exports of motor vehicles and automotive parts from Brazil from 2010 to 2023 (in billion U.S. dollars)

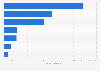

Brazil: leading destinations for automotive exports 2023, by value

Leading destinations of automotive exports from Brazil in 2023, based on value

Brazil: automotive industry import value 2010-2023

Imports of motor vehicles and automotive parts in Brazil from 2010 to 2023 (in billion U.S. dollars)

Brazil: leading origins for automotive imports 2023, by value

Leading origins of automotive imports in Brazil in 2023, based on import value

Leading passenger car brands in Brazil by number of registrations 2023

Leading passenger car brands in Brazil in 2023, by number of registrations (in 1,000s)

Brazil: best-selling electric vehicle brands 2023

Best-selling electric vehicle brand in Brazil in 2023

Light commercial vehicle brands in Brazil 2023

Leading light commercial vehicles brands in Brazil in 2023, by number of registrations (in 1,000s)

Leading truck brands in Brazil 2023

Leading truck brands in Brazil in 2023, based on number of registrations

Leading bus brands in Brazil 2023, by number of registrations

Leading bus brands in Brazil in 2023, based on number of registrations

Brazil: motor vehicle dealerships 2023, by brand

Number of motor vehicle dealerships in Brazil in 2023, by brand

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)