Mathilde Carlier

Research Expert covering transportation and logistics

Detailed statistics

Revenue - automobile manufacturing industry worldwide 2019-2023

Detailed statistics

Worldwide motor vehicle production by type 2019-2023

Detailed statistics

Annual car sales worldwide 2010-2023, with a forecast for 2024

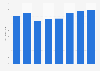

Revenue - automobile manufacturing industry worldwide 2019-2023

Global car manufacturing industry revenue between 2019 and 2022, with a forecast for 2023 (in trillion U.S. dollars)

Automotive - global merger and acquisition deal value Q1 2017-Q1 2023

Value of automotive merger and acquisition deals worldwide between 1st quarter 2017 and 1st quarter 2023 (in billion U.S. dollars)

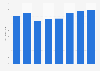

Automotive R&D spending worldwide 2020-2022

Global automotive research and development spending between 2020 and 2021, with a forecast for 2022 (in billion U.S. dollars)

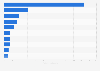

R&D expenses and intensity of selected automotive companies worldwide 2022

Research and development expenses and intensity of selected global automotive manufacturers in 2022 (in million euros and percent)

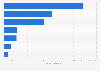

Value of automotive products imports in key countries worldwide 2022

Value of automotive products imports worldwide in 2022, by major country (in billion U.S. dollars)

Value of automotive products exports in key countries worldwide 2022

Value of automotive products exports worldwide in 2022, by major country (in billion U.S. dollars)

Best-selling car models worldwide in 2023

Best-selling passenger car worldwide in 2023 (in million units)

Best selling SUV models worldwide in 2023

Best-selling sport-utility vehicle models worldwide in 2023 (in million units sold)

Global PEV sales by leading brand YTD 2023

Best-selling plug-in electric vehicle brands worldwide between January and December 2023, based on sales volume

Worldwide light vehicle sales growth - outlook 2017-2024

Projected worldwide light vehicle sales growth from 2017 to 2024

Worldwide motor vehicle production 2000-2023

Estimated worldwide motor vehicle production from 2000 to 2023 (in million vehicles)

Worldwide motor vehicle production growth 2015-2023

Worldwide motor vehicle production growth year-on-year between 2015 and 2023

Worldwide motor vehicle production by type 2019-2023

Estimated worldwide motor vehicle production between 2019 and 2023, by type (in 1,000 units)

Changes in worldwide vehicle production by region 2016-2023

Estimated global vehicle production growth from 2016 to 2023, by region

Major passenger car producing countries 2023

Estimated passenger car production in selected countries in 2023 (in million units)

Worldwide commercial vehicle production by region 2018-2022

Commercial vehicle production volume worldwide between 2018 and 2022, by region (in units)

Motor vehicle sales worldwide 2005-2022

Worldwide motor vehicle sales from 2005 to 2022 (in million units)

Motor vehicle sales growth worldwide 2015-2022

Worldwide motor vehicle sales year-over-year growth between 2015 and 2022

Motor vehicle sales worldwide by type 2016-2023

Global motor vehicle sales by type from 2016 to 2023 (in million units)

Annual car sales worldwide 2010-2023, with a forecast for 2024

Number of cars sold worldwide from 2010 to 2023, with a 2024 forecast (in million units)

International automobile sales by region 2018-2024

Global passenger car sales by region from 2018 to 2023, with a forecast for 2024 (in million units)

Largest automobile markets based on new car registrations 2023

Largest automobile markets worldwide in 2023, based on new car registrations (in million units)

Commercial vehicles worldwide sales 2005-2022

Worldwide commercial vehicle sales from 2005 to 2022 (in million units)

Commercial vehicles - sales in selected countries 2022

Commercial vehicle sales in selected countries in 2022 (in 1,000 units)

Revenue of leading carmakers worldwide 2022

Revenue of leading automakers worldwide in 2022 (in billion U.S. dollars)

Car brand market share worldwide 2023

Global automobile market share in 2023, by brand

Toyota Motor Corporation: net revenue 2012-2024

Toyota Motor Corporation's net revenue from FY 2012 to FY 2024 (in trillion Japanese yen)

Toyota Motor Corporation: motor vehicle sales by region 2017-2024

Toyota Motor Corporation's motor vehicle sales between FY 2017 and FY 2024, by main region (in 1,000s)

Volkswagen Group's sales revenue 2006-2023

Volkswagen Group's sales revenue from FY 2006 to FY 2023 (in billion euros)

Volkswagen Group - worldwide vehicle deliveries 2012-2023

Volkswagen Group's worldwide vehicle deliveries from 2012 to 2023 (in millions)

Honda's annual revenue 2002-2024

Worldwide revenue of Honda from FY 2002 to FY 2024 (in trillion Japanese yen)

Honda's worldwide automobile sales 2002-2023

Worldwide number of automobiles sold by Honda Group from FY 2002 to FY 2023 (in 1,000 units)

Renault Group's revenue 2010-2023

Renault Group's revenue from FY 2010 to FY 2023 (in billion euros)

Regional vehicle sales of Renault Group 2021-2023

Renault Group's vehicle sales in 2021 and 2023, by region (in 1,000 units)

The leading global automotive suppliers based on revenue 2022

The leading global automotive suppliers in 2022, based on revenue (in billion euros)

Bosch - revenue 2008-2023

Bosch's revenue from FY 2008 to FY 2023 (in billion euros)

Denso - global revenue 2008-2023

Denso's global revenue from FY 2008 to FY 2023 (in billion Japanese yen)

ZF Friedrichshafen AG sales revenue 2009-2023

ZF Friedrichshafen AG's sales revenue from FY 2009 to FY 2023 (in million euros)

Magna International Inc. - global sales 2011-2023

Global sales of Magna International Inc. from FY 2011 to FY 2023 (in billion U.S. dollars)

Aisin Corporation's revenue FY 2015-2024

Revenue of Aisin Corporation from fiscal year 2015 to 2024 (in trillion Japanese yen)

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)