Nils-Gerrit Wunsch

Research expert covering foods trends in North America, Europe, and the global food system

Get in touch with us now

Detailed statistics

Leading food and drink product exports in the United Kingdom (UK) 2021, by value

Detailed statistics

Leading European markets for food exports from the United Kingdom (UK) 2021

Detailed statistics

Customer base of supermarkets based on Brexit vote in the United Kingdom (UK) in 2016

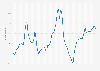

Monthly change in the consumer price index for food & beverages in the U.S. 2021-2024

Monthly percentage change in the consumer price index for food and beverages in the United States from January 2021 to January 2024

Producer Price Index (PPI) change in major economies 2020-2024

Monthly change in the Producer Price Index (PPI) for all commodities in major economies from January 2020 to March 2024

Price change of food in Canada by product category 2023

Actual price change of food products in Canada for 2023, by product category

Price growth of chilled and frozen food in the UK 2022-2023, by type

Price change of chilled and frozen food in the United Kingdom between December 2022 and December 2023, by product type

Global annual food price index by category 2000-2024

Annual food price index worldwide from 2000 to 2024, by category

Global food price index 2000-2024

Monthly food price index worldwide from 2000 to 2024

Food consumer price index monthly change in Mexico 2018-2023

Monthly change in Consumer Price Index (CPI) of food in Mexico from January 2018 to October 2023

Average price of food basket with essential food products in Portugal 2022-2024

Average price of basic food basket in Portugal from February 23, 2022 to April 10, 2024 (in euros)

Brazil: Consumer Price Index change of food products Q1 2023

Monthly change in Consumer Price Index (CPI) of food products in Brazil in the first three months of 2023

Mainstream residential property price change forecast London 2024-2028

Annual residential property price change forecast in London from 2024 to 2028

Change in beef retail price in the UK 2023/24, by product type

Annual change in the price of one kilogram of beef in the United Kingdom (UK) as of February 2024, by product type

Producer Price Index (PPI) all commodities in major economies: 2020-2024

Monthly Producer Price Index (PPI) for all commodities in major economies from January 2020 to February 2024

Provincial breakdown of food price inflation in Canada in Canada in 2023

Annual change in food prices in Canada in 2023, by province

Consumer price index (CPI) of food and beverages in Iceland monthly 2022-2023

Consumer price index (CPI) of food and non-alcoholic beverages in Iceland from January 2022 to October 2023

Rate of price change for patented drugs by country 2022

Patented drugs average price change in 2022, by country

Annual price change of residential rent in Norway 2024, by city

Annual price change of residential rents in Norway as of the 1st quarter 2024, by city

Producer price development in the food industry in Germany 2023, by product group

Year-on-year change of producer prices in the food industry in Germany in 2023, by product group

U.S. monthly change in the Consumer Price Index (CPI-U) 2023-2024

Monthly percentage change in the Consumer Price Index (CPI-U) in the United States from March 2023 to March 2024

Common consumption measures against food price hikes in Japan 2023

Most common measures taken against food price inflation among consumers in Japan as of October 2023

Consumer price index (CPI) of food servicing services in Singapore 2014-2023

Consumer price index (CPI) of food servicing services in Singapore from 2014 to 2023

Monthly food consumer price inflation in China 2021-2024

Monthly consumer price inflation rate for food products in China from March 2021 to March 2024

Mexico: avocado consumer price index monthly change 2018-2024

Monthly change in Consumer Price Index (CPI) of avocado in Mexico from January 2018 to February 2024

Price of basic food products Philippines 2022-2024

Price of basic food products in the Philippines from January 2022 to January 2024 (in Philippine pesos)

United States: monthly price change of food items January 2024

Year-over-year inflation rate of selected food items in the United States in January 2024, by category

U.S. Producer Price Index for commodities 1990-2022

Producer Price Index (PPI) for commodities in the United States from 1990 to 2022

Luxury real estate price change worldwide 2022, by city

Luxury real estate price change in selected cities worldwide in 2022

Price of select staple food items in the U.S. 2019-2023

Price of select staple food items in the United States from November 2019 to November 2023 (in U.S. dollars per pound)

Food price changes in Romania 2023

Food price changes in Romania in 2023

Consumer price index for food in the U.S. 1960-2023

Consumer price index for food in the United States from 1960 to 2023

Annual change in the producer price index (PPI) of all commodities Japan 2014-2023

Annual growth rate of the producer price index (PPI) of all commodities in Japan from 2014 to 2023

U.S. consumer price index: medical care and food 1960-2022

Consumer price index for medical care compared to food in the U.S. from 1960 to 2022

Consumer price index (CPI) of food in Singapore 2014-2023

Consumer price index (CPI) for food in Singapore from 2014 to 2023

Food and drink consumer price index (CPI) monthly in the UK 2016-2023

Consumer price index (CPI) for food and non-alcoholic beverages in the United Kingdom (UK) from January 2016 to November 2023

Soft drinks and food consumer price index (CPI) in Spain 2018-2024

Consumer price index (CPI) of food and non-alcoholic beverages in Spain from January 2018 to February 2024

Y-o-y change of consumer, retail and food prices in Germany 2000-2023

Year-on-year change of consumer, retail and food prices in Germany from 2000 to 2023

Quarterly price index of food and beverage stores in Canada 2014-2023

Quarterly price index of food and beverage stores in Canada from 2014 to 2023

Annual change in the house price index Wellington, New Zealand 2024, by district

Annual change in the house price index from the previous year in Wellington, New Zealand as at March 2024, by district

Change in the house price index from the previous month New Zealand 2024, by region

Change in the house price index from the previous month in New Zealand as at March 2024, by region

Change in the house price index from the previous year New Zealand 2024, by region

Annual change in the house price index from the previous year in New Zealand as at March 2024, by region

Monthly change in the food price index of eggs in New Zealand 2023

Monthly change in the food price index of eggs in New Zealand from July 2022 to November 2023

Change in average retail price of selected food items in Kenya 2022

Change in average retail price of selected food items in Kenya as of May 2022 (compared to the previous month)

Food price index inflation rate in New Zealand 2016-2023

Annual percentage change in the food price index in New Zealand from January 2016 to March 2023

Consumers annoyed with food & non-alcoholic drinks price changes in the U.S. 2023

Consumers who were annoyed with food and non-alcoholic drink consumer goods price changes in the United States in 2023

Annual change in food inflation India FY 2013-2023

Annual change in food inflation in India from financial year 2013 to 2023

U.S. Producer Price Index annual change 1990-2022

Annual changes of the Producer Price Index (PPI) for commodities in the United States from 1990 to 2022

Luxury real estate price change forecast worldwide 2023, by city

Luxury real estate price change forecast in selected cities worldwide in 2023

Retail sales change of food, beverages, and tobacco in Czechia 2001-2023

Annual change in retail sales of food, beverages, and tobacco in constant prices in Czechia from 2001 to 2023

Monthly consumer price index (CPI) of food in Denmark 2021-2023

Consumer price index (CPI) of food in Denmark from June 2021 to July 2023

Sugar and sweets consumer price index monthly change in Mexico 2018-2023

Monthly change in Consumer Price Index (CPI) of sugar, marmalade, honey, chocolates and sweets in Mexico from January 2018 to October 2023

Fruits consumer price index monthly change in Mexico 2018-2023

Monthly change in Consumer Price Index (CPI) of fruits in Mexico from January 2018 to October 2023

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)