Key insights

- Value of quantitative easing in June 2020

- 100bn GBP

Detailed statistics

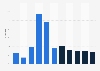

Quantitative easing by the Bank of England 2009-2020

- Cumulative value of quantitative easing in the UK in November 2020

- 895bn GBP

Detailed statistics

Quantitative easing by the Bank of England 2009-2020

- Bank base interest rate in the UK

- 5%

Detailed statistics

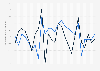

Monthly bank rate in the UK 2012-2024

Editor’s Picks Current statistics on this topic

Further recommended statistics

-

Basic Statistic

Inflation rate and central bank interest rate 2024, by selected countries

Inflation rate and central bank interest rate 2024, by selected countries

Inflation rate and central bank interest rate in developed and emerging countries in January 2022 and July 2024 (compared to the same month of the previous year)

-

Premium Statistic

Monthly inflation rate and central bank interest rate in Brazil 2018-2024

Monthly inflation rate and central bank interest rate in Brazil 2018-2024

Monthly inflation rate and central bank interest rate in Brazil from January 2018 to July 2024

-

Premium Statistic

Monthly inflation rate and central bank interest rate in the UK 2018-2024

Monthly inflation rate and central bank interest rate in the UK 2018-2024

Average inflation rate and central bank interest rate in the United Kingdom from January 2018 to August 2024

-

Premium Statistic

Monthly inflation rate and Federal Reserve interest rate in the U.S. 2018-2024

Monthly inflation rate and Federal Reserve interest rate in the U.S. 2018-2024

Inflation rate and Federal Reserve interest rate monthly in the United States from January 2018 to July 2024

-

Basic Statistic

Monthly inflation rate and central bank interest rate in Germany 2018-2024

Monthly inflation rate and central bank interest rate in Germany 2018-2024

Average inflation rate and European Central Bank (ECB) interest rate in the Germany from January 2018 to August 2024

-

Premium Statistic

Monthly inflation rate and bank rate in Canada 2018-2024

Monthly inflation rate and bank rate in Canada 2018-2024

Average inflation rate and bank rate in Canada from January 2018 to July 2024

-

Premium Statistic

Monthly central bank interest rate in Israel 1994-2024

Monthly central bank interest rate in Israel 1994-2024

Monthly Bank of Israel declared interest rate from January 1994 to May 2024

-

Basic Statistic

Monthly real vs. nominal interest rates and inflation rate for the U.S. 1982-2023

Monthly real vs. nominal interest rates and inflation rate for the U.S. 1982-2023

Monthly 10-year real interest rate, Federal Funds effective rate and inflation rate in the United States from 1982 to 2023

-

Basic Statistic

U.S. annual inflation rate 1990-2023

U.S. annual inflation rate 1990-2023

Annual inflation rate in the United States from 1990 to 2023

-

Basic Statistic

Inflation rate of the European Union 1997-2024

Inflation rate of the European Union 1997-2024

Harmonized index of consumer prices (HICP) inflation rate of the European Union from January 1997 to July 2024

-

Premium Statistic

Brazil: monthly inflation rate 2016-2024

Brazil: monthly inflation rate 2016-2024

Inflation rate in Brazil from January 2016 to July 2024 (compared to the same month of the previous year)

-

Basic Statistic

Inflation rate in the UK 1989-2024

Inflation rate in the UK 1989-2024

Inflation rate for the Consumer Price Index (CPI) in the United Kingdom from January 1989 to July 2024

-

Basic Statistic

Monthly central bank interest rates in the U.S., EU, and the UK 2003-2024

Monthly central bank interest rates in the U.S., EU, and the UK 2003-2024

Monthly Federal funds effective rate, European Central Bank fixed interest rate, and Bank of England Bank Rate from 2003 to 2024

-

Basic Statistic

RPI annual inflation rate UK 2000-2028

RPI annual inflation rate UK 2000-2028

Annual inflation rate of the Retail Price Index in the United Kingdom from 2000 to 2028

-

Premium Statistic

Monthly inflation rate in Israel 2022-2024

Monthly inflation rate in Israel 2022-2024

Monthly price inflation rate in Israel from January 2022 to May 2024

-

Premium Statistic

Monthly inflation rate in Hong Kong 2021-2024

Monthly inflation rate in Hong Kong 2021-2024

Monthly consumer price inflation rate in Hong Kong from July 2021 to July 2024

-

Premium Statistic

Monthly inflation rate in OECD 2020-2024

Monthly inflation rate in OECD 2020-2024

Total monthly inflation rate in member countries of the Organization for Economic Co-Operation and Development (OECD) from January 2020 to March 2024

-

Basic Statistic

Inflation rate in EU and Euro area 2029

Inflation rate in EU and Euro area 2029

Inflation rate in the European Union and the Euro area from 2019 to 2029 (compared to the previous year)

-

Basic Statistic

Inflation rate in Europe in March 2024, by country

Inflation rate in Europe in March 2024, by country

Harmonized index of consumer prices (HICP) inflation rate in Europe in March 2024, by country

-

Basic Statistic

Fixed rate interest rates set by the ECB 2008-2024

Fixed rate interest rates set by the ECB 2008-2024

Fluctuation of the European Central Bank fixed interest rate from 2008 to 2024

-

Basic Statistic

Monthly inflation rate in Argentina 2018-2024

Monthly inflation rate in Argentina 2018-2024

Inflation rate in Argentina from January 2018 to May 2024 (CPI compared to the same month of the previous year)

-

Basic Statistic

Fluctuation of the ECB interest rate on marginal lending facilities 2008-2024

Fluctuation of the ECB interest rate on marginal lending facilities 2008-2024

Fluctuation of the European Central Bank interest rate on the marginal lending facilities from 2008 to 2024

-

Basic Statistic

Inflation rate of the European Union 2002-2024, by category

Inflation rate of the European Union 2002-2024, by category

Harmonized index of consumer prices (HICP) inflation rate of the European Union from January 2002 to July 2024, by category

-

Basic Statistic

Monthly inflation rate in Chile 2018-2024

Monthly inflation rate in Chile 2018-2024

Inflation rate in Chile from January 2018 to April 2024 (CPI compared to the same month of the previous year)

-

Basic Statistic

Monthly inflation rate in Nicaragua 2017-2024

Monthly inflation rate in Nicaragua 2017-2024

Inflation rate in Nicaragua from January 2017 to July 2024 (CPI compared to same month of the previous year)

-

Basic Statistic

Monthly inflation rate in Dominican Republic 2013-2024

Monthly inflation rate in Dominican Republic 2013-2024

Inflation rate in Dominican Republic from January 2013 to June 2024 (CPI compared to previous month)

-

Basic Statistic

Inflation rate in Japan 2029

Inflation rate in Japan 2029

Japan: Inflation rate from 1980 to 2029 (compared to the previous year)

-

Basic Statistic

Countries with the highest inflation rate 2023

Countries with the highest inflation rate 2023

The 20 countries with the highest inflation rate in 2023 (compared to the previous year)

-

Basic Statistic

Countries with the lowest inflation rate 2023

Countries with the lowest inflation rate 2023

The 20 countries with the lowest inflation rate in 2023 (compared to the previous year)

-

Basic Statistic

Inflation rate in China 2013-2029

Inflation rate in China 2013-2029

Inflation rate in China from 2013 to 2023 with forecasts until 2029

-

Basic Statistic

Inflation rate in Brazil 2029

Inflation rate in Brazil 2029

Brazil: Inflation rate from 1987 to 2029 (compared to the previous year)

-

Basic Statistic

Inflation rate in Russia 2029

Inflation rate in Russia 2029

Russia: Inflation rate from 1997 to 2029 (compared to the previous year)

-

Basic Statistic

Inflation rate in France 2029

Inflation rate in France 2029

France: Inflation rate from 1987 to 2029 (compared to the previous year)

-

Premium Statistic

Inflation rate in the ASEAN countries 2029

Inflation rate in the ASEAN countries 2029

ASEAN countries: Inflation rate from 2019 to 2029 (compared to the previous year)

-

Basic Statistic

Inflation rate in Germany 1992-2023

Inflation rate in Germany 1992-2023

Inflation rate in Germany from 1992 to 2023 (change of CPI compared to the previous year)

-

Basic Statistic

Monthly inflation rate in the Euro area September 2023

Monthly inflation rate in the Euro area September 2023

Inflation rate in the Euro area from September 2021 to September 2023 (compared to the same month of the previous year)

-

Basic Statistic

Inflation rate in Hong Kong 2000-2029

Inflation rate in Hong Kong 2000-2029

Inflation rate in Hong Kong from 2000 to 2023 with forecasts until 2029

-

Basic Statistic

Inflation rate in the emerging market and developing economies 2029

Inflation rate in the emerging market and developing economies 2029

Emerging market and developing economies: Inflation rate from 2019 to 2029 (compared to the previous year)

-

Basic Statistic

Inflation rate in the BRICS countries 2000-2029

Inflation rate in the BRICS countries 2000-2029

Inflation rate in the BRICS countries from 2000 to 2029 (compared to the previous year)

-

Premium Statistic

Monthly inflation rate in the United Kingdom August 2023

Monthly inflation rate in the United Kingdom August 2023

United Kingdom: Inflation rate from August 2022 to August 2023 (compared to the same month of the previous year)

-

Basic Statistic

Monthly inflation rate in European countries December 2023

Monthly inflation rate in European countries December 2023

Inflation rate in selected European countries in December of 2023 (compared to the same month of the previous year)

-

Premium Statistic

Inflation rate in the MENA countries 2023

Inflation rate in the MENA countries 2023

MENA countries: Inflation rate in 2023 (compared to the previous year)

-

Premium Statistic

Inflation rate in the DACH countries 2029

Inflation rate in the DACH countries 2029

DACH countries: Inflation rate from 2019 to 2029 (compared to the previous year)

-

Premium Statistic

Inflation rate Costa Rica 2024, by sector

Inflation rate Costa Rica 2024, by sector

Inflation rate in Costa Rica in July 2024, by sector

-

Premium Statistic

Inflation rate Panama 2024, by sector

Inflation rate Panama 2024, by sector

Inflation rate in Panama in June 2024, by sector

-

Premium Statistic

Inflation rate Nicaragua 2024, by sector

Inflation rate Nicaragua 2024, by sector

Inflation rate in Nicaragua in June 2024, by sector

-

Premium Statistic

Inflation rate Belize 2022, by sector

Inflation rate Belize 2022, by sector

Inflation rate in Belize in 2022, by sector

-

Premium Statistic

Inflation rate Honduras 2024, by sector

Inflation rate Honduras 2024, by sector

Inflation rate in Honduras in July 2024, by sector

-

Basic Statistic

U.S. monthly inflation rate 2024

U.S. monthly inflation rate 2024

Monthly 12-month inflation rate in the United States from July 2020 to July 2024

-

Basic Statistic

Monthly inflation rate in China August 2024

Monthly inflation rate in China August 2024

Monthly inflation rate in China from August 2022 to August 2024

Further reports

Get the best reports to understand your industry

Contact

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)