Financial markets in Germany - statistics & facts

Key insights

- GDP per capita in Germany 2028 forecast

- 65,212.39 USD

Detailed statistics

GDP per capita in current prices of Germany 2028

- Germany's share of total world equity market value

- 2.1%

Detailed statistics

Countries with largest stock markets globally 2023

- Total market capitalization of the Frankfurt Stock Exchange

- 2tr EUR

Detailed statistics

Market cap of the Frankfurt Stock Exchange 2002-2023

Editor’s Picks Current statistics on this topic

Current statistics on this topic

Related topics

Recommended statistics

Global economic overview

4

Global economic overview

-

Basic Statistic

Countries with the largest gross domestic product (GDP) 2022

Countries with the largest gross domestic product (GDP) 2022

The 20 countries with the largest gross domestic product (GDP) in 2022 (in billion U.S. dollars)

-

Premium Statistic

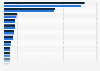

Countries with largest stock markets globally 2023

Countries with largest stock markets globally 2023

Distribution of countries with largest stock markets worldwide as of January 2023, by share of total world equity market value

-

Premium Statistic

Largest stock exchange operators worldwide 2023, by market capitalization

Largest stock exchange operators worldwide 2023, by market capitalization

Largest stock exchange operators worldwide as of December 2023, by market capitalization of listed companies (in trillion U.S. dollars)

-

Premium Statistic

FDI inward stock in Germany 2005-2022

FDI inward stock in Germany 2005-2022

Foreign direct investment inward stock in Germany from 2005 to 2022 (in million U.S dollars)

Stock exchanges

4

- Premium Statistic Market cap of the Frankfurt Stock Exchange 2002-2023

- Premium Statistic Biggest companies listed on Frankfurt Stock Exchange 2024, by market cap

- Premium Statistic Transaction volume of Xetra and Börse Frankfurt 2019-2023, by month

- Premium Statistic Turnover comparison of three DAX indices in Germany 2019-2023

Stock exchanges

-

Premium Statistic

Market cap of the Frankfurt Stock Exchange 2002-2023

Market cap of the Frankfurt Stock Exchange 2002-2023

Total market capitalization of all domestic shares listed on the Frankfurt Stock Exchange from 2002 to December 2023 (in billion euros)

-

Premium Statistic

Biggest companies listed on Frankfurt Stock Exchange 2024, by market cap

Biggest companies listed on Frankfurt Stock Exchange 2024, by market cap

Leading companies listed on the Frankfurt Stock Exchange in Germany as of March 2024, by market capitalization (in billion euros)

-

Premium Statistic

Transaction volume of Xetra and Börse Frankfurt 2019-2023, by month

Transaction volume of Xetra and Börse Frankfurt 2019-2023, by month

Monthly transaction volume of prime standard shares listed on the different trading venues of the Frankfurt Stock Exchange from January 2019 to March 2023 (in million units)

-

Premium Statistic

Turnover comparison of three DAX indices in Germany 2019-2023

Turnover comparison of three DAX indices in Germany 2019-2023

Monthly transaction value of prime standard shares listed on the Frankfurt Stock Exchange from January 2019 to March 2023, by index (in billion euros)

Stock indices

-

Premium Statistic

Monthly development DAX Index 2015-2024

Monthly development DAX Index 2015-2024

Monthly development of DAX Index from January 2015 to February 2024

-

Premium Statistic

Monthly development MDAX Index 2015-2024

Monthly development MDAX Index 2015-2024

Monthly development of the MDAX Index from January 2015 to February 2024

-

Premium Statistic

Monthly development SDAX Index 2015-2024

Monthly development SDAX Index 2015-2024

Monthly development of the SDAX Index from January 2015 to February 2024

-

Premium Statistic

Monthly development TecDAX Index 2015-2024

Monthly development TecDAX Index 2015-2024

Monthly development of the TecDAX Index from January 2015 to February 2024

Currency (forex) market

5

Currency (forex) market

-

Basic Statistic

USD/EUR FX rate, up until Apr 26, 2024

USD/EUR FX rate, up until Apr 26, 2024

U.S. Dollar (USD) to euro (EUR) exchange rate from June 29, 2020 to April 26, 2024

-

Basic Statistic

EUR/GBP FX rate, up until Apr 26, 2024

EUR/GBP FX rate, up until Apr 26, 2024

Euro (EUR) to British pound sterling (GBP) exchange rate from June 29, 2020 to April 26, 2024

-

Basic Statistic

EUR/CAD FX rate, up until Apr 25, 2024

EUR/CAD FX rate, up until Apr 25, 2024

Euro (EUR) to Canadian dollar (CAD) exchange rate from June 28, 2020 to April 25, 2024

-

Basic Statistic

EUR/CNY FX rate, up until Apr 26, 2024

EUR/CNY FX rate, up until Apr 26, 2024

Euro (EUR) to Chinese Yuan Renminbi (CNY) exchange rate from June 29, 2020 to April 26, 2024

-

Basic Statistic

EUR/JPY FX rate, up until Apr 26, 2024

EUR/JPY FX rate, up until Apr 26, 2024

Euro (EUR) to Japanese yen (JPY) exchange rate from June 29, 2020 to April 26, 2024

Fixed income (bond) market

5

- Premium Statistic 10-year government bond yields in Germany 1994-2023

- Basic Statistic German two-year treasury note yield 2014-2023, by month

- Basic Statistic General government debt Germany 2022

- Premium Statistic Maturity of government bonds in Germany in 2015 2020 and 2023

- Premium Statistic Outstanding debt securities among corporations in Germany 2018-2022

Fixed income (bond) market

-

Premium Statistic

10-year government bond yields in Germany 1994-2023

10-year government bond yields in Germany 1994-2023

Long-term government bond yields in Germany from 1994 to 2023

-

Basic Statistic

German two-year treasury note yield 2014-2023, by month

German two-year treasury note yield 2014-2023, by month

Monthly yield of German treasury notes with a two year maturity (Schatz) from January 2014 to March 2023

-

Basic Statistic

General government debt Germany 2022

General government debt Germany 2022

Germany: General government debt from 2003 to 2022 (in million euros)

-

Premium Statistic

Maturity of government bonds in Germany in 2015 2020 and 2023

Maturity of government bonds in Germany in 2015 2020 and 2023

Distribution of outstanding government debt securities in Germany in 2015, 2020 and 2023, by maturity

-

Premium Statistic

Outstanding debt securities among corporations in Germany 2018-2022

Outstanding debt securities among corporations in Germany 2018-2022

Outstanding value of corporate debt securities in Germany from 1st quarter 2018 to 4th quarter 2022, by corporation type (in billion U.S. dollars)

Money market

5

- Basic Statistic Size of interbank borrowing in the eurozone 2017-January 2023

- Basic Statistic Euro short term rate 2019-2024, by month

- Premium Statistic Monthly EURIBOR rate 2020-2023, by maturity

- Basic Statistic Fluctuation of the ECB interest rate on deposit facilities 2008-2023

- Basic Statistic Fluctuation of the ECB interest rate on marginal lending facilities 2008-2023

Money market

-

Basic Statistic

Size of interbank borrowing in the eurozone 2017-January 2023

Size of interbank borrowing in the eurozone 2017-January 2023

Average daily turnover of unsecured borrowing between banks in the euro money market from 2017 to January 2023 (in billion euro)

-

Basic Statistic

Euro short term rate 2019-2024, by month

Euro short term rate 2019-2024, by month

Monthly euro short term rate from October 2019 to February 2024

-

Premium Statistic

Monthly EURIBOR rate 2020-2023, by maturity

Monthly EURIBOR rate 2020-2023, by maturity

Comparison of the monthly Euro Interbank Offered Rate from January 2020 to March 2023, by maturity

-

Basic Statistic

Fluctuation of the ECB interest rate on deposit facilities 2008-2023

Fluctuation of the ECB interest rate on deposit facilities 2008-2023

Fluctuation of the European Central Bank interest rate on deposit facilities from 2008 to 2023

-

Basic Statistic

Fluctuation of the ECB interest rate on marginal lending facilities 2008-2023

Fluctuation of the ECB interest rate on marginal lending facilities 2008-2023

Fluctuation of the European Central Bank interest rate on the marginal lending facilities from 2008 to December 2023

Further reportsGet the best reports to understand your industry

Get the best reports to understand your industry

Contact

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)