Mathilde Carlier

Research Expert covering transportation and logistics

Detailed statistics

Annual car sales worldwide 2010-2023, with a forecast for 2024

Detailed statistics

Annual car sales worldwide 2010-2023, with a forecast for 2024

Detailed statistics

Worldwide light vehicle sales growth - outlook 2017-2024

Annual car sales worldwide 2010-2023, with a forecast for 2024

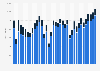

Number of cars sold worldwide from 2010 to 2023, with a 2024 forecast (in million units)

Worldwide light vehicle sales growth - outlook 2017-2024

Projected worldwide light vehicle sales growth from 2017 to 2024

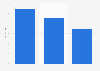

Growth forecast for the international auto sales by market 2020-2023

Projected light vehicle sales growth worldwide between 2020 and 2023, by major market

United States - car growth outlook 2020-2023

Post-pandemic light vehicle sales in the United States between 2020 and 2023 (in million units)

Monthly inventory/sales ratio in the U.S. auto industry 2009-2023

Monthly U.S. auto industry inventory-to-sales ratio between January 2009 and April 2023

Monthly car loan rates in the U.S. 2014-2024

Interest rates on 60-month new car loans in the United States from February 2014 to August 2024

United States - monthly vehicle sales by type through May 2023

U.S. vehicle sales between January 2021 and May 2023, by vehicle type (in 1,000 units)

Monthly car sales in Europe through December 2023

Monthly passenger car sales in Europe between March 2020 and December 2023 (in 1,000 units)

YTD market share of selected car manufacturers in Europe 2023

Selected passenger car manufacturers' European market share between January and December 2023, based on new registrations

Volume index of motor vehicle production in the EU by country 2020-2023

Volume index of motor vehicle production in selected European markets between January 2020 and December 2023

Monthly automobile sales in China 2021-2023

Monthly automobile sales in China from January 2021 to August 2023 (in 1,000 units)

Vehicle sales by month - BRIC countries 2020

Motor vehicle sales in the BRIC countries between March 2019 and December 2020 (in million units)

Revenue of automotive manufacturers worldwide in H1 2012 and 2021

Revenue of automotive manufacturers worldwide between January and June 2012 and 2021 (in billion euros)

Ranking of motor vehicle manufacturers worldwide by global sales 2023

Leading motor vehicle manufacturers worldwide in 2023, based on sales worldwide (in million units)

Toyota Motor Corporation: motor vehicle sales by region 2017-2024

Toyota Motor Corporation's motor vehicle sales between FY 2017 and FY 2024, by main region (in 1,000s)

Volkswagen Group - worldwide vehicle deliveries 2012-2023

Volkswagen Group's worldwide vehicle deliveries from 2012 to 2023 (in millions)

Mercedes-Benz Cars' unit sales 2019-2023

Mercedes-Benz Cars' unit sales between FY 2019 and FY 2023 (in 1,000 units)

Wholesale vehicle sales of the Ford Motor Company by region 2019-2022

Number of Ford Motor Company vehicles sold by wholesale between FY 2019 and FY 2022, by regional segment (in 1,000 units)

Transportation consumer spending worldwide 2023, by country

Ranking of the total consumer spending on transportation by country 2023 (in million U.S. dollars)

Transportation consumer spending per capita worldwide 2023, by country

Ranking of the per capita consumer spending on transportation by country 2023 (in U.S. dollars)

Mobility at transit stations amid coronavirus crisis in regions

Activity at transit stations in selected locations between February 29, 2020 and March 31, 2021, compared with movement prior to the coronavirus outbreak

Mobility in cities amid coronavirus crisis 2021

Mobility in selected cities between March 3, 2020 and June 1, 2021, compared with movement prior to the coronavirus outbreak

Self-reported impact of COVID-19 on the number of vehicles per household by country

"The pandemic has caused me to reconsider the number of vehicles I need for my household."

Attitudes towards purchasing cars online after Covid-19 in the UK, China, and India

Percentage of survey respondents in the UK, India, and China who would purchase their future vehicles online after Covid-19

Consumers' interest in electric vehicles in the wake of the pandemic

Percentage of consumers in key regions worldwide who agree that the COVID-19 pandemic has increased their interest in electric vehicles as of September 2020

Vehicle segment inventory by days of supply in the U.S. 2020-2021

Vehicle segment* inventory in the United States as of June 2021, based on days of supply

Vehicle brand inventory by days of supply in the U.S. 2023

Vehicle brands availability in the United States as of November 2023, based on days of supply

Share of U.S. auto intenders delaying vehicle purchases 2021

Percentage of U.S. respondents planning to delay vehicle purchase between August 2020 and May 2021

Covid-19 reopening: timeline for car shoppers to return to dealerships

Percentage of U.S. respondents who are comfortable purchasing a vehicle from a dealership once COVID-19 restrictions are lifted, as of May 2020

Incentives to drive vehicle purchases during Covid-19 in U.S.

Percentage of U.S. respondents who claim that certain incentives could increase their willingness to purchase a vehicle during Covid-19, as of April 2020

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)