Xin Ou

Research expert covering Greater China

Detailed statistics

Retail sales value of cosmetics China 2014-2023

Detailed statistics

GMV of major cosmetic brands China 2023

Detailed statistics

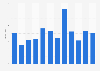

Number of new cosmetics companies China 2016-2023

Revenue of the beauty & personal care industry worldwide 2018-2028

Revenue of the beauty & personal care market worldwide from 2018 to 2028 (in billion U.S. dollars)

Market size of beauty & personal care in 20 countries worldwide 2023

Revenue of the beauty & personal care market worldwide by country in 2023 (in billion U.S. dollars)

By country revenue of prestige cosmetics and fragrances market worldwide in 2023

Revenue of prestige cosmetics and fragrances market worldwide in 2023, by country (in million U.S. dollars)

Revenue of the skin care market worldwide by country 2023

Worldwide revenue of the skin care market by country in 2023 (in million U.S. dollars)

Cosmetics market value China 2015-2025

Cosmetics market size in China from 2015 to 2023 with forecasts until 2025 (in billion yuan)

Retail sales value of cosmetics China 2014-2023

Retail sales value of beauty and cosmetic products in China from 2014 to 2023 (in billion yuan)*

Retail sales of cosmetics in China by month 2023-2024

Retail trade revenue of cosmetics in China from July 2023 to July 2024 (in billion yuan)

Cosmetics retail sales breakdown China 2023, by category

Retail sales distribution of cosmetic products in China in 2023, by category

Revenue in the Cosmetics market China 2018-2028

Revenue in the Cosmetics market for different segments China from 2018 to 2028 (in billion U.S. dollars)

Revenue in the prestige cosmetics & fragrances segment China 2018-2028

Revenue in the prestige cosmetics & fragrances segment of the luxury goods market China from 2018 to 2028 (in billion U.S. dollars)

Import value of cosmetics personal care and cosmetics products into China 2018-2023

Import value of preparations for make-up and personal care into China from 2018 to 2023 (in billion U.S. dollars)

Import value of China's personal care and cosmetics 2022, by category

Import value of China's personal care and cosmetic products in 2022, by category (in million U.S. dollars)

Leading origins of beauty products imported into China 2022

Distribution of import value of beauty products in China in 2022, by region of origin

Export value of cosmetics, personal care, and cosmetics products from China 2018-2023

Export value of personal care and cosmetics products from China from 2018 to 2023 (in billion U.S. dollars)

Leading destinations of beauty products exported from China 2022

Distribution of export value of beauty products in China in 2022, by region of destination

Cosmetics retail sales breakdown China 2023, by distribution channel

Distribution of cosmetics retail sales value in China in 2023, by distribution channel

Number of cosmetic counters China 2019-2023

Number of makeup and cosmetic counters in China from March 2019 to September 2023

Online cosmetic market GMV distribution China 2023, by platform

Distribution of the gross merchandise volume (GMV) of China's online cosmetic market from January to November 2023, by e-commerce platform

Color cosmetics retail sales breakdown China 2022, by distribution channel

Share of color cosmetics retail sales value in China in 2022, by distribution channel

Singles' Day perfume and makeup sales distribution China 2023, by platform

Singles' Day perfume and color cosmetics sales distribution in China in 2023, by e-commerce platform

Cosmetics retail sales breakdown China 2023, by brand origin

Retail sales distribution of cosmetic products in China in 2023, by brand origin

GMV of major cosmetic brands China 2023

Gross merchandise volume (GMV) of leading brands for beauty and cosmetic products in China in 2023 (in billion yuan)

YoY GMV growth of major cosmetic brands China 2023

Year-over-year growth in gross merchandise volume (GMV) of leading brands for beauty and cosmetic products in China in 2023

Leading color cosmetic brands China 2022, by market share

Leading color cosmetic brands in China in 2022, by market share

Leading haircare brands based on online sales share China 2022

Distribution of e-commerce sales value of leading haircare products in China in 2022, by brand

Market size of skin care products China 2015-2025

Market size of skincare products in China from 2015 to 2023, with estimates until 2025 (in billion yuan)

Sales growth of skincare products China 2023, by channel

Year-on-year sales development of skincare products in China in 2023, by distribution channel

Breakdown of skincare market China 2023, by type

Skincare product retail sales distribution in China in 2023, by type

Breakdown of skincare market China 2023, by price range

Distribution of skincare market in China in 2023, by price range

Distribution of skincare product sales on Douyin China 2023, by product

Distribution of online retail sales of skincare products on Douyin in China in 2023, by product category

Market value of color cosmetics China 2015-2025

Market size of color cosmetics industry in China from 2015 to 2023, with forecasts until 2025 (in billion yuan)

Breakdown of color cosmetics market China 2019-2027, by product

Distribution of color cosmetics market in China from 2019 to 2022, with forecasts until 2027, by product category

Sales revenue of base make-up products China 2019-2027

Retail sales value of base makeup products in China from 2019 to 2022, with estimates until 2027 (in billion yuan)

Sales revenue of eye make-up products China 2019-2027

Retail sales value of eye color cosmetics in China from 2019 to 2022, with estimates until 2027 (in billion yuan)

Sales revenue of lip make-up products China 2019-2027

Retail sales value of lip color cosmetic products in China from 2019 to 2022, with estimates until 2027 (in billion yuan)

Sales revenue of nail make-up products China 2019-2027

Retail sales value of nail color cosmetic products in China from 2019 to 2022, with estimates until 2027 (in million yuan)

Sales revenue of makeup sets China 2019-2027

Retail sales value of color cosmetic sets in China from 2019 to 2022, with estimates until 2027 (in billion yuan)

Revenue in the hair care segment of the beauty & personal care market China 2018-2028

Revenue in the hair care segment of the beauty & personal care market China from 2018 to 2028 (in billion U.S. dollars)

Revenue in the fragrances segment China 2018-2028

Revenue in the fragrances segment of the beauty & personal care market China from 2018 to 2028 (in million U.S. dollars)

Revenue of the shower & bath beauty & personal care industry in China 2018-2028

Revenue of the shower & bath beauty & personal care market in China from 2018 to 2028 (in billion U.S. dollars)

Per capita annual spending on cosmetics China 2017-2025

Per capita annual expenditure on beauty and cosmetic products in China in 2017 and 2022, with a forecast for 2025 (in yuan)

Number of users in the beauty care segment of the e-commerce market China 2017-2027

Number of users in the beauty care segment of the e-commerce market China from 2017 to 2027 (in million individuals)

Leading considerations when buying skincare products China 2023

Major factors affecting the decision on buying skincare products among consumers in China as of March 2023

Domestic cosmetic product consumer distribution China 2023, by age

Distribution of domestic China-chic beauty and cosmetic product consumers in China as of June 2023, by age

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)