Facebook's Fourth Quarter Earnings

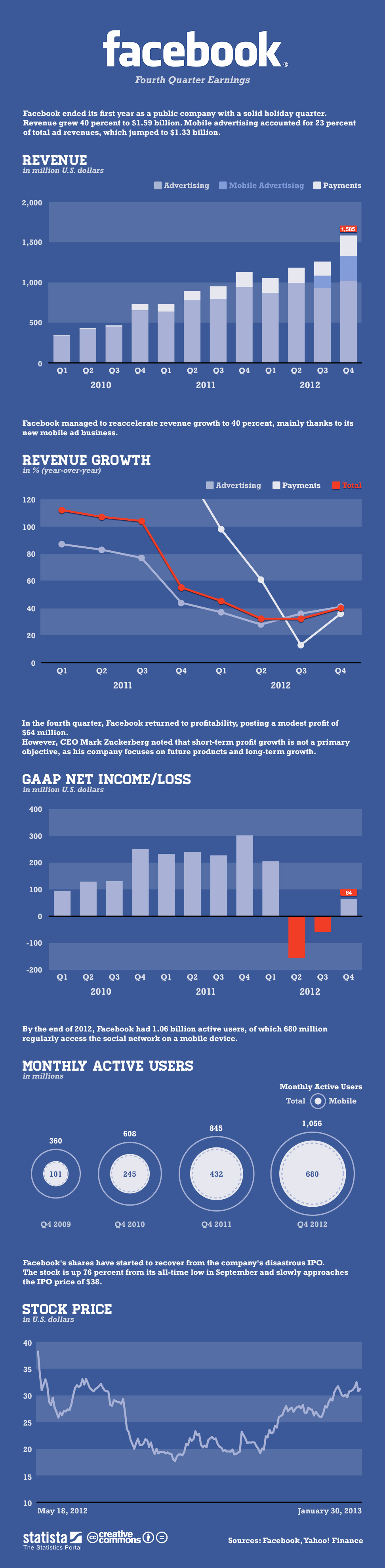

Facebook’s fourth quarter revenue grew 40 percent to $1.59 billion. Mobile advertising accounted for 23 percent of ad revenues, up from 14 percent in the third quarter. A year ago, Facebook didn’t even serve ads to mobile devices; now these ads account for almost one fifth of the company’s total revenue. The decision to build a mobile ad business is also the main driver behind the reacceleration of Facebook’s revenue growth. The company’s rate of revenue growth had declined for six straight quarters before the introduction of mobile ads in 2012.

In the fourth quarter, Facebook returned to profitability, posting a modest profit of $64 million. However, CEO Mark Zuckerberg noted that short term profit growth is not a primary objective, as his company will continue to invest in future products to pursue long-term growth.

After a tumultuous year, Facebook’s shares ended 2012 on a positive note. By the end of the year, the stock was trading 50 percent above the all-time low it had hit in September. The stock continued to climb through January and is slowly approaching the IPO price of $38.

Description

This infographic contains everything you need to know about Facebook's latest earnings report.