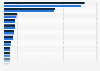

Prediction of 10 year U.S. Treasury note rates 2019-2024

In April 2024, the yield on a 10-year U.S. Treasury note was 4.54 percent, forecasted to decrease to reach 3.39 percent by January 2025. Treasury securities are debt instruments used by the government to finance the national debt.

Who owns treasury notes?

Because the U.S. treasury notes are generally assumed to be a risk-free investment, they are often used by large financial institutions as collateral. Because of this, billions of dollars in treasury securities are traded daily. Other countries also hold U.S. treasury securities, as do U.S. households. Investors and institutions accept the relatively low interest rate because the U.S. Treasury guarantees the investment.

Looking into the future

Because these notes are so commonly traded, their interest rate also serves as a signal about the market’s expectations of future growth. When markets expect the economy to grow, forecasts for treasury notes will reflect that in a higher interest rate. In fact, one harbinger of recession is an inverted yield curve, when the return on 3-month treasury bills is higher than the ten year rate. While this does not always lead to a recession, it certainly signals pessimism from financial markets.