Online trading - statistics & facts

Key insights

- Size of the global eTrading market

- 10.21bn USD

Detailed statistics

Size of the global online trading market 2020, with forecasts up until 2026

- Monthly users of WeBull globally in July 2021

- 2.69m

Detailed statistics

Monthly active users of the leading eTrading apps worldwide 2017-2021

Editor’s Picks Current statistics on this topic

Current statistics on this topic

Related topics

Other interesting statistics

-

Premium Statistic

Online retail revenue from selected product groups in Germany 2019-2023

Online retail revenue from selected product groups in Germany 2019-2023

Product groups ranked by online retail revenue in Germany from 2019 to 2023 (in million euros)

-

Premium Statistic

Common ways to place stock orders among retail investors in Japan 2023

Common ways to place stock orders among retail investors in Japan 2023

Most common ways to place stock orders among individual investors in Japan as of July 2023

-

Premium Statistic

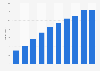

Online retail spending in the United Kingdom (UK) 2011-2023

Online retail spending in the United Kingdom (UK) 2011-2023

Online retail spending in the United Kingdom (UK) from 2011 to 2023 (in billion GBP)

-

Premium Statistic

Online fashion retail sales in Germany 2006-2023

Online fashion retail sales in Germany 2006-2023

Sales in online fashion retail in Germany from 2006 to 2023 (in billion euros)

-

Premium Statistic

Market size of online retail industry in India 2018-2027

Market size of online retail industry in India 2018-2027

Market size of online retail industry across India from 2018 to 2023, with estimates until 2027 (in billion U.S. dollars)

-

Premium Statistic

Importance of trading app features to retail investors in the UK 2023, by broker

Importance of trading app features to retail investors in the UK 2023, by broker

Importance of trading app features to retail investors in the United Kingdom in 2023, by broker

-

Premium Statistic

Importance of trading app features to retail investors in the UK 2023, by gender

Importance of trading app features to retail investors in the UK 2023, by gender

Importance of trading app features to retail investors in the United Kingdom in 2023, by gender

-

Premium Statistic

Importance of trading app features to retail investors in the UK 2023, by age

Importance of trading app features to retail investors in the UK 2023, by age

Importance of trading app features to retail investors in the United Kingdom in 2023, by age

-

Premium Statistic

Online shopping market retail sales volume in China 2015-2023

Online shopping market retail sales volume in China 2015-2023

Retail sales volume of China's online shopping market from 2015 to 2023 (in trillion yuan)

-

Premium Statistic

Frequency that retail investors use AI to conduct financial research in the U.S. 2023

Frequency that retail investors use AI to conduct financial research in the U.S. 2023

Rate of frequency that retail investors use AI tools to conduct financial research in the United States in 2023

-

Premium Statistic

Key areas of evolution among retail investors in the U.S. 2023

Key areas of evolution among retail investors in the U.S. 2023

Key areas of evolution among retail investors in the United States in 2023

-

Premium Statistic

Top investment information sources of retail investors in the U.S. 2023

Top investment information sources of retail investors in the U.S. 2023

Top investment information sources of retail investors in the United States in 2023

-

Premium Statistic

Ease of using trading app features for retail investors in the UK 2023, by broker

Ease of using trading app features for retail investors in the UK 2023, by broker

Ease of using specific trading app features for retail investors in the United Kingdom in 2023, by broker

-

Premium Statistic

Online revenue from clothing and shoes in Germany 2006-2023

Online revenue from clothing and shoes in Germany 2006-2023

Online retail revenue from clothing and shoes in Germany from 2006 to 2023 (in billion euros)

-

Premium Statistic

Online retail sales growth South Korea 2016-2023

Online retail sales growth South Korea 2016-2023

Annual growth of online retail sales in South Korea from 2016 to 2023

-

Premium Statistic

Breakdown of China's online retail sales 2023, by category

Breakdown of China's online retail sales 2023, by category

Breakdown of online retail sales revenue in China in 2023, by category

-

Premium Statistic

Sales value of cross-border online retail India 2023-2025

Sales value of cross-border online retail India 2023-2025

Value of online retail sales across borders from India in 2023, with estimates until 2025 (in billion U.S. dollars)

-

Premium Statistic

Breakdown of China's online retail stores 2023, by product category

Breakdown of China's online retail stores 2023, by product category

Breakdown of online retail stores in China in 2023, by product category

-

Premium Statistic

Breakdown of China's online retail stores 2023, by region

Breakdown of China's online retail stores 2023, by region

Breakdown of online retail stores in China in 2023, by region

-

Premium Statistic

Annual growth of online retail sales in goods value in China 2015-2023

Annual growth of online retail sales in goods value in China 2015-2023

Annual growth of value of the online retail sales of physical goods in China from 2015 to 2023

-

Premium Statistic

Ease of using trading app features for retail investors in the UK 2023, by age

Ease of using trading app features for retail investors in the UK 2023, by age

Ease of using specific trading app features for retail investors in the United Kingdom in 2023, by age

-

Basic Statistic

Online share of retail sales in Great Britain November 2023, by sector

Online share of retail sales in Great Britain November 2023, by sector

Share of total retail sales made online in Great Britain in November 2023, by sector

-

Premium Statistic

Online retail revenuel in Germany 2021-2023, by type of seller

Online retail revenuel in Germany 2021-2023, by type of seller

Online retail sales revenue in Germany from 2021 to 2023, by type of seller (in million euros)

-

Premium Statistic

Awareness of ESG investing among retail investors in Japan 2023

Awareness of ESG investing among retail investors in Japan 2023

Awareness of ESG investing among individual investors in Japan as of July 2023

-

Premium Statistic

Importance of trading app features to investors in the UK 2023, by portfolio value

Importance of trading app features to investors in the UK 2023, by portfolio value

Importance of trading app features to retail investors in the United Kingdom in 2023, by portfolio value

-

Premium Statistic

Mail order and online retail stores revenue in Hungary 2010-2023

Mail order and online retail stores revenue in Hungary 2010-2023

Revenue of mail order and online retail stores in Hungary from 2010 to 2023 (in million forints)

-

Premium Statistic

Online retail order growth in the U.S. 2024, by device

Online retail order growth in the U.S. 2024, by device

Quarterly change in online retail orders in the United States from 1st quarter 2022 to 1st quarter 2024, by device

-

Basic Statistic

Online retail month-on-month retail sales change in Great Britain 2023

Online retail month-on-month retail sales change in Great Britain 2023

Month-on-month percentage change in online retail sales in Great Britain from January 2021 to November 2023, by sector

-

Premium Statistic

Consumer opinion on investing on stock market or crypto in the U.S. 2023

Consumer opinion on investing on stock market or crypto in the U.S. 2023

Opinion from consumers in the United States on whether investing in cryptocurrencies is more risky and/or more profitable than investing on the stock market as of 2023

-

Premium Statistic

Percentage of the population in the UK investing 2023, by income group

Percentage of the population in the UK investing 2023, by income group

Percentage of the population in the United Kingdom participating in investing in 2023, by income group

-

Premium Statistic

Share of retail stock market investors Philippines 2021, by gender

Share of retail stock market investors Philippines 2021, by gender

Distribution of retail stock market investors in the Philippines in 2021, by gender

-

Premium Statistic

Share of online stock market investors Philippines 2021, by gender

Share of online stock market investors Philippines 2021, by gender

Distribution of online stock market investors in the Philippines in 2021, by gender

-

Premium Statistic

Preferred investment strategies of retail investors in the U.S. 2023

Preferred investment strategies of retail investors in the U.S. 2023

Preferred investment strategies of retail investors in the United States in 2023

-

Premium Statistic

Most popular countries to make cross-border online purchases 2023

Most popular countries to make cross-border online purchases 2023

Leading markets of most recent cross-border online purchase worldwide in 2023

-

Premium Statistic

Share of Americans investing money in the stock market 1999-2023

Share of Americans investing money in the stock market 1999-2023

Share of adults investing money in the stock market in the United States from 1999 to 2023

-

Premium Statistic

Shift in risk tolerance of retail investors in the U.S. 2023

Shift in risk tolerance of retail investors in the U.S. 2023

Shift in risk tolerance of retail investors in the United States from January to July 2023

-

Premium Statistic

Confidence level of retail investors in their portfolio strategy in the U.S. 2023

Confidence level of retail investors in their portfolio strategy in the U.S. 2023

Confidence level of retail investors in their portfolio strategy in the United States in 2023

-

Premium Statistic

Share of retail investors that do not include ESG in their portfolio in the U.S. 2023

Share of retail investors that do not include ESG in their portfolio in the U.S. 2023

Share of retail investors that do not include environmental, social, and corporate governance (ESG) in their portfolio in the United States in 2023, by generation

-

Premium Statistic

Retail investors' understanding of an ESG strategy in the U.S. 2023

Retail investors' understanding of an ESG strategy in the U.S. 2023

Retail investors' understanding of an environmental, social, and corporate governance (ESG) strategy in the United States in 2023

-

Premium Statistic

Main reasons for AI adoption among retail investors in the U.S. 2023

Main reasons for AI adoption among retail investors in the U.S. 2023

Leading reasons for AI adoption among retail investors in the United States in 2023

-

Premium Statistic

Leading digital retail media markets in Europe 2023

Leading digital retail media markets in Europe 2023

Digital retail media advertising revenue in Europe in 2023, by country (in million U.S. dollars)

-

Premium Statistic

Types of investments held by retail investors in the UK 2022

Types of investments held by retail investors in the UK 2022

Types of investments held by retail investors in the United Kingdom in 2022

-

Premium Statistic

Portfolio value range held by retail investors in the UK 2022

Portfolio value range held by retail investors in the UK 2022

Portfolio value range held by retail investors in the United Kingdom in 2022

-

Premium Statistic

Retail market share of mail-order and online retail in Germany 2000-2022

Retail market share of mail-order and online retail in Germany 2000-2022

Market share of mail-order and online retail in the retail trade sector in Germany from 2000 to 2022

-

Premium Statistic

Distribution of online and offline retail volume in Germany 2022, by industry

Distribution of online and offline retail volume in Germany 2022, by industry

Distribution of industries in online and offline retail volume in Germany in 2022

-

Premium Statistic

Average importance of trading app features for investors in the UK 2023, app feature

Average importance of trading app features for investors in the UK 2023, app feature

Average importance of trading app features for retail investors in the United Kingdom in 2023, by app feature

-

Premium Statistic

Average ease of using trading app features for investors in the UK 2023, app feature

Average ease of using trading app features for investors in the UK 2023, app feature

Average ease of using specific trading app features for retail investors in the United Kingdom in 2023, by app feature

-

Premium Statistic

Top factors driving investment decisions among retail investors in the U.S. 2023

Top factors driving investment decisions among retail investors in the U.S. 2023

Leading factors driving investment decisions among retail investors in the United States in 2023

-

Premium Statistic

Ease of using trading app features for investors in the UK 2023, by portfolio value

Ease of using trading app features for investors in the UK 2023, by portfolio value

Ease of using specific trading app features for retail investors in the United Kingdom in 2023, by portfolio value

-

Premium Statistic

Ease of using trading app features for investors in the UK 2023, by gender

Ease of using trading app features for investors in the UK 2023, by gender

Ease of using specific trading app features for retail investors in the United Kingdom in 2023, by gender

Further reportsGet the best reports to understand your industry

Get the best reports to understand your industry

Contact

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)