The road to success

The late 90s witnessed disruptions in China’s internet industry. The success of Yahoo inspired many young ambitious Chinese entrepreneurs to start their own online businesses. In the midst of the entrepreneurial boom, an English teacher realized there was great potential in e-commerce and founded a B2B marketplace site named Alibaba. The teacher, Ma Yun (also known as Jack Ma), later became a legend and pioneer of China’s internet development. Alibaba’s success truly began when it expanded its online retail business. The company launched its C2C retail platform Taobao in 2003 and its B2C retail platform Tmall in 2008. These platforms rapidly filled in the gaps in China’s online retail market, and the company’s profits have been snowballing since then. In November 2009, Alibaba initiated its first Singles’ Day online shopping event. Since then, the event is recurred annually and has become the world’s largest sales event. Besides the e-commerce platforms, Alibaba also owned a third-party online payment platform Alipay, an instant messaging tool Aliwangwang, and a digital marketing platform Alimama.com. A conglomerate began to take shape.In 2014, the company went public in New York with a record 25 billion U.S. dollars IPO, more extensive than Google, Facebook, and Twitter combined. By 2023, it is still the second-largest IPO worldwide.

The threats to Alibaba’s e-commerce empire

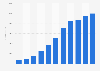

In the fiscal year ending March 31, 2023, Alibaba Group’s annual revenue surpassed 860 billion yuan, soaring by more than 16-fold compared to a decade ago. In the past decade, Alibaba’s organizational structure has undergone several rounds of changes. Internationally, Alibaba attracted more than 300 million overseas consumers to its international online shopping properties. Domestically, the company expanded its business into cloud computing, logistics services, O2O customer services, and entertainment. In 2014, Alibaba Group split its financial service Alipay and rebranded it as Ant Group. Today, domestic e-commerce still contributes around two-thirds of the company’s revenue. Nevertheless, other segments have witnessed robust growth.Despite its revenue growth, Alibaba has faced unprecedented competition in recent years. Pinduoduo, Douyin, and Kuaishou have gained immense popularity in recent years due to the rise of social commerce and short-video commerce. In 2021, Alibaba's average customer acquisition cost was 477 yuan, nearly six times higher than Kuaishou's.

Globally, Alibaba is also beleaguered by the rising unfavorable views against Chinese companies. Around 16 percent of the U.S. adults in a survey said that Alibaba should be banned. While in another survey among consumers in Peru, Alibaba was one of the least-trusted internet companies in terms of personal data protection. Domestically, China's erratic policies and political uncertainties further hurt investors’ confidence in Alibaba. In November 2020, Beijing halted Ant Group’s 34.5 billion U.S. dollars’ IPO, which was expected the be the world’s largest at the time. In the following months, China’s market regulators began investigating Alibaba and several other big techs for violating China’s anti-monopoly law. As a result of the investigation, Alibaba Group received a record 2.8 billion U.S. dollars fine.