Raynor de Best

Content expert covering payments and (crypto)currencies

Detailed statistics

Credit cards and debit cards per capita in Belgium 2010-2021

Detailed statistics

Credit cards and debit cards per capita in the Netherlands 2010-2021

Detailed statistics

Credit cards and debit cards per capita in Luxembourg 2010-2021

Market size of POS transactions in 34 countries in Europe 2019

POS transactions market size in 34 countries in Europe in 2019

Market size of B2C e-commerce in Europe 2021, by country

Online shopping market size in 25 countries in Europe in 2021

Comparison of domestic and cross-border e-commerce in Europe 2019, by country

Share of individuals who bought something online in Europe, either domestically or from abroad, in 2019, by country

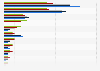

Visa, Mastercard share against domestic solutions in 14 countries in Europe 2022

Market share of international and domestic payment card schemes in 14 countries in Europe in 2022

Number of cash withdrawals in Belgium 2005-2020

Total number of cash withdrawals in Belgium from 2005 to 2020 (in millions)

Annual level of cash payments in Luxembourg 2017-2020

Share of cash estimate at point of sale (POS) in Luxembourg from 2017 to 2020

Payment card use in Luxembourg in 2020, based on volume

Distribution of total payments volume in Luxembourg in 2020

Annual level of cash payments in the Netherlands 2005-2021

Share of cash estimate at point of sale (POS) in the Netherlands from 2005 to 2021

Share of cash, debit cards and credit cards in the Netherlands in 2020, by POS

Distribution of payment methods used in selected retail environments and other purchase locations in the Netherlands in 2020

Annual credit card and debit cards issued in Belgium 2000-2022

Total number of credit cards and debit cards in circulation in Belgium from 2000 to 2022

Credit cards and debit cards per capita in Belgium 2010-2021

Number of credit cards and debit cards per capita in Belgium from 2010 to 2021

Bancontact and VISA/MasterCard transaction value in Belgium 2010-2020

Average transaction value of Bancontact and VISA/MasterCard in Belgium from 2010 to 2020 (in euros)

Credit card and debit card number in Luxembourg 2000-2022

Total number of credit cards and debit cards in Luxembourg from 2000 to 2022

Credit cards and debit cards per capita in Luxembourg 2010-2021

Number of credit cards and debit cards per capita in Luxembourg from 2010 to 2021

Debit card transaction value in Luxembourg 2006-2019

Total value of debit card transactions in Luxembourg from 2006 to 2019 (in billion euros)

Annual credit card and debit cards issued in the Netherlands 2000-2022

Total number of credit cards and debit cards in circulation in the Netherlands from 2000 to 2022

Credit cards and debit cards per capita in the Netherlands 2010-2021

Number of credit cards and debit cards per capita in the Netherlands from 2010 to 2021

Annual credit card spending in the Netherlands 2012-2022, in local currency and USD

Value of credit card transactions for payments in the Netherlands from 2012 to 2022 (in million euros, and estimates in U.S. dollars)

Contactless payment market share during COVID-19 in Belgium 2020-2021

Share of contactless payment transactions at POS (points of sale) in Belgium during the coronavirus pandemic in 2020 and 2021

Contactless payment market share during COVID-19 in the Netherlands 2020

Share of contactless payment transactions at POS (points of sale) in the Netherlands during the coronavirus pandemic in 2020

Quarterly number of contactless payments in the Netherlands 2014-2021

Total registered Near Field Communication (NFC) payments in the Netherlands from 3rd quarter 2014 to 4th quarter 2021 (in 1,000s)

Annual share of contactless in total debit payments in the Netherlands 2022-2023

Share of Near-Field Communication (NFC) transactions compared to total debit transactions in the Netherlands in 2022 and 2023

Contactless payments market share at POS in Europe 2018, by country

Share of contactless payment transactions at POS (points of sale) in selected countries in Europe in 2018

Use of wearable technology for POS payments in Europe 2019, by country

Distribution of payment transactions via wearables across selected countries in Europe in 2019

Ranking of mobile payment apps in Belgium, based on DAU 2018

Average number of daily active users (DAU) of selected mobile payment apps in Belgium in 2018

Number of Payconiq transactions in Belgium 2017-2020

Total number of Payconiq transactions in Belgium from 2017 to 2020 (in million)

Ranking of mobile payment apps in the Netherlands, based on DAU 2018

Average number of daily active users (DAU) of selected mobile payment apps in the Netherlands in 2018

Number of users of Tikkie in the Netherlands 2016-2021

Total number of users of payment app Tikkie in the Netherlands from 2016 to 2021 (in millions)

Daily active users of PayPal in 21 countries in Europe in 2019

Average number of daily active users (DAU) of the PayPal app in 21 countries in Europe in 2019

Coronavirus effect on daily active users of PayPal in Europe in 2020, by country

Average change of daily active users (DAU) of the PayPal app in 21 countries in Europe from 2019 to 2020

Leading payment methods in online retail in Belgium 2015-2019

Leading payment methods for products or services purchased online in Belgium from 2015 to 2019

Belgium, Europe and MEA e-commerce payment methods 2020

Distribution of payment methods used for e-commerce in Belgium in 2020, compared to Europe and the MEA (Middle East and Africa)

Bancontact, VISA/MasterCard and Maestro/V-Pay transactions in Belgium 2010-2020

Total number of offline and online processed card payment transactions in Belgium from 2010 to 2020, by payment scheme (in millions)

Bancontact and VISA/MasterCard transaction value in Belgium 2010-2020

Average transaction value of Bancontact and VISA/MasterCard in Belgium from 2010 to 2020 (in euros)

Most used e-commerce payment methods in Netherlands 2016-2023, with 2027 forecast

Market share of cash, credit cards, and other payment methods during online shopping in the Netherlands from 2016 to 2023, with a forecast for 2027

Leading payment methods for online shopping in the Netherlands 2016-2020

Which of the following methods do you prefer to use when you pay for a product you have bought online?

Netherlands, Europe and MEA e-commerce payment methods 2020

Distribution of payment methods used for e-commerce in the Netherlands in 2020, compared to Europe and MEA (Middle East and Africa)

Annual number of transactions with A2A scheme iDEAL in the Netherlands 2006-2023

Total number of A2A payment transactions processed with iDEAL in the Netherlands from 2006 to 2023

Payment cards issued with an e-money function in Belgium 2000-2020

Total number of payment cards issued with an e-money function in Belgium from 2000 to 2020 (in 1,000s)

Number of payments per capita in Belgium 2010-2020, by type of payment service

Number of payments per capita in Belgium from 2010 to 2020, by type of payment service

Annual number of e-money transactions in the Netherlands 2000-2021

Number of e-money purchase transactions in the Netherlands from 2000 to 2021 (in millions)

Number of payments per capita in Netherlands 2010-2020, by type of payment service

Number of payments per capita in the Netherlands from 2010 to 2020, by type of payment service

Annual number of e-money transactions in Luxembourg 2000-2021

Number of e-money purchase transactions in Luxembourg from 2000 to 2021 (in millions)

Number of payments per capita in Luxembourg 2010-2020, by type of payment service

Number of payments per capita in Luxembourg from 2010 to 2020, by type of payment service

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)