The company ranked within the fifteen most valuable brands across all industries in 2023. Tesla continued to break records in 2023, with its vehicle deliveries reaching a record 1.8 million units in 2023. This global presence contributes to the company’s financial performance, though Tesla remains reliant on its domestic market.

Financial performance boosted by the U.S. market

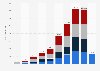

Tesla recorded a net income in 2020 and has reported considerable year-over-year growth since then, despite an increasing cost of revenues. At over 78.5 billion U.S. dollars in revenue, Tesla's automotive sales represent the core of Tesla’s business activities. The manufacturer has been steadily increasing its research and development expenses, investing in fields such as artificial intelligence and connected vehicles.To round up its 2023 performance, Tesla also became the North American Charging Standard as many of its competitors committed to using its fast-charging connectors. The company has been incrementing its Supercharger network, which should soon be open to a wider range of electric vehicles and therefore a broader range of customers. This is not the only way in which the United States remained Tesla's most important target market: Tesla was also among the ten manufacturers with the largest market share of the U.S. automotive market.

Increased competition from Chinese automakers

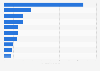

Tesla’s reliance on its domestic market can be contextualized by increasing global competition. Chinese manufacturers are closing the gap between them and the U.S. electric vehicle giant, partly due to the size of China’s EV market. After years of topping the best-selling EV brand ranking, Tesla was overtaken by BYD in 2022, and the Asian automaker widened this gap in 2023, selling over one million EV more than Tesla.Tesla's success is also helping boost EV popularity in the U.S., increasing competition in its domestic market. Encouraged by Tesla's global performance, startups such as Rivian, Lucid Motors, and Canoo entered the U.S. electric vehicle market. Though the market is booming, these companies face profitability challenges: Lucid Motors reported a net loss of approximately 2.8 billion U.S. dollars in 2023.