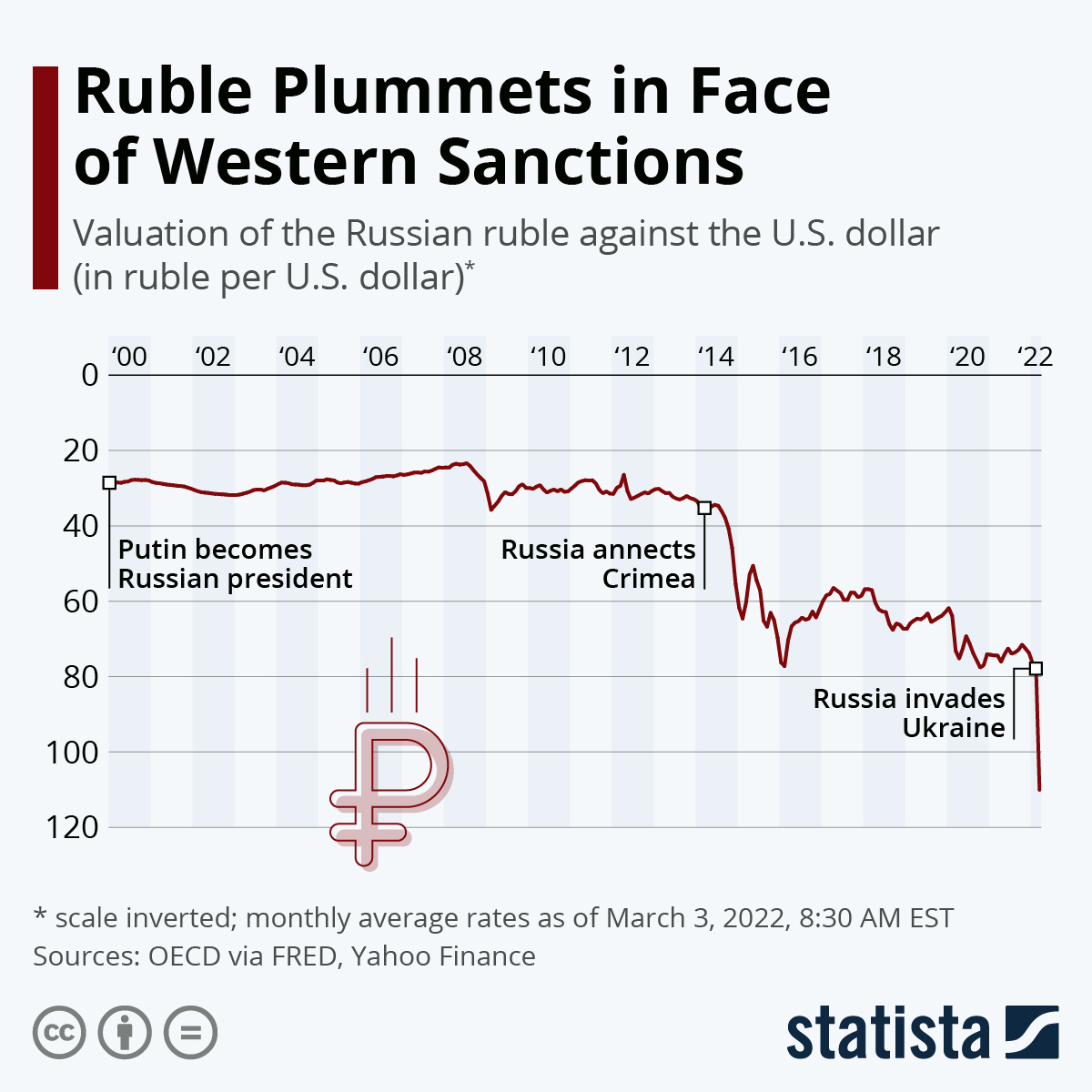

Following the joint announcement of further economic sanctions against Russia made by Western leaders on Saturday, the Russian financial system was shaken to its core on Monday. In response to the most severe sanctions yet, the ruble’s value crashed to historical lows against the dollar, trading as low as 119 rubles per dollar on Thursday morning before making up some lost ground. For reference, the ruble stood at roughly 30 rubles per dollar when Putin first became Russian president in 2000 and at 60 rubles per dollar before the Covid crisis hit in early 2020.

On Saturday, leaders of the European Union, France, Germany, Italy, the UK, Canada and the United States had announced a new set of sanctions designed to “impose costs on Russia that will further isolate Russia from the international financial system and our economies.” Aside from removing selected Russian banks from the SWIFT messaging system, effectively cutting off the country’s access to the international financial system, the Western allies also announced measures that will “prevent the Russian Central Bank from deploying its international reserves in ways that undermine the impact of our sanctions.” The latter move in particular is seen as a significant blow to Russia, as it directly targets the country’s war chest, i.e. its $630 billion stockpile of international reserves.

In an attempt to shore up the ruble in face of the latest sanctions, the Bank of Russia raised its key interest rate from 9.5 to 20 percent on Monday while also ordering companies to sell 80 percent of their foreign currency revenues and banning nonresidents from selling Russian securities. The swiftness and severity of the sanctions imposed against Russia has left many commentators surprised, and while they are all but certain to cripple the country’s economy, the Russian people will also pay a heavy price, as the threat of hyperinflation looms large over the now isolated country.