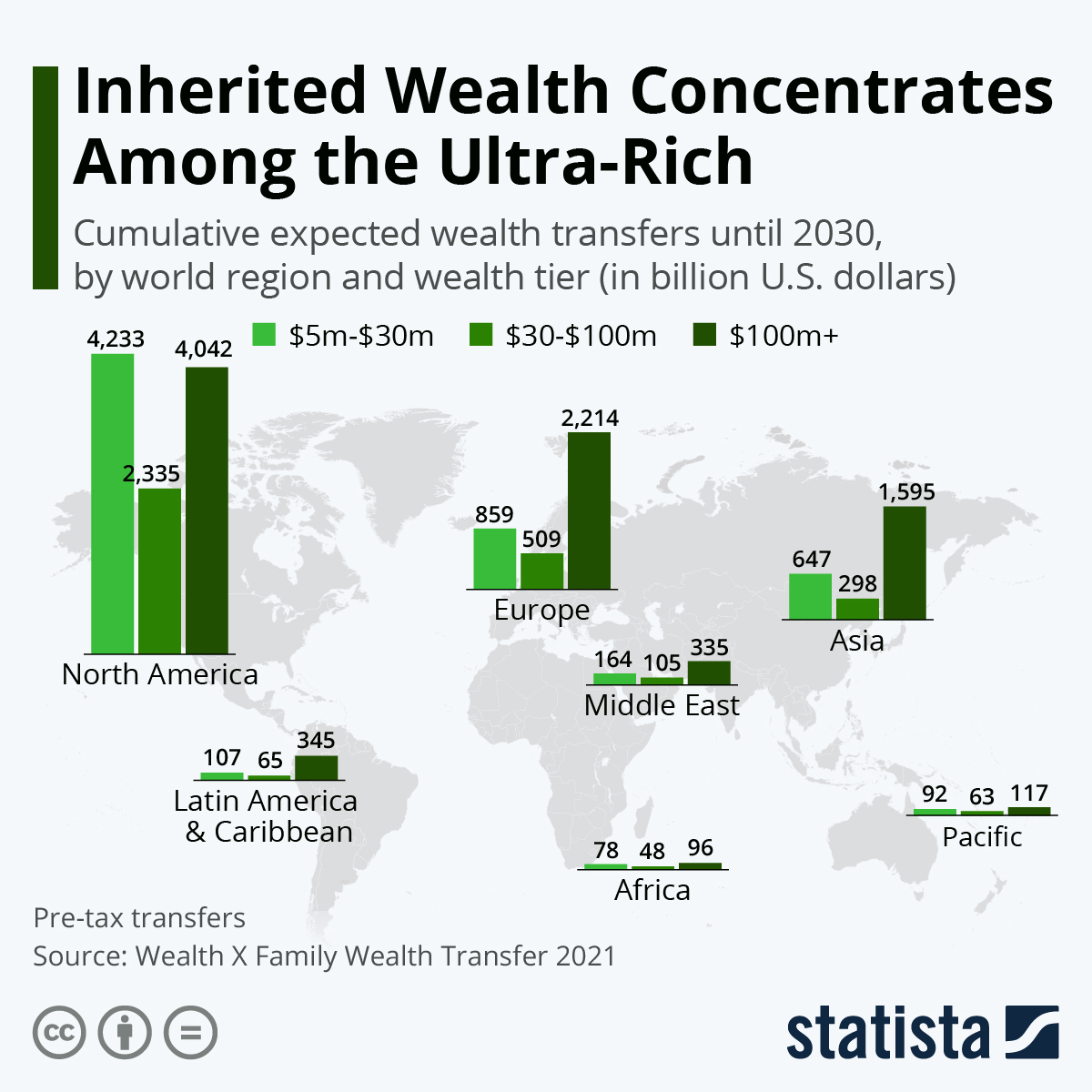

The ultra-rich are wealthier than any mere mortal could ever imagine. Looking at how much wealth they are expected to pass on to the next generation until 2030 drives home this point. A whopping 60 percent of the total pre-tax wealth that is expected to be handed down in this time frame will come from North American countries. Due to favorable inheritance tax rules, U.S. heirs are among those who will be able to keep more of their handed-down wealth than those living in other places, an aspect further contributing to the accumulation of wealth among America’s richest.

A recent report by Wealth X defines individuals with a net worth of $5 million to $30 million as high-net worth individuals and those with $30 million or more to their name as ultra-high net worth people. But there is an even more exclusive subset of these UHNWI: individuals with $100 million or more in net worth. These play an outsized part in intergenerational wealth transfers in the U.S. and around the world.

Despite being small in numbers, ultra-ultra-high-net-worth individuals are responsible for upwards of 60 percent of the projected wealth transfers in Europe and Asia each. This is despite the fact that on both of these continents, the number of those who have $100 million or more to their name and are expected to pass it on soon is only around 4-5 percent of all millionaires and billionaires examined for the study.

The picture is somewhat different in the United States, where 2.7 percent of the study’s millionaires and billionaires sit at the very top of the food chain and will be responsible for 38 percent of passed-on wealth on the continent by 2030.

The size of intergenerational wealth transfers in the study are given on a pre-tax basis. Therefore, the cut paid to the government varies depending on location. U.S. heirs can count on keeping a bigger share because of their country’s flat inheritance tax rate of 40 percent, high exemption thresholds and the favorable treatment of both family and non-family recipients. As a result, many heirs are able to keep 100 percent of their inherited wealth in the U.S.

These wealth-positive U.S. laws also reflect in the fact that inheritance, estate and gift tax revenues in the country are just slightly above the OECD average, despite the much larger concentration of wealth in United States.

The United States' flat inheritance tax rate of 40 percent is actually the fifth-highest maximum rate in the OECD for family inheritance. However, the exemption threshold in the U.S. is many times higher than elsewhere within the organization of developed nations - at a whopping $11.6 million for children, for example. This compares to exemptions of only $1.1 million in Italy, $640,000 in the UK or just around $18,000 in Spain. In contrast to the U.S., many European countries start inheritance taxation at much lower sums and also at lower rates, increasing those rates progressively as estate sizes grow.

While in European countries like Germany, France and the UK, the share of wealth held by the top 1 percent steadily decreased since the beginning of the 20th century and only started to rise again in the late 1990s, the wealth held by the top 1 percent in the U.S. has been rising again since 1975, reaching 1940s levels as early as 2015.

Overall, a quarter of the global HNWI and UHNWI populations is expected to pass on their wealth by 2030. Many of these individuals come from the U.S. and Europe, while many millionaires in Asia are younger and are expected to pass on their wealth at a later date.