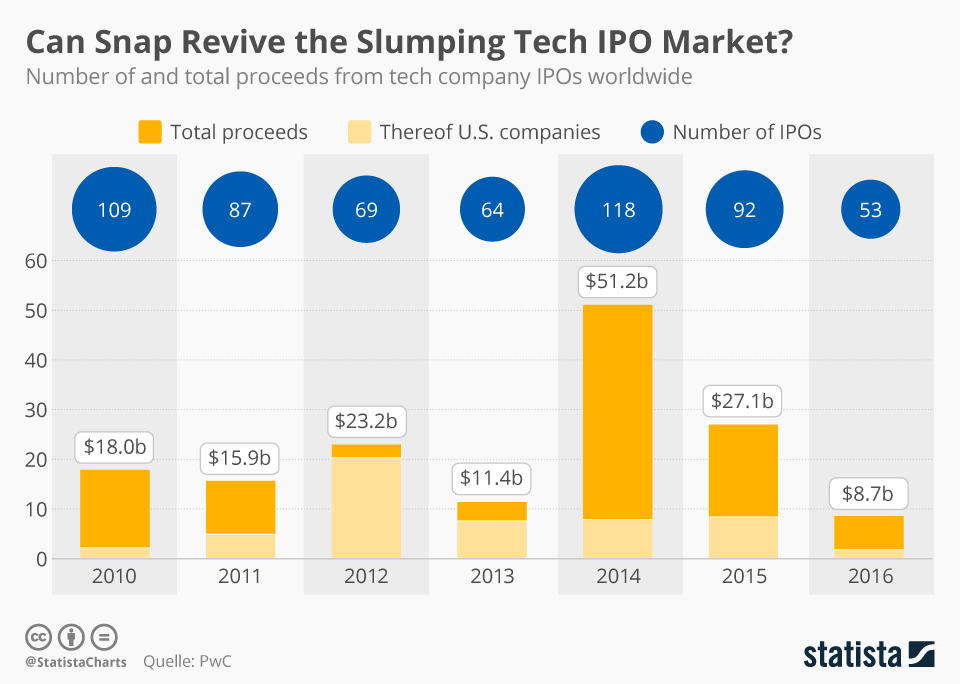

Today’s IPO of Snap marks the largest tech company IPO since Alibaba made its stock market debut in 2014. The parent company of Snapchat raised $3.4 billion at a $24 billion valuation, thereby single-handedly beating the 2016 total for U.S. tech company IPOs.

As our chart illustrates, 2016 was a very slow year for tech IPOs in the U.S. and internationally. Both in terms of IPO proceeds and the number of offering, the past year marked the worst in the current decade. A weak stock market at the beginning of the year combined with uncertainty over political developments (Brexit, U.S. election) made for an unfavorable climate for IPOs, which caused many startups to hold off on going public.

If Snap’s IPO goes well, it could jumpstart the IPO market, as other IPO candidates might take the plunge themselves after Snap tested the waters.

Can Snap Revive the Slumping Tech IPO Market?

IPO market