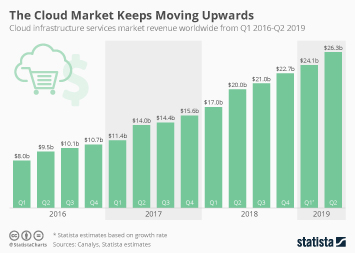

Over the past few years, as more and more IT services were moved to the cloud, the market for cloud infrastructure services grew manifold. According to Synergy Research, cloud infrastructure service revenues jumped $90 billion to $419 billion last year, an almost ninefold increase since 2017. And while the market's growth had gradually and naturally slowed to just below 20 percent in 2023, the rise of generative AI and the corresponding cloud computing needs have led to a re-acceleration of growth in 2024 and 2025 - which is remarkable given the market's size. Last year, the global cloud market grew at a rate of 27 percent, which is the highest since 2022.

“GenAI has simply put the cloud market into overdrive," John Dinsdale, chief analyst at Synergy Research Group said in a statement. "AI-specific services account for much of the growth since 2022, but AI technology has also enhanced the broader portfolio of cloud services, driving revenue growth across the board." Dinsdale added.

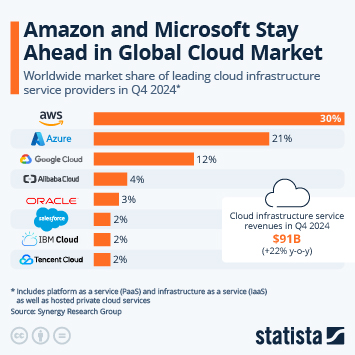

In terms of market share, Amazon (AWS) and Microsoft (Azure) remain the market leaders, with Amazon alone accounting for 28 percent of cloud infrastructure revenue in the most recent quarter. Considering that it's a $400-billion market, this means that Amazon's cloud arm rakes in more than $100 billion in revenue per year. And this is high-margin revenue: In 2025, AWS generated $45.6 billion in operating profit, accounting for almost 60 percent of Amazon's total operating profit.