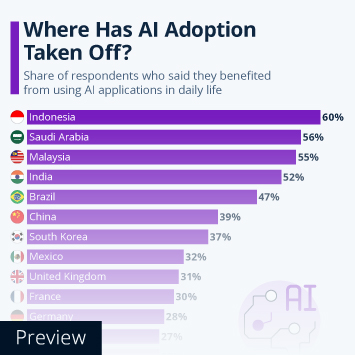

India hosts the AI Impact Summit 2026 from February 16 to 21. The event, which gathers global industry leaders and policymakers, draws international attention and highlights India's growing influence in the artificial intelligence sector, as well as its ability to attract significant investments.

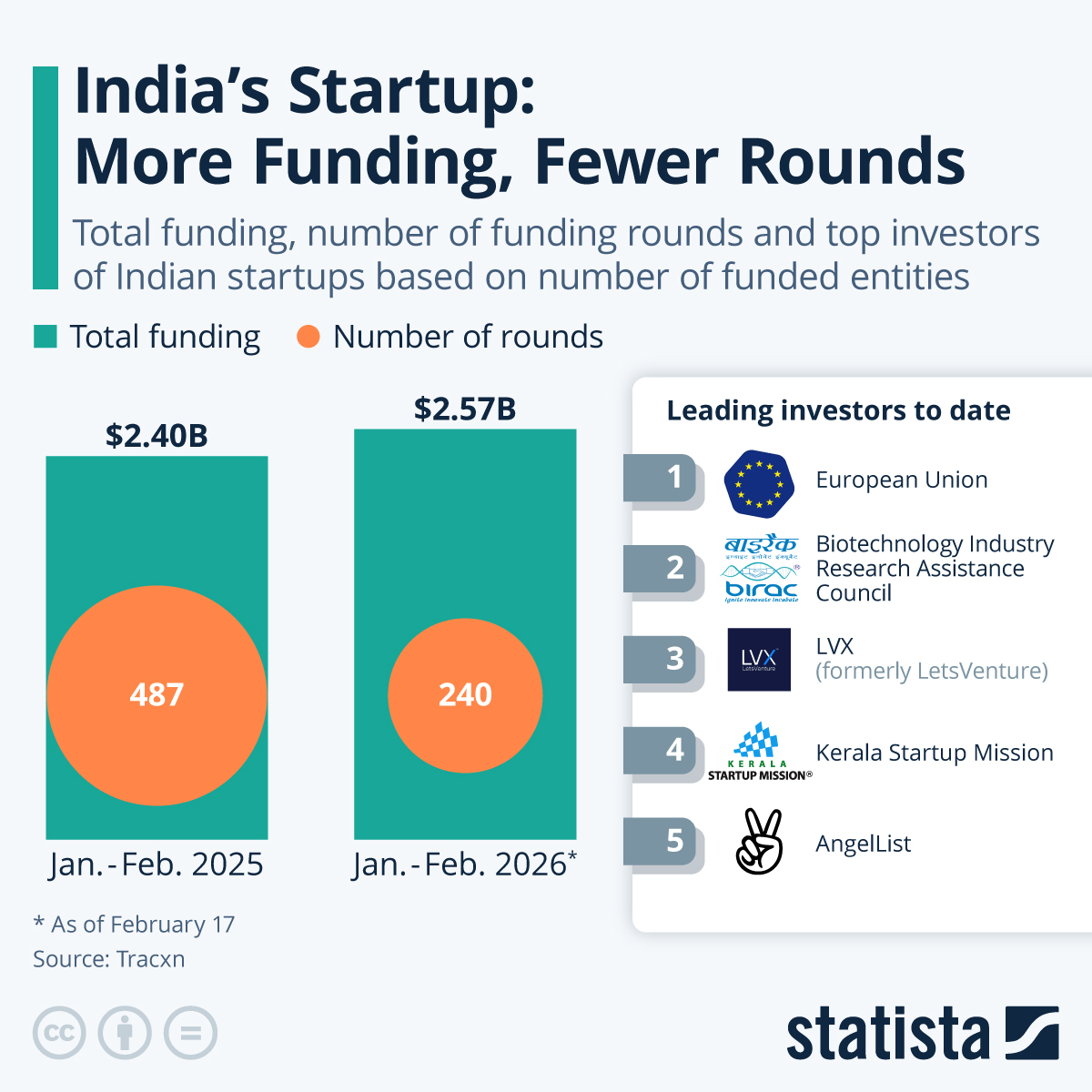

Recent data from Tracxn reveals the India's startup ecosystem is undergoing a notable shift, with a growing total fund value, but fewer investment rounds, reflecting a more selective funding environment. As our infographic shows, Indian startups raised a total of $2.57 billion in funding between January 1 and February 17, 2026, a slight increase (+5 percent) from the $2.40 billion raised during the same period in 2025. At the same time, the number of funding rounds has dropped sharply, from over 480 to 240, indicating a trend toward larger, more concentrated investments. This suggests that investors are focusing on fewer, high-potential startups rather than spreading capital across a broader range of early-stage ventures.

The chart also highlights the key players in the Indian startup investment landscape. According to Tracxn, the European Union is the top investor group based on the number of funded companies, while the Biotechnology Industry Research Assistance Council of India (BIRAC), LVX (formerly LetsVenture), the Kerala Startup Mission and AngelList (from the United States) are among the other leaders. These institutions are not only providing capital but also fostering innovation and growth in India's AI and biotech sectors. Notable recent funding rounds include substantial investments in AI-driven healthcare platforms and advanced biotech research initiatives, reflecting the country's strategic focus.