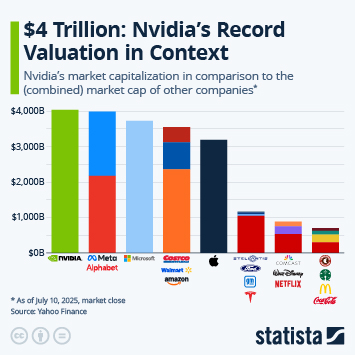

Even though it didn't always feel that way and investors faced many question marks along the way, the S&P 500 ended a volatile 2025 with another double-digit gain, the third in a row. At the end of December, the index was up 16.4 percent for the year, way above the 10.7-percent average gain it recorded annually since 1980. After a terrible start to the year, which saw the S&P 500 slip 4.6 percent in Q1 2025 before things turned really ugly around President Trump's "Liberation Day" tariff announcements in early April, stocks quickly rebounded on hopes of tariff reprieve, recovering their first-quarter losses before the end of Q2. In the second half of the year, the index remained on an upward trajectory, interrupted by bouts of volatility as investors grappled with concerns over a potential AI bubble. This resulted in some sharp swings of mega-cap tech and AI stocks, which moved along with any shift in sentiment about the staying power of AI. And despite AI bellwether Nvidia beating expectations time and time again and ending the year up 39 percent, AI exuberance now comes with an extra dose of skepticism sprinkled in.

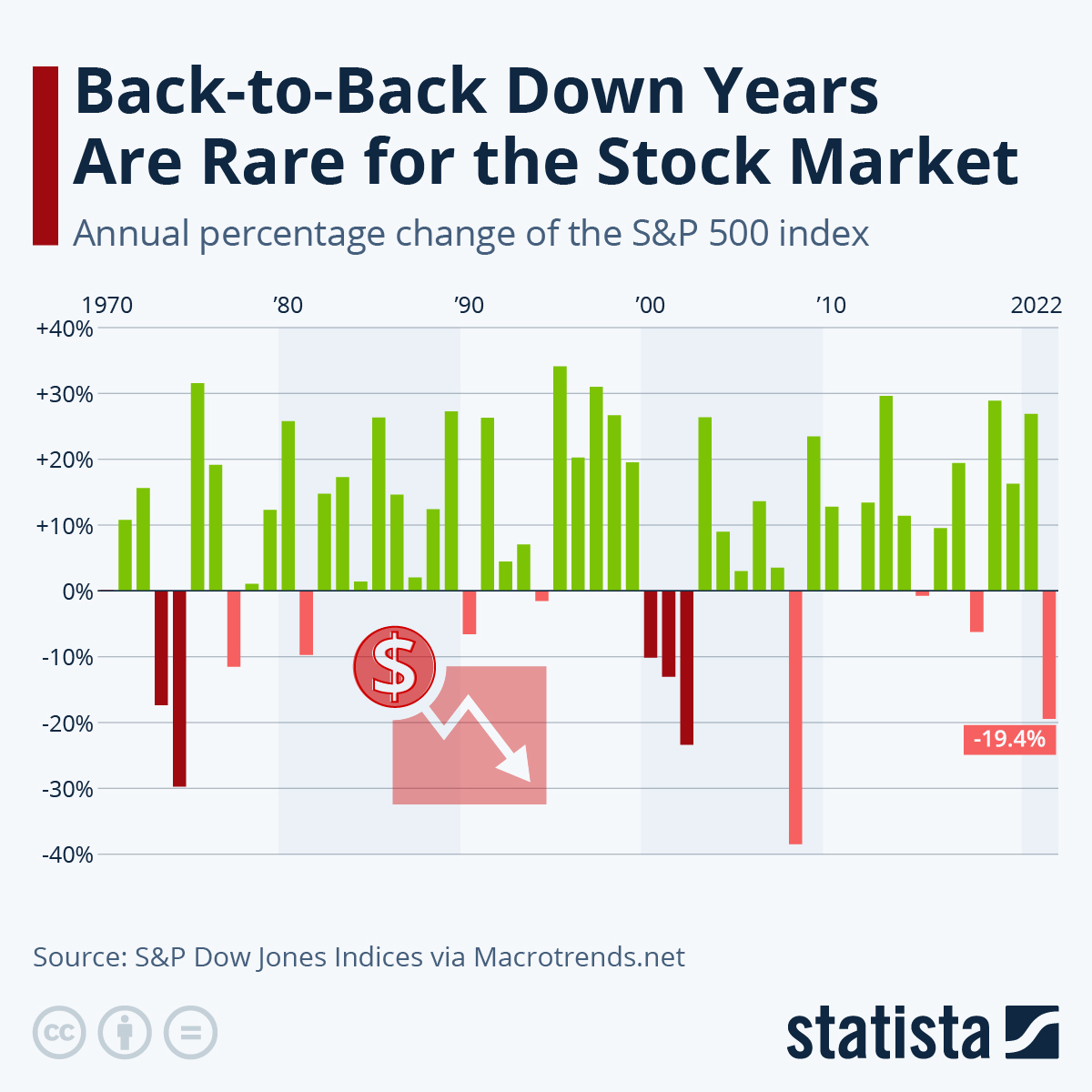

While 2025 marked the sixth year of double-digit gains in the past seven years for the S&P 500, such returns shouldn’t be taken for granted. In fact, 2023 and 2024 were the first back-to-back years where the S&P 500 gained more than 20 percent in two and a half decades. From 1995 to 1998, the index even clocked four consecutive years of 20+ percent gains plus another 19.5-percent increase in 1999. That long-time rally was followed by the bursting of the dot-com bubble in 2000, however, which resulted in three consecutive down years of the S&P 500.

Thankfully, back-to-back down years are a very rare occurrence, as our chart shows. According to Macrotrends.net, the S&P 500 has only seen consecutive years of negative returns three times since 1957, in 1973/1974 and in 2001/2002/2003 with returns getting worse in the second (and third) down year on each of those occasions. Since 1957, the S&P 500 has ended the year in the red 18 times including 2022. 15 times out of 18, the index returned to growth the next year.