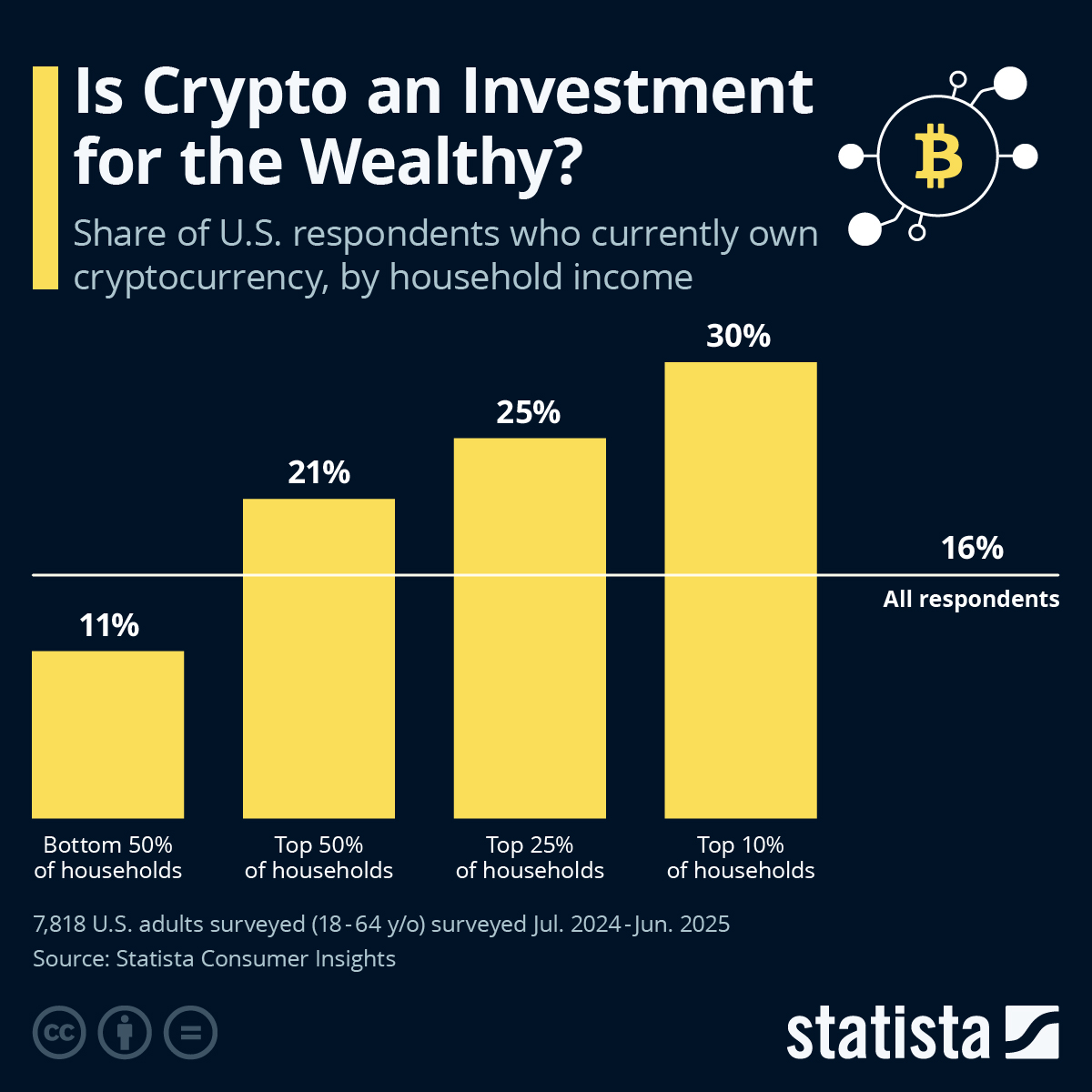

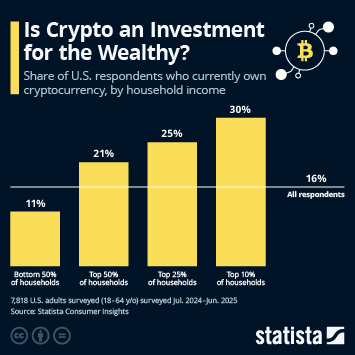

In theory, Bitcoin and other cryptocurrencies are accessible to anyone with an internet connection and enough dollars to spare to buy a fraction of a coin. And yet, like other investments, crypto ownership is far more common among the wealthy.

According to Statista Consumer Insights, roughly one in six U.S. adults owns cryptocurrency, up from just six percent five years ago. As our chart shows, crypto ownership is not distributed equally, though, with respondents from households in the top 10 percent income bracket almost three times as likely to own Bitcoin or other cryptocurrency as respondents from the bottom 50 percent in terms of household income.

The reasons for this are relatively simple: not only do high-income or high-net-worth individuals have more money to invest, but they’re also more risk tolerant, which is an important trait for any investor, but even more so for crypto investors given the volatility of many cryptocurrencies. Instead, smaller investors with limited capital and low risk tolerance may favor more traditional investment instruments over the highly speculative and relatively unproven nature of crypto.