Stacy Jo Dixon

Research expert covering social media usage worldwide

Detailed statistics

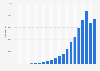

Meta: annual revenue 2009-2023, by segment

Detailed statistics

Meta: annual advertising revenue worldwide 2009-2023

Detailed statistics

Meta: annual net income 2018-2023

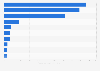

Most used social networks 2024, by number of users

Most popular social networks worldwide as of April 2024, by number of monthly active users (in millions)

Social media: global penetration rate 2024, by region

Global social network penetration rate as of April 2024, by region

Leading social media usage reasons worldwide 2023

Most popular reasons for internet users worldwide to use social media as of 4th quarter 2023

Media usage in an online minute 2023

Media usage in an internet minute as of December 2023

Meta: annual revenue 2009-2023

Annual revenue generated by Meta Platforms from 2009 to 2023 (in million U.S. dollars)

Meta: annual revenue 2009-2023, by segment

Annual revenue generated by Meta Platforms from 2009 to 2023, by segment (in million U.S. dollars)

Meta: annual advertising revenue worldwide 2009-2023

Annual advertising revenue of Meta Platforms worldwide from 2009 to 2023 (in million U.S. dollars)

Meta: annual marketing expenditure worldwide 2010-2023

Annual marketing and sales costs of Meta Platforms from 2010 to 2023 (in million U.S. dollars)

Meta annual ad spend 2014-2023

Annual advertising expense of Meta Platforms from 2014 to 2023 (in million U.S. dollars)

Meta: annual EBIT 2008-2023

Annual EBIT generated by Meta Platforms from 2008 to 2023 (in million U.S. dollars)

Meta: annual net income 2018-2023

Annual net income generated by Meta Platforms from 2008 to 2023 (in million U.S. dollars)

Meta: worldwide quarterly revenue 2011-2024

Global revenue generated by Meta Platforms from 4th quarter 2011 to 1st quarter 2024 (in million U.S. dollars)

Meta: worldwide quarterly revenue 2020-2024, by segment

Global revenue generated by Meta as of 1st quarter 2024, by segment (in million U.S. dollars)

Meta: quarterly net income 2010-2024

Net income generated by Meta Platforms from 2nd quarter 2010 to 1st quarter 2024 (in million U.S. dollars)

Meta top executive compensation 2011-2023

Compensation of Meta Platforms leading executive officers from 2011 to 2023 (in million U.S. dollars)

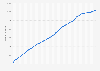

Meta: number of employees 2004-2023

Number of full-time Meta Platforms employees from 2004 to 2023

Market value of the largest internet companies worldwide 2023

Market capitalization of the largest internet companies worldwide as of August 2023 (in billion U.S. dollars)

Market capitalization of the largest U.S. internet companies 2024

Market capitalization of the largest U.S. internet companies as of February 2024 (in billion U.S. dollars)

Biggest revenue source of leading tech companies 2023

Biggest revenue source of leading online and tech companies in most recently reported quarter ending June 2023

Workforce of leading global online companies 2014-2023

Number of employees of leading internet companies worldwide from 2014 to 2023

Internet companies ranked by revenue 2017-2023

Leading online companies ranked by revenue from 2017 to 2023 (in billion U.S. dollars)

Social media platform usage for Gen Z and global users 2023

Most used social media platforms among Gen Z and internet users worldwide as of September 2023

Most well-known messenger services in the United States 2023

Leading messenger services ranked by brand awareness in the United States in 2023

Meta: monthly active product family users 2023

Cumulative number of monthly Meta product users as of 4th quarter 2023 (in billions)

Meta: daily active people (DAP) 2018-2024

Cumulative number of daily Meta product users as of 1st quarter 2024 (in billions)

Meta: average revenue per user 2011-2023

Average revenue per user (ARPU) of Meta Platforms from 2011 to 2023 (in U.S. dollars)

Facebook: quarterly number of MAU (monthly active users) worldwide 2008-2023

Number of monthly active Facebook users worldwide as of 4th quarter 2023 (in millions)

Facebook: number of daily active users worldwide 2011-2023

Number of daily active Facebook users worldwide as of 4th quarter 2023 (in millions)

Countries with the most Instagram users 2024

Leading countries based on Instagram audience size as of January 2024 (in millions)

Meta: annual Reality Labs revenue 2019-2023

Annual revenue generated by Meta Reality Labs segment from 2019 to 2023 (in million U.S. dollars)

Meta: annual Reality Labs operating income/loss 2019-2023

Annual operating loss generated by Meta Reality Labs segment from 2019 to 2023 (in million U.S. dollars)

XR headset vendor shipment share worldwide 2020-2023, by quarter

Extended reality (XR) headset vendor shipment share worldwide from 2020 to 2023, by quarter

Comparison of VR headsets worldwide 2024, by price

Comparison of virtual reality (VR) headsets worldwide in 2024, by price (in U.S. dollars)

Meta Quest mobile app global downloads 2018-2023

Number of downloads of the Meta Quest mobile app worldwide from 2018 to 2023 (in millions)

Threads: quarterly global MAUs Q2 2024

Number of monthly active Threads users worldwide as of 2nd quarter 2024 (in millions)

Global Threads sign-ups 2023

Number of Threads sign-ups worldwide as of July 10, 2023 (in millions)

Threads app: source of social media mentions 2023

Platforms and online spaces where users worldwide mentioned social media app Threads as of July 2023

Threads app: number of social media mentions 2023, by sentiment

Number of mentions of social media app Threads on online platforms worldwide as of July 2023, by user sentiment

Threads app download share worldwide 2023

Share of downloads of social media app Threads worldwide as of July 12, 2023

Threads: global daily time spent 2023

Average daily time spent on Threads worldwide as of July 2023 (in minutes)

U.S. Gen Z reasons for downloading Threads 2023

Reasons for downloading social media app Threads according to Generation Z in the United States as of July 2023

Threads global app downloads 2024

Number of Threads app downloads worldwide from July 2023 to March 2024 (in millions)

U.S. adults willing to pay for ad-free versions of Meta products 2023, by generation

Share of adults in the United States on monthly amount they would be willing to pay for an advert-free version of Facebook and/or Instagram as of November 2023, by generation

U.S. Facebook and Instagram signup interest in Meta Verified 2023, by age group

Share of Facebook and Instagram users in the United States who are likely to sign up for Meta Verified as of March 2023, by age group

U.S. adults positive opinion of Facebook after Trump ban lifted 2023

Share of adults in the United States who trust in and have a favorable impression of Facebook after Meta announced the lifting of Donald Trump ban between January 8 and February 5, 2023

Relevance of digital ads to Facebook users in the U.S. 2022-2023

Perceived relevance of digital advertising to Facebook users in the United States in 2022 and 2023

U.S. adults who have a favorable impression of Facebook 2022

Share of adults in the United States who have a favorable impression of Facebook as of May 2022

U.S. adults who have a favorable impression of Facebook 2022, by age group

Share of adults in the United States who have a favorable impression of Facebook as of May 2022, by age group

U.S. adults who have a favorable impression of Facebook 2022, by gender

Share of adults in the United States who have a favorable impression of Facebook as of May 2022, by gender

Global adults on knowledge of the metaverse 2023

Share of adults who know about the metaverse worldwide as of May 2023

Global adults knowledge of the metaverse 2023, by age group

Share of adults who know about the metaverse worldwide as of May 2023, by age group

U.S. adults brands most associated with the metaverse 2022

Brands most associated with the metaverse according to adults in the United States as of January 2022

U.S. adults descriptions of the metaverse 2022

Most accurate descriptions of the metaverse according to adults in the United States as of January 2022

Global interest in metaverse experiences 2022, by generation

Share of adults worldwide who are interested in trying select types of metaverse experiences as of February 2022, by generation

U.S. adults who have heard of Horizon Worlds 2022

Share of internet users in the United States who have heard about Horizon Worlds as of March 2022

Global active users of Meta Horizon Worlds VR platform 2022

Number of active Meta Horizon Worlds users worldwide as of October 2022 (in 1,000s)

Mon - Fri, 9am - 6pm (EST)

Mon - Fri, 9am - 5pm (SGT)

Mon - Fri, 10:00am - 6:00pm (JST)

Mon - Fri, 9:30am - 5pm (GMT)

Mon - Fri, 9am - 6pm (EST)