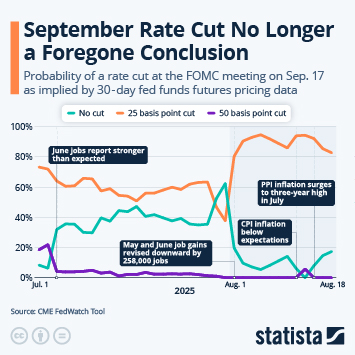

Despite a shutdown-related lack of up-to-date labor market and inflation data, the Federal Open Market Committee decided to cut its key policy rate by 25 basis points on Wednesday. After having kept rates unchanged for the first nine months of 2025, the latest decision marks the third cut in as many meetings, bringing the target range for the federal funds rate to 3.50-3.75 percent for the time being, down from a peak of 5.25-5.50 percent from July 2023 to September 2024. The Fed's projections, which are based on the individual opinions of the 19 committee members, signaled a slightly more cautious approach going forward, suggesting just one 25-point cut for 2026 and another one in 2027. However, there is an unusually high degree of dissent within the committee on the right policy path ahead, as both of the Fed's policy goals - maximum employment and 2 percent inflation - are currently in tension.

"There is no risk-free path for policy as we navigate this tension between our employment and inflation goals," Fed Chairman Jerome Powell said at the post-meeting press conference on Wednesday, acknowledging that it's a "challenging situation." Over the past year, Powell had repeatedly warned that the two goals of the Fed may end up in tension - a scenario that leaves policymakers stuck in two minds as cooling inflation would require higher rates while supporting the labor market calls for lower rates. While inflation remains elevated compared to the Fed's 2-percent goal, the most recent available data suggests that the labor market has cooled off significantly, with job additions slowing to a near halt. And while unemployment remains relatively low in historical terms, the unemployment rate has gradually ticked up from 3.4 percent in April 2023 to 4.4 percent in September 2025.

Ultimately, the Fed officials decided that the downside risks to employment outweigh the inflation risk for now, as they assume that the inflationary effect of tariffs on prices will be short-lived. "With today’s decision, we have lowered our policy rate three quarters of a percentage point over our last three meetings," Jerome Powell concluded. "This further normalization of our policy stance should help stabilize the labor market while allowing inflation to resume its downward trend toward 2 percent once the effects of tariffs have passed through."