When Covid-19 hit the United States with full force in early 2020, thousands of businesses were forced to shut down, millions of Americans lost their jobs within weeks and, as a result, U.S. gross domestic product plummeted by an unprecedented 28 percent in Q2 2020. At the time, there was a lot of uncertainty over how quickly the economy would bounce back, but now, almost four years later, it can safely be said that the recovery has been nothing short of impressive.

After total nonfarm employment returned to its pre-pandemic level in June 2022, the labor market has remained remarkably strong until now, despite the Fed's best efforts to cool it down to tame inflation. More importantly though, the economy as a whole has also returned to its pre-pandemic growth trajectory, as consumer spending has proven surprisingly robust throughout the post-Covid recovery and the ensuing inflation crisis. According to the second estimate of Q4 and full-year 2023 GDP released by the U.S. Bureau of Economic Analysis (BEA) on Wednesday, real GDP grew 2.5 percent in 2023, re-accelerating from 1.9 percent in 2022 despite the Fed's restrictive policy stance.

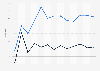

As the following chart illustrates, Covid-19 did put a dent in U.S. economic growth but, thanks at least in part to generous stimulus spending in the early phase of the pandemic, it didn't throw it off its trajectory permanently. Measured in chained 2017 dollars, U.S. GDP amounted to $22.37 trillion in 2023, up 8.1 percent from 2019, the last year unaffected by the pandemic. That equates to an average real GDP growth rate of 2.0 percent over the past four years, which is quite remarkable considering the global circumstances under which this growth was achieved.