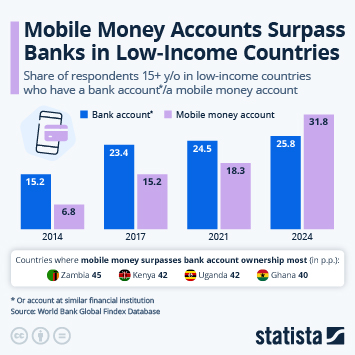

Data by the World Bank shows that mobile money accounts are elevating saving in many low and middle-income countries. Overall, 13 percent of people over the age of 15 in low-income countries said in 2024 that they had saved money using a traditional bank account or similar product. This rose to almost 28 percent when also including saving via mobile money accounts. 55 percent in these countries said they had saved any money in 2024.

In comparison, mobile money accounts make less of a difference in middle income countries, where the rates in question were 21 percent and 26 percent for lower middle income, and 54 and 55 percent for upper middle income, respectively.

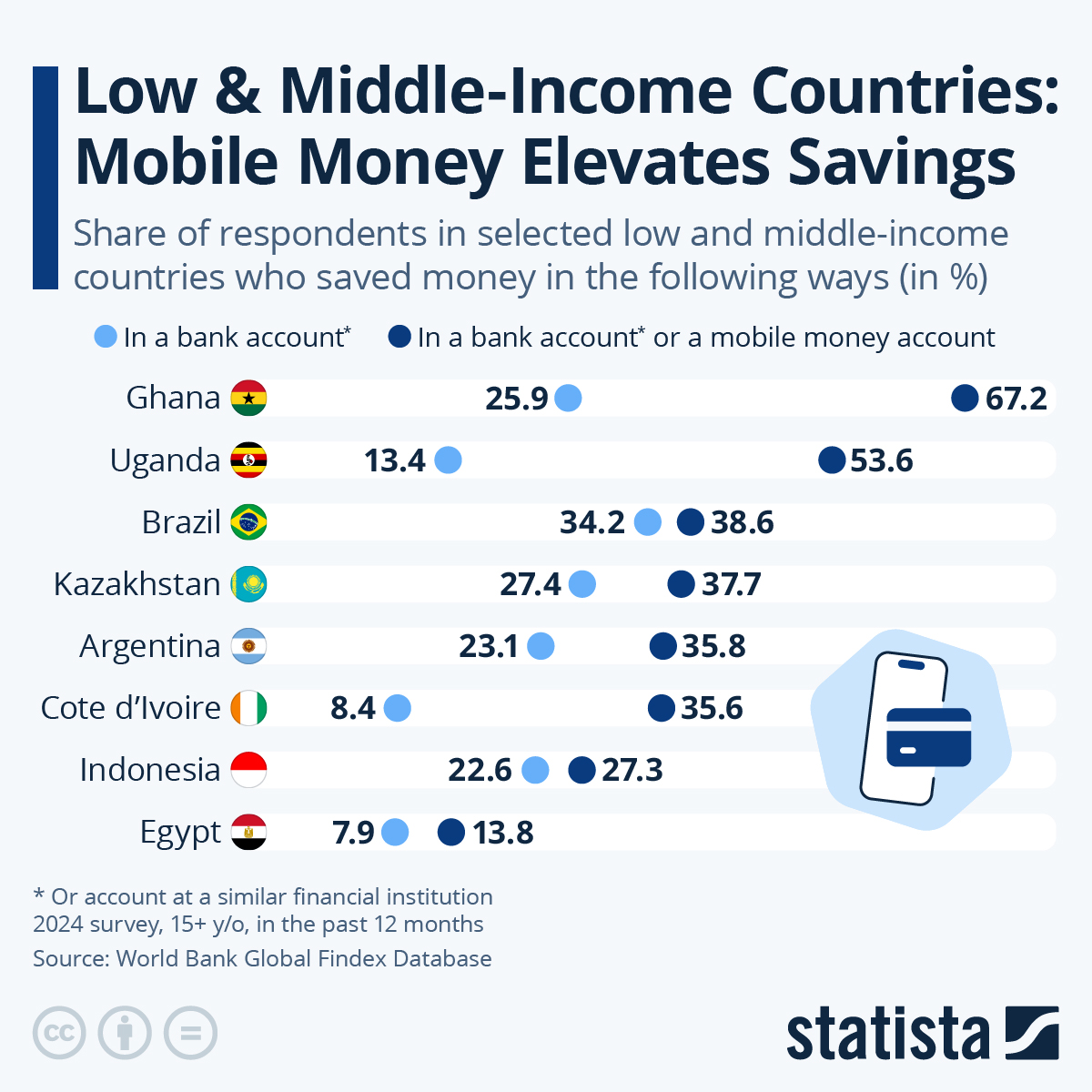

However, the findings differ from country to country and mobile money is making a difference even in relatively richer nations in financial crisis situations. In 2024, almost 36 percent of Argentinians said they saved money via a bank or mobile money application, while traditional bank account saving stood only at 23 percent. In neighboring Brazil, mobile money accounts only elevated savings rates by a couple of percentage points.

The biggest increases due to mobile money saving could be seen in African countries like Ghana or Uganda, among others. In Kazakhstan, the savings rate including mobile money was more than 10 percentage points higher than just the traditional bank rate, while this number was around 6 percent in Egypt and 5 percent in Indonesia.