Founded in 1989 as a business intelligence software company, MicroStrategy made its name providing analytics tools to enterprises worldwide. In 2020, under the leadership of co-founder Michael Saylor, the company took an unprecedented turn: it began using its corporate treasury to buy Bitcoin. Over time, this bold pivot became its defining focus, and in 2025 the company rebranded as Strategy Inc., signaling its evolution from a pure software vendor to a hybrid of technology firm and Bitcoin holding company.

Strategy’s playbook is simple but aggressive: acquire as much Bitcoin as possible, often by issuing convertible debt or selling equity, and hold it for the long term. Because Bitcoin’s price has appreciated dramatically since the company began its accumulation in August 2020, Strategy’s market capitalization has surged along with the value of its Bitcoin holdings. This positive feedback loop - rising Bitcoin prices boosting the company’s share price, enabling it to raise more capital to buy more Bitcoin - has led some observers to call Strategy’s strategy an “infinite money glitch.”

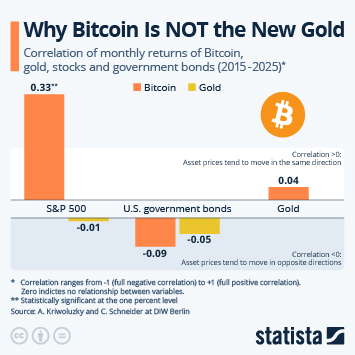

While it has clearly worked for the past five years - Strategy’s share price is up 3,500 percent since August 2020 as its Bitcoin holdings have appreciated by roughly $30 billion - the strategy is not without risk. Bitcoin’s price is famously volatile and a significant downturn could sharply erode both Strategy’s balance sheet and investor confidence. Moreover, the company’s reliance on debt to fuel purchases adds financial leverage, magnifying both gains and losses. In essence, Strategy Inc., which currently holds three percent of all Bitcoin that has ever existed, has tethered its fortunes to the future of the cryptocurrency - a bet that could continue to pay off spectacularly or unravel just as dramatically.