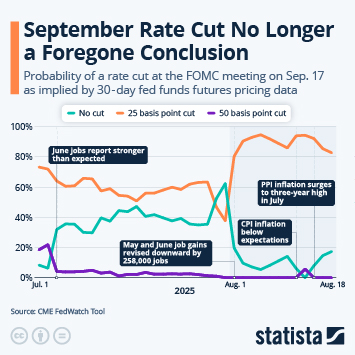

Following last week’s CPI report, which showed no signs of a steep, tariff-induced inflation resurgence, investors were all but certain that a rate cut was imminent. According to the CME FedWatch tool, markets priced in a zero percent chance of the Fed keeping rates where they are at its September meeting the day after, while the chances of a 25-point cut climbed to almost 95 percent.

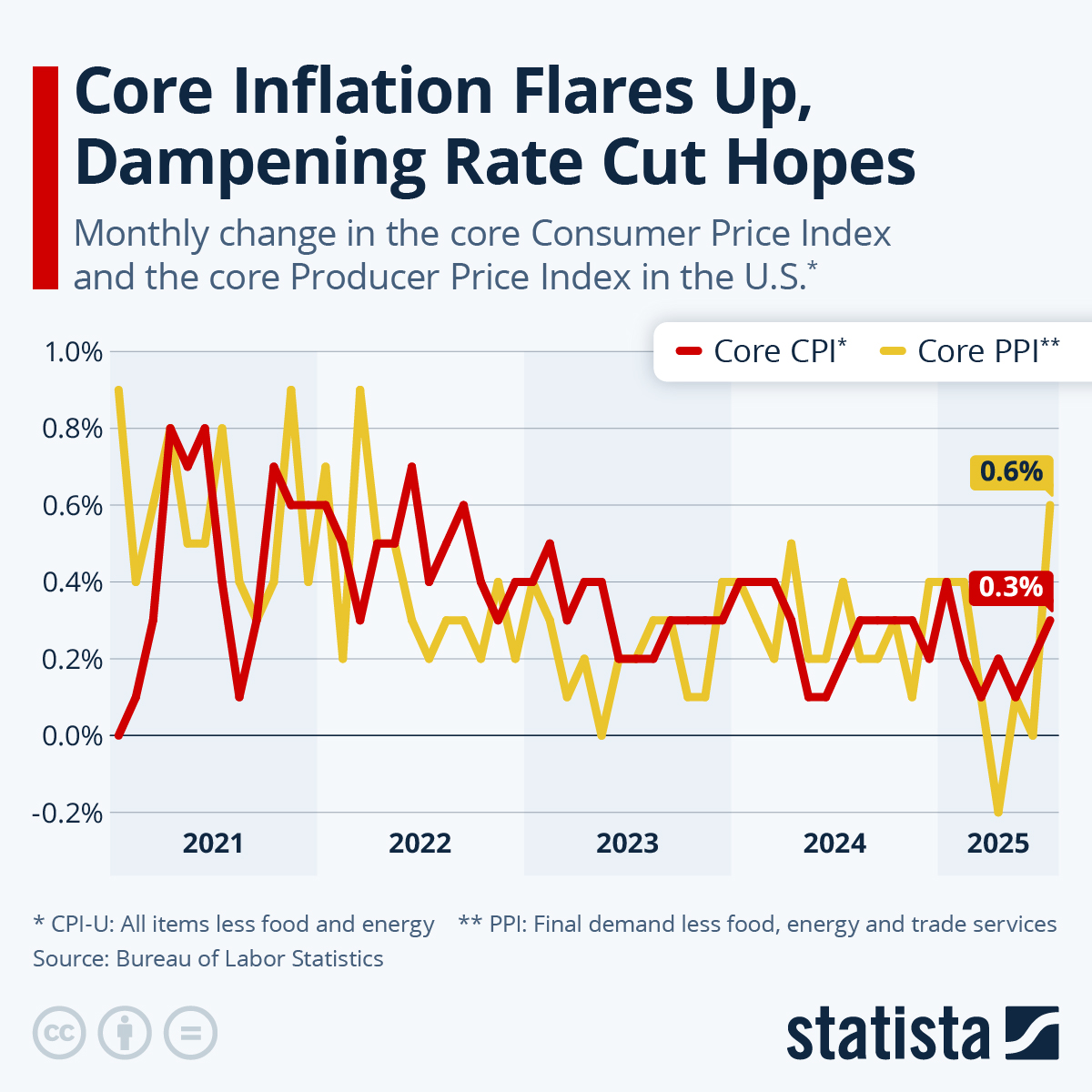

The rate cut euphoria only last two days, however, before the Bureau of Labor Statistics dampened the mood with its latest report on producer prices. The Producer Price Index (PPI) for July showed that wholesale inflation had flared up in July, with the Producer Price Index for final demand rising 0.9 percent versus expectations of just 0.2 percent. "Core" producer prices, which exclude food, energy and trade services, rose 0.6 percent last month, the highest reading since March 2022.

Since producers often pass higher input costs on to consumers, the elevated PPI reading could be a sign of consumer prices also going up in the coming months – a scenario which the Fed desperately wants to avoid. As our chart shows, core CPI inflation excluding food and energy prices has already accelerated in recent months, reaching 0.3 percent in July, the highest level since January.