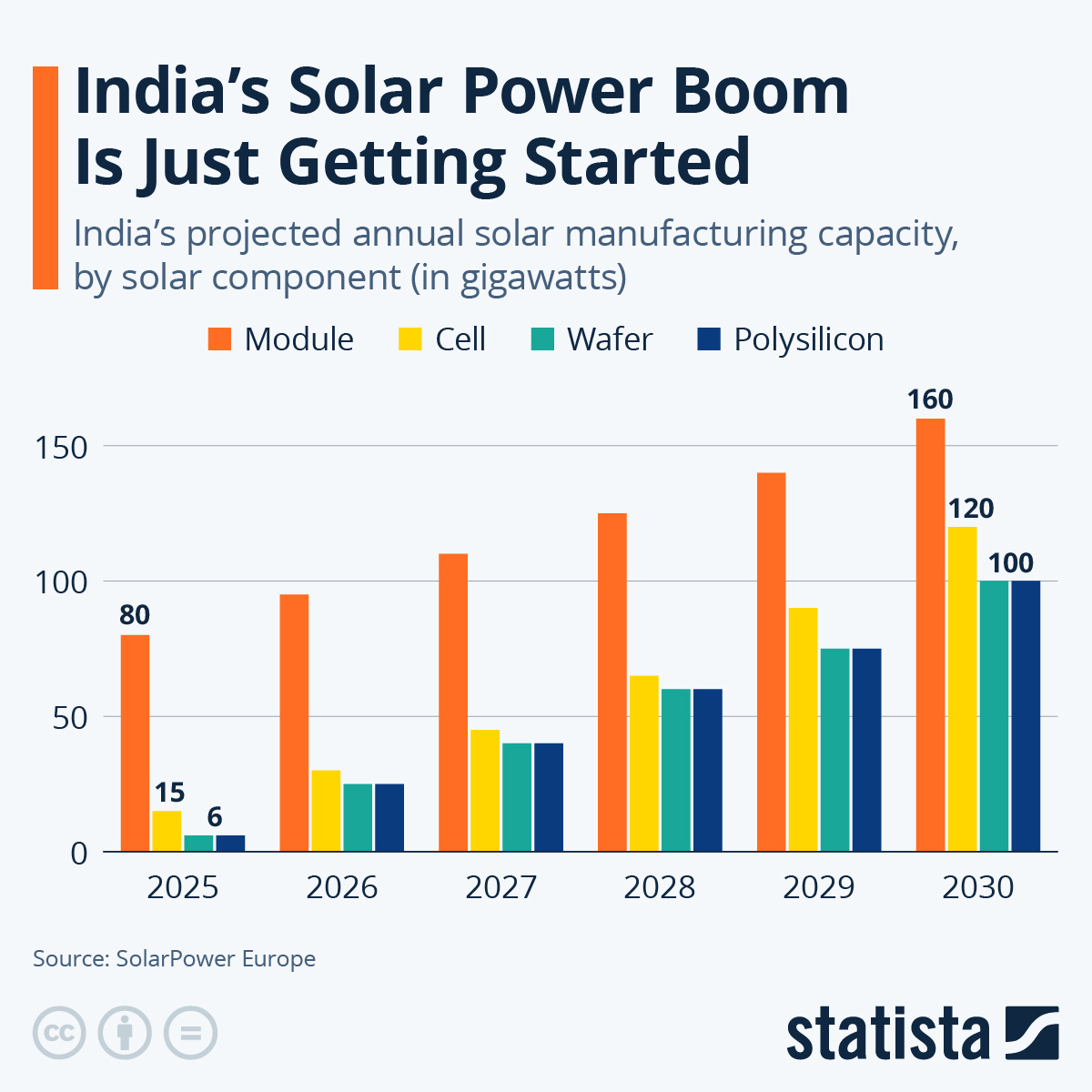

India’s increasing energy demand, driven by rapid industrialization, urbanization and its commitment to achieving net zero emissions by 2070, is fuelling a solar power manufacturing boom. According to estimates by SolarPower Europe, the country’s photovoltaic module manufacturing capacity is set to increase from 80 gigawatts in 2025 to 160 GW by 2030.

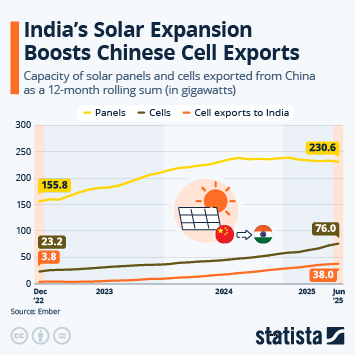

PV modules are made up of various components, including smaller cells and within those, wafers. As the following chart shows, India’s domestic production of solar cells and wafers are currently lagging behind its panel production. To be able to provide its panel factories with enough of the necessary cells and wafers to create the final product, India is therefore importing both of these components from China, at least until it can scale up its own manufacturing of these parts.

This is set to happen in the coming years, with India’s manufactured cell capacity projected to soar from just 15 GW in 2025 to 120 GW in 2030, as wafer and polysilicon capacities are also expected to grow (from 6 GW to 100 GW). This will make the country less reliant on imports and gain greater control over its supply chain.

According to the IEEFA, India has made significant progress in recent years in transitioning from being a net importer of PV products towards being a net exporter. The United States is its biggest export partner, receiving almost all of its PV exports in FY2023 and FY2024. Other export destinations include South Africa, Somalia, Kenya, the UAE, Afghanistan, Nepal and Bangladesh.

China is currently the world’s biggest exporter of PV products and accounts for over 80 percent of manufacturing capacity across the supply chain. The U.S. has placed heavy restrictions on Chinese PV exports, which extends to products from Southeast Asian countries involved in circumvention. According to Ember, following scrutiny of Indian panels containing Chinese cells, Indian exports to the U.S. dropped 30 percent in H1 2025.