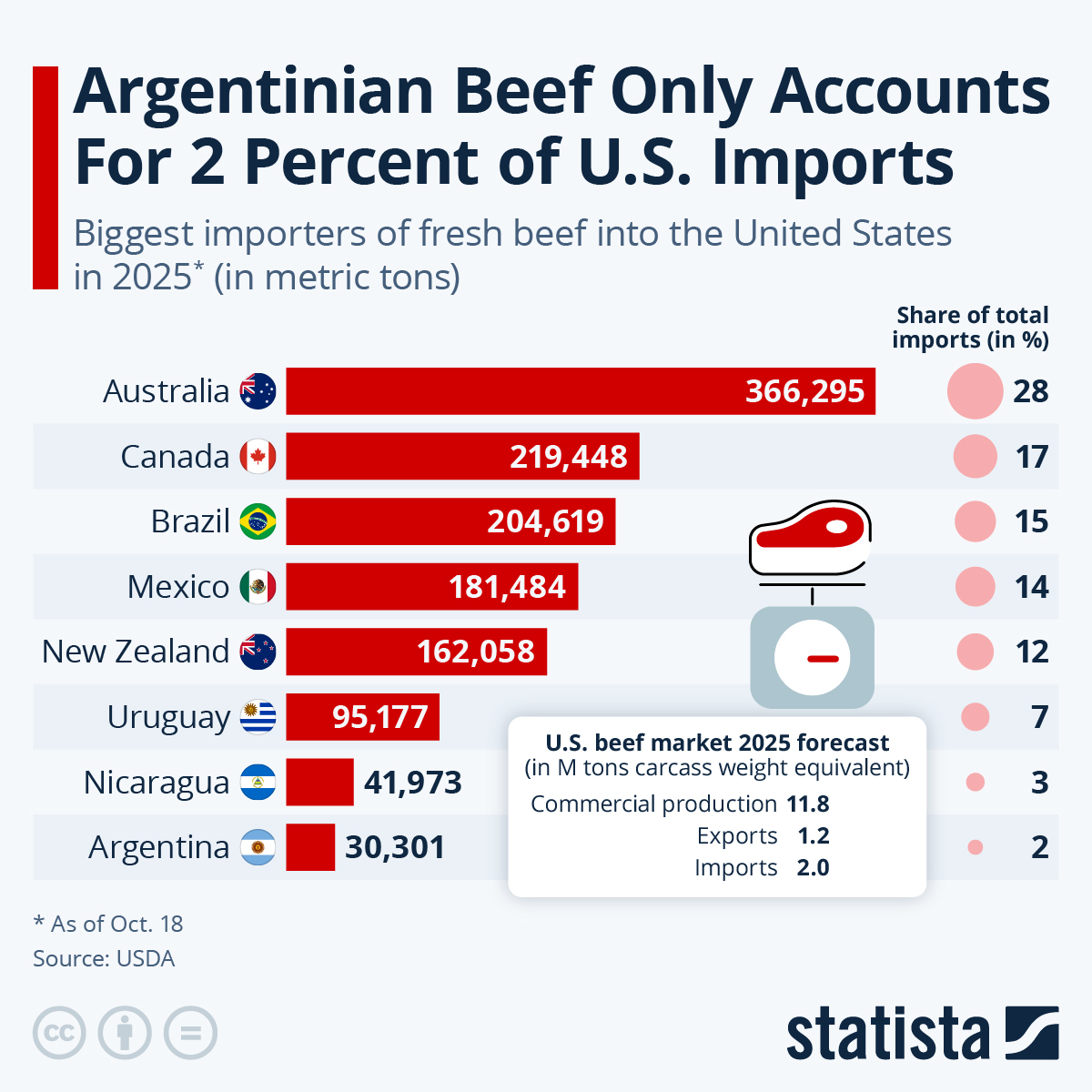

A plan by U.S. President Donald Trump to up imports of Argentinian beef has angered ranchers and farmers in the country. The White House plans to increase the low-tariff quota for Argentinian beef imports to 80,000 metric tons annually from just 20,000 metric tons, allowing for more sales from Argentina as U.S. beef supply is tight.

While droughts in the U.S. have decimated herds and Mexican supply was cut off due to pests, Brazilian imports also recently slowed amid rising tariffs. However, a look at 2025 USDA data shows that even quadrupling influx from Argentina would not change the U.S. beef market by much and would not be expected to bring down the sky-high U.S. beef prices that have developed due to the shortages.

As of October 18, fresh Argentinian beef had only made up 2 percent of U.S. import in the category this year. Yet, ranchers, who typically have very small profit margins, are taking issue even with this relatively small market intervention, prompting responses from the administration that cattle herders will receive aid due to the current drought issues.

Furthermore, Trump's recent dealings with Argentina also drew the ire of U.S. farmers. At the end of September, the U.S. government purchased Argentinian bonds and estabilished a stand-by credit line as well as finalizing a $20 billion currency swap agreement ahead of the country's midterms. This happened despite Argentina - in a further move to stabilize its economy - having dropped export duties on soy, wheat, corn and meats, effectively swooping up Chinese market shares in soybeans that U.S. farmers serviced ahead of the trade war. The party of Argentinian President Javier Milei, a Trump ally, won the midterm election yesterday. U.S. farmers have also been told they can expect a bailout due to sales lost to tariffs, similar to Trump's first term.

USDA numbers additionally show that despite many tariffs coming into effect over the course of the first year of the Trump presidency, overall 2025 beef imports as of October from most major importers, including Brazil, have increased rather than decreased and levels are expected to reach record highs by the end of the year due to the tight U.S. market conditions.

Imports rising or staying the same desite tariffs is a phenomenon seen with other products as well and could partly be a result of front-loading - shipping large amounts of stock out before tariffs hit. The 50-percent tariff on Brazil active since August, however, is now starting to change the global meat export market in which the country is the biggest player.