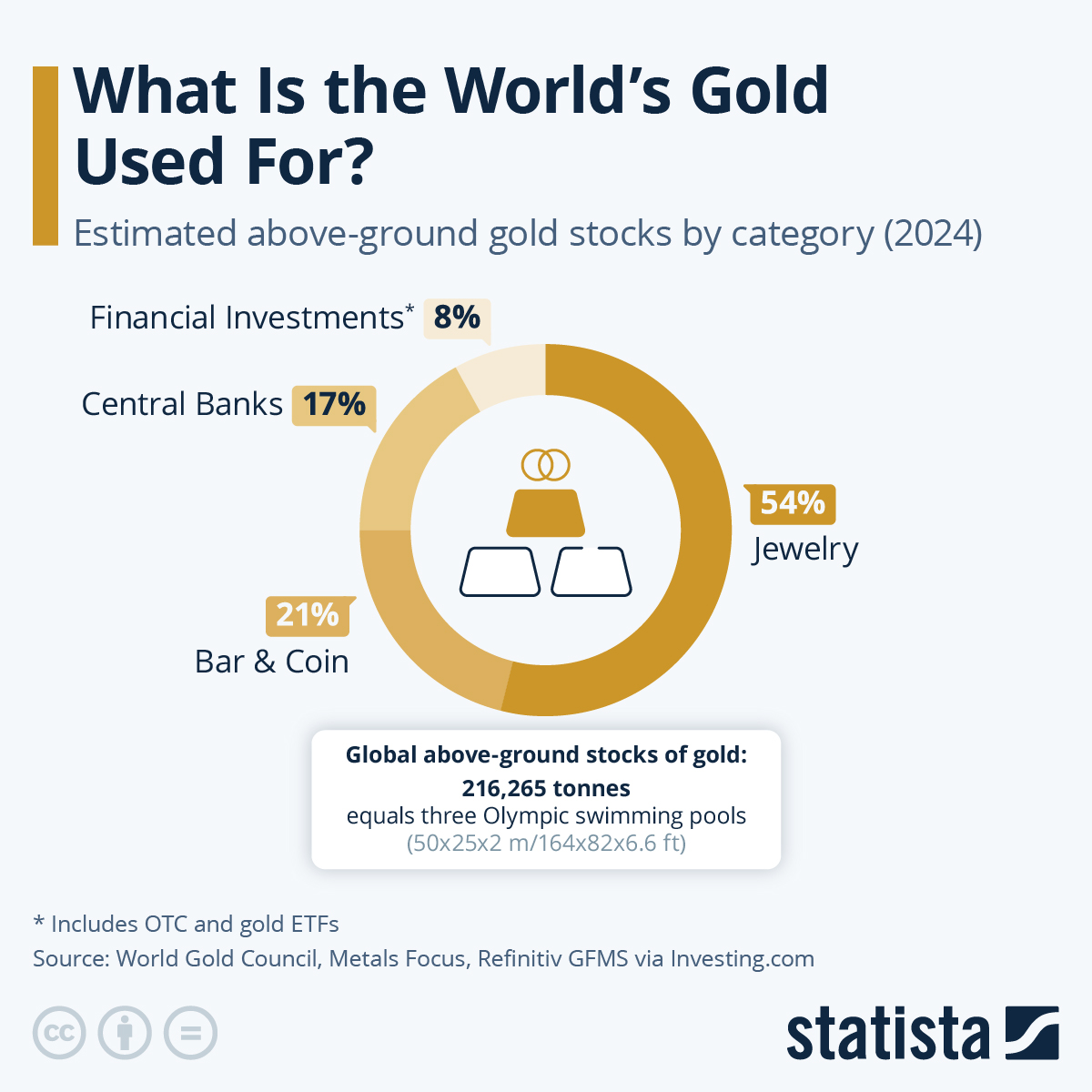

Most people would be surprised to learn that all the gold ever mined in the world would nearly fit into just three Olympic swimming pools (of 50x25x2 meters or 164x82x6.6 feet). Even more surprising might be the fact that just over half of this is tied up in jewelry and just 17 percent is made up of central bank reserves.

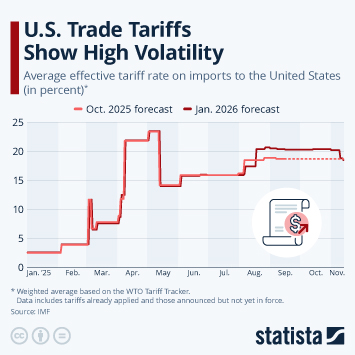

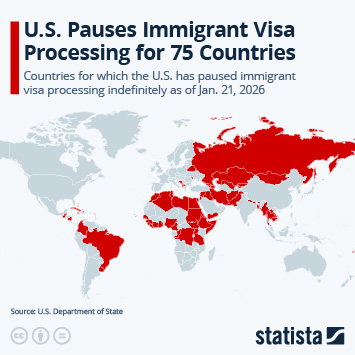

However, it is gold's versatility of use that makes it the perceived safe haven and interently valuable asset that attracts investors, collectors, governments and the everyday person alike. In 2025, the global gold price has rallied to above $4,000 per ounce and is expected to reach $5,000 at least intermittendly next year. Amid a climate of global crisis, interest falling once more on financial products and a weak dollar enabling cheaper purchases of gold in global curriencies, gold is having a defining moment.

Despite it feeling old-fashioned compared to other investments and often decribed as a way to store funds to maintain their value, Investing.com writes that gold's long-term returns have still been sizable over the past 50 years, standing at an average of 8 percent annually, above U.S. inflation of around 4 percent per annum over the same time period. This calculation is taking into account gold in the context of a financial investment product and otherwise. 1971 saw the end of the Bretton Woods gold standard, a set price for the precious metal, which is why the calculation of the World Gold Council published by Investing.com start there.