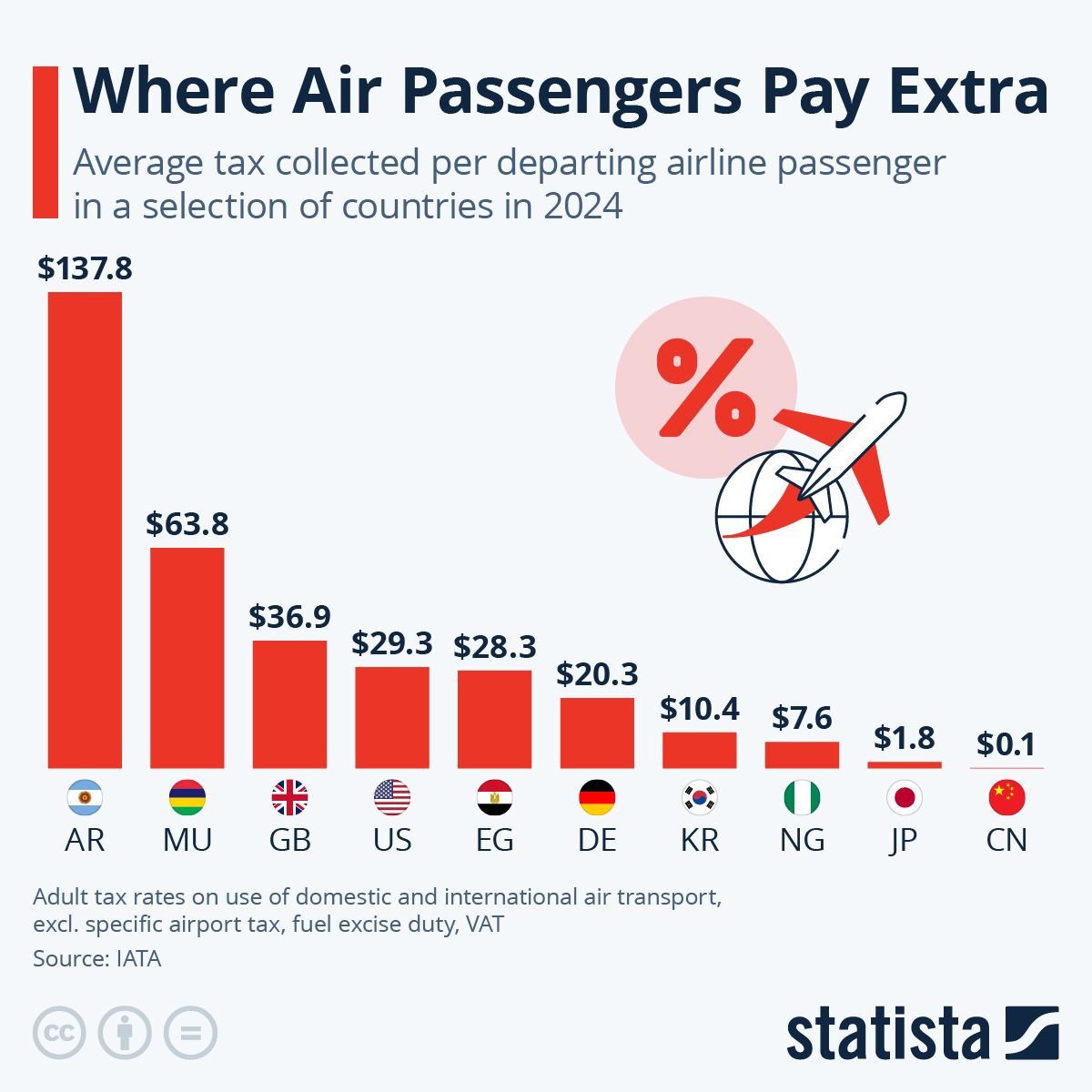

While there are a myriad of different taxes associated with flying, governments in many countries levy passenger-specific air transport departure duties that can be used to help offset some of the costs of tourism, of the environmental impacts of flying or simply bolster government revenue.

Japan, which has seen tourist numbers rise to new heights after a pandemic slump, last week saw calls by lawmakers to triple the departure tax from currently 1,000 Yen (around $6.50). Like Japan, many countries include the departure tax in the price of a ticket so that passengers are mostly unaware that they are paying it. However, the proceeds can then be used towards different projects, in the case of Japan to offset some of the effects of overtourism.

Data by the International Air Transport Association shows that air travel related taxes in Japan are currently very low in an international comparison at just an average $1.80 per departing passenger, as the country only charges international passengers its exit tax (and will continue to do so in the future). Countries in Asia generally tend to charge lower passenger-specific duties, the survey shows.

Other countries have charges for domestic passengers as well, bolstering revenues for whatever project the proceeds are tied to. High levies are charged in the United States and the United Kingdom, for example. The statistic also shows that countries relying on tourism, like Mauritius and also Fiji, might up their departure taxes even higher to recoup some of their costs, especially if they are very small states. Countries in financial difficulty can also happen to have high departure taxes, like Argentina. High taxes on international departures can also be observed in African countries like Gabon or Sierra Leone.

Depending on the route, airline and travel class, taxes can make up as much as 40 percent of an air fare. The IATA stat only shows passenger-specific air travel departure taxes that can occur on domestic and international routes. Additionally, air travelers may also pay fuel excise taxes, value-added taxes or specific fees tied to and benefiting the airport they are using. Airlines can also be subject to airspace use fees or per-aircraft landing fees, which are more indirectly passed on to passengers. While including passenger-specific taxes and fees in the ticket price as an itemized expense is the most common way to go, some countries also chose to charge them at the airport (and sometimes land borders as well) as a way to include only foreigners.